- Guggenheim and Ripple have teamed as much as convey a US Treasury-backed fixed-income asset to the XRP Ledger (XRPL).

- Guggenheim is reported to have issued and redeemed $10.3 trillion of Asset-Backed Industrial Paper (ABCP) within the final 27 years.

Guggenheim, a good funding supervisor within the US, has introduced a strategic partnership with Ripple to increase its digital business paper providing successfully. In response to the press assertion, this growth highlights the rising relationship and the relentless dedication to bridge the crypto native enterprise and conventional finance.

In the meantime, this collaboration happens between the blockchain firm and Guggenheim Treasury Companies, a subsidiary of Guggenheim. Beneath the phrases, XRP Ledger (XRPL) would have the posh to host a “US Treasury-backed fixed-income asset”. Moreover, Ripple is predicted to allocate $10 million into the asset.

Additional explaining the collaboration, RippleX govt Markus Infanger highlighted that Ripple’s stablecoin RLUSD would play an important position on this initiative by guaranteeing the supply of the business paper product. As famous in our earlier information replace, RLUSD has considerably powered Actual World Finance and crypto integration since its inception, with its market cap at the moment surpassing $393 million.

Our analysis additionally means that this product is absolutely supported or backed by the US Treasury.

Guggenheim’s Earlier Strikes and Ripple’s Position in Asset Tokenisation

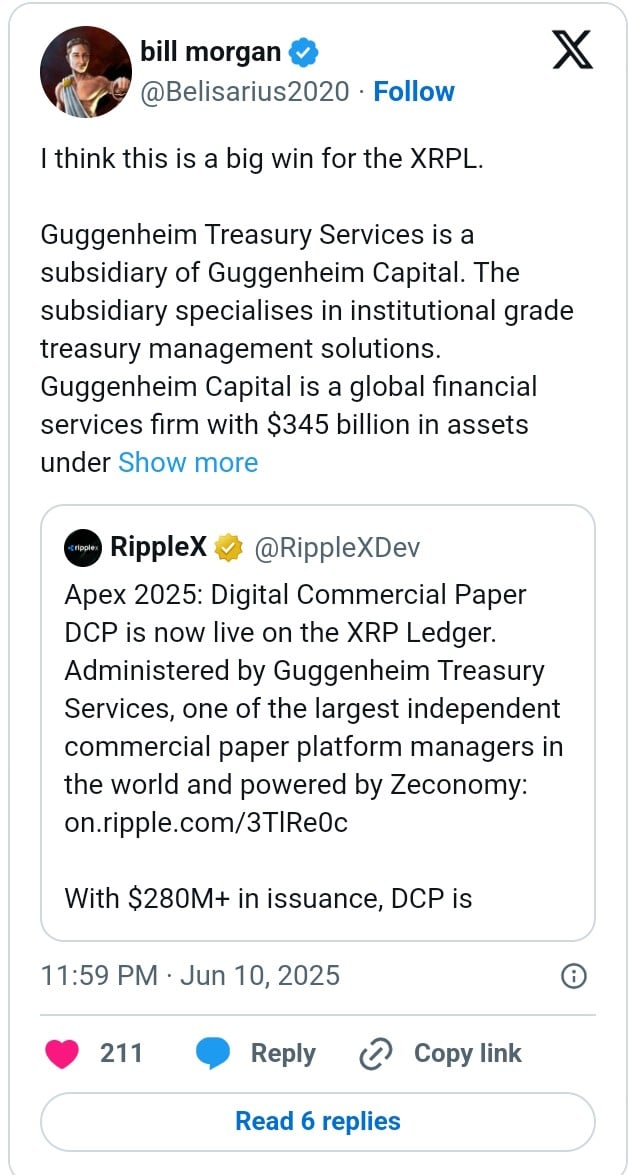

Guggenheim’s important transfer throughout the blockchain ecosystem isn’t new. In 2024, it made a dramatic entry into the blockchain house by tokenising $20 million in business paper on the Ethereum blockchain. This traditionally made the product the primary digital model of business paper. The latest growth has additionally caught the eye of XRP Lawyer Invoice Morgan who has lauded it as an enormous win for XRPL.

Within the midst of those, Guggenheim Treasury has positioned itself among the many largest “Asset-Backed Industrial Paper (ABCP) managers” on this planet. Over the past 27 years, it has efficiently issued and redeemed over $10.3 trillion of ABCP. Our analysis reveals that these issuances have been finished by Zeconomy’s AmpFi.Digital platform.

Commenting on this, the CEO of Zeconomy Giacinto Cosenza, hinted that its success has been hinged on the unprecedented demand for digital property.

As clearly demonstrated by the ETFs’ approval and the expansion of the tokenisation house, there’s a huge demand for these digital property.

Ripple has additionally performed an plain position in tokenisation as its a number of groundbreaking partnerships and initiatives place it on the forefront of this enviable sector. As indicated in our earlier information transient, Ripple partnered with Ondo Finance to convey tokenised U.S. Treasury securities to the XRPL. Particularly, this was reported to see the combination of a $185 million US Treasury token, OUSG, into the blockchain community inside six months.

In 2024, Ripple additionally teamed up with Archax, a UK-based firm to introduce a tokenised cash market fund to the XRP Ledger. Ripple invested $5 million in Lux Fund with the corporate anticipated to convey years of expertise within the institutional-grade blockchain resolution.

XRPL, has, then again, been largely utilised for this impact. As talked about in our latest weblog submit, its decentralised change allows the buying and selling of tokenised property with out the necessity for a particular contract.

XRPL additionally lately powered Dubai’s first government-issued actual property digital asset. This mission ensured that title deeds could be securely minted and recorded on-chain. As detailed in our earlier information protection, this might affect the quick progress of Dubai’s tokenised actual property market which is predicted to achieve $16 billion by 2033.

The latest partnership with Guggenheim has marginally impacted the worth of XRP which recorded virtually 2% positive factors on its day by day worth chart to commerce at $2.3.

In response to our latest evaluation, the asset may quickly break the $2.6 degree and subsequently hit $5.5. In the meantime, one other analyst expects the asset to blow up by 5x, as explored by CNF in a latest dialogue.

Advisable for you: