Key Highlights:

- Pudgy Penguins dropped 19.6% within the final 7 days. This has triggered round 175 underwater loans being liquidated on Blur.

- The Canary Capital PENGU ETF to incorporate each Pudgy Penguins and PENGU tokens.

- Such crises increase considerations about NFT volatility and valuation, which may complicate the ETF’s approval.

Pudgy Penguin, a well known NFT assortment, is dealing with a dramatic downturn as the ground value of the NFT fell by 19.6% during the last seven days as per CoinGecko. This motion has sparked intense volatility and compelled liquidations on the Blur NFT lending market. It has been noticed that influencers and market analysts are warning about cascading defaults that may attract important uncertainty.

Compelled Liquidations Hit Pudgy Penguins

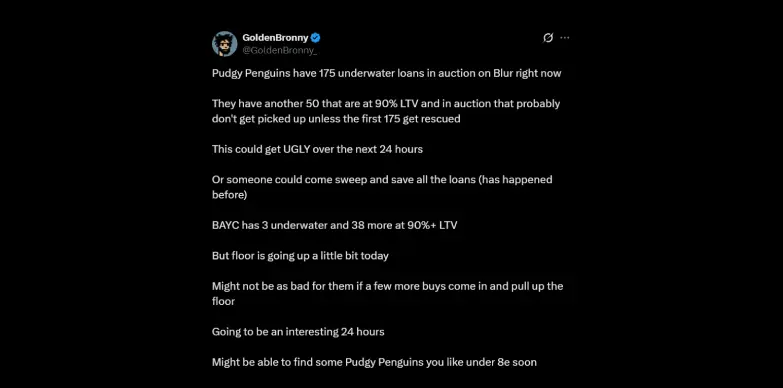

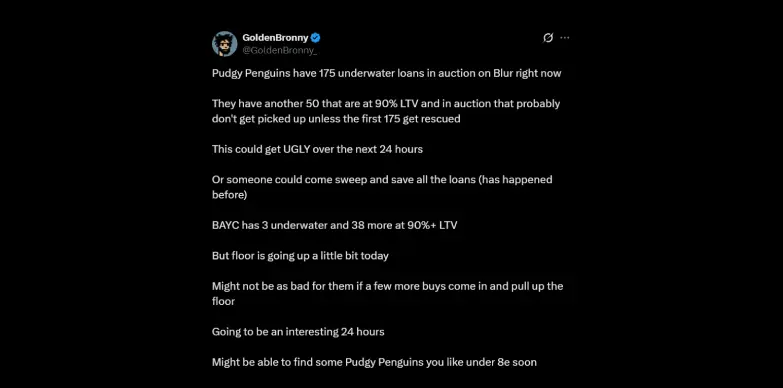

The present scenario is dangerous as 175 Pudgy Penguins loans are underwater and in energetic public sale on Blur. This offers a transparent indication that the debtors will not be in a position to repay the loans and the lenders have selected promoting the collateral NFTs on the open market.

Additionally, there are one other 50 loans which are at 90% Mortgage-to-Worth (LTV). Which means these 50 loans are in a dangerous place, and if the asset costs transfer barely towards them, they are going to be liquidated.

If no purchaser rescues the market by buying these NFTs throughout its liquidation, lenders could possibly be caught holding them as an alternative of getting their a reimbursement. Prior to now, there have been traders who stepped in and stopped the costs from crashing any additional by merely shopping for massive quantities of those NFTs. This remark was made by an NFT professional Golden Bronny on X (previously often known as Twitter).

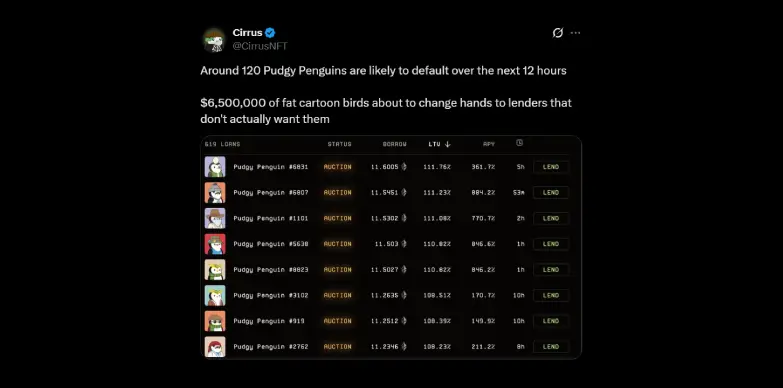

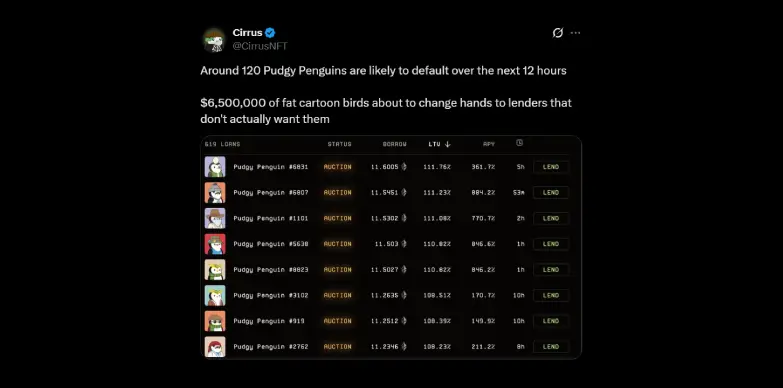

One other NFT professional Cirrus NFT highlighted the extent of the danger. In his submit on X, he highlighted that round 120 Pudgy Penguins are poised to default inside the subsequent 12 hours. This means that just about $6.5 million NFT worth could quickly shift fingers from debtors to lenders, most of whom didn’t intend to personal these “fats cartoon birds” long-term.

BAYC’s Completely different Trajectory

Then again, the Bored Apt Yatch Membership (BAYC), one other high blue chip NFT assortment seems like it’s holding issues a lot better than Pudgy Penguins, BAYC has solely 3 NFTs price lower than their loans and 358 near 90% LTV. This makes the general danger decrease than Pudgy Penguins as per Golden Bronny.

The BAYC ground value has been resilient all these years and the value has been trending a bit of as cautious consumers step in to stabilize the market. If there’s a continued shopping for exercise, it may hold the scenario contained for BAYC holders and make the correction notably much less extreme for them.

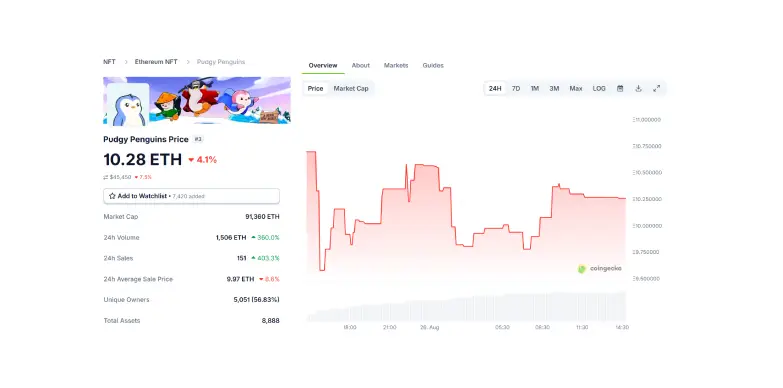

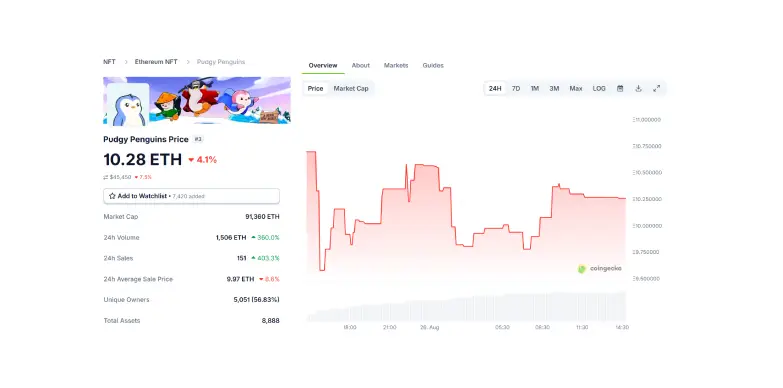

The pressured liquidations on Blur could have a strain on the Pudgy Penguins NFT ground value. As of now, the ground value of the NFT stands at 10.28 ETH ($45,450) which has dropped 4.1% within the final 24 hours and has come down by 19.6% within the final 7 days as per CoinGecko.

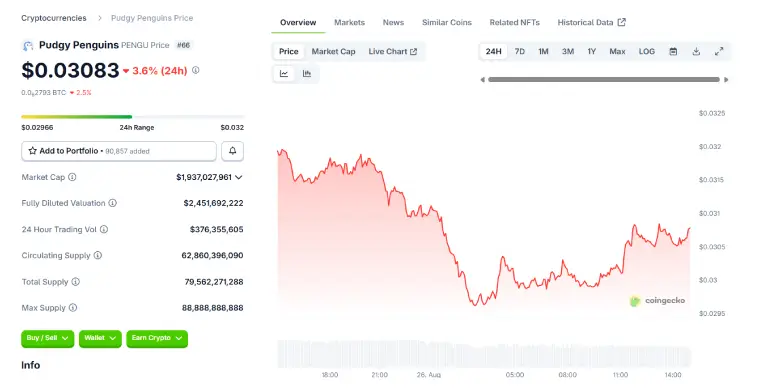

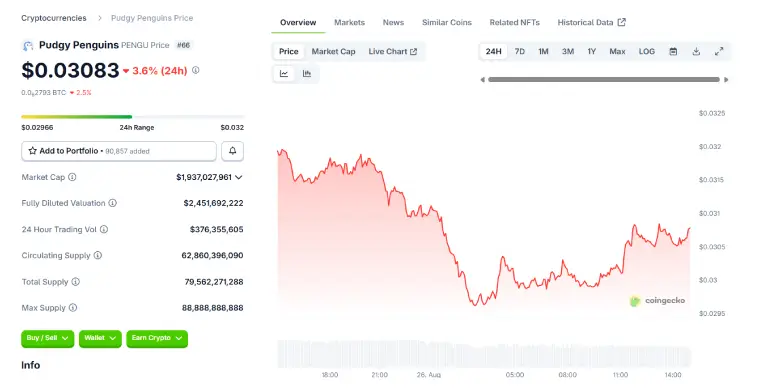

These liquidations may negatively have an effect on the investor confidence within the PENGU token and may trigger short-term value drops. As of now, the value of PENGU token stands at $0.03083 which is down by 3.6% within the final 24 hours.

Will This Have an effect on Canary Capital PENGU ETF?

The Canary Capital PENGU ETF has not been accredited but and is beneath SEC (Securities and Alternate Fee) overview. The choice has been postponed till October 12, 2025. This delay is part of broader warning from the company concerning cryptocurrency and NFT-related ETFs as they assess and consider the regulatory, custody, and valuation challenges.

This problem (pudgy Penguin NFT liquidation) can negatively impression the ETF’s approval. Compelled liquidation highlights market volatility and dangers round NFT valuation. This can make the SEC extra cautious as such situations increase considerations about stability, investor safety and liquidity within the ETF construction which could decelerate the regulatory clearance. Nonetheless, then again, a well-managed intervention or stabilization within the NFTs and token market may enhance the whole situation.

Additionally Learn: OKB Climbs Previous $200 Mark Amid Rising Momentum

Key Highlights:

- Pudgy Penguins dropped 19.6% within the final 7 days. This has triggered round 175 underwater loans being liquidated on Blur.

- The Canary Capital PENGU ETF to incorporate each Pudgy Penguins and PENGU tokens.

- Such crises increase considerations about NFT volatility and valuation, which may complicate the ETF’s approval.

Pudgy Penguin, a well known NFT assortment, is dealing with a dramatic downturn as the ground value of the NFT fell by 19.6% during the last seven days as per CoinGecko. This motion has sparked intense volatility and compelled liquidations on the Blur NFT lending market. It has been noticed that influencers and market analysts are warning about cascading defaults that may attract important uncertainty.

Compelled Liquidations Hit Pudgy Penguins

The present scenario is dangerous as 175 Pudgy Penguins loans are underwater and in energetic public sale on Blur. This offers a transparent indication that the debtors will not be in a position to repay the loans and the lenders have selected promoting the collateral NFTs on the open market.

Additionally, there are one other 50 loans which are at 90% Mortgage-to-Worth (LTV). Which means these 50 loans are in a dangerous place, and if the asset costs transfer barely towards them, they are going to be liquidated.

If no purchaser rescues the market by buying these NFTs throughout its liquidation, lenders could possibly be caught holding them as an alternative of getting their a reimbursement. Prior to now, there have been traders who stepped in and stopped the costs from crashing any additional by merely shopping for massive quantities of those NFTs. This remark was made by an NFT professional Golden Bronny on X (previously often known as Twitter).

One other NFT professional Cirrus NFT highlighted the extent of the danger. In his submit on X, he highlighted that round 120 Pudgy Penguins are poised to default inside the subsequent 12 hours. This means that just about $6.5 million NFT worth could quickly shift fingers from debtors to lenders, most of whom didn’t intend to personal these “fats cartoon birds” long-term.

BAYC’s Completely different Trajectory

Then again, the Bored Apt Yatch Membership (BAYC), one other high blue chip NFT assortment seems like it’s holding issues a lot better than Pudgy Penguins, BAYC has solely 3 NFTs price lower than their loans and 358 near 90% LTV. This makes the general danger decrease than Pudgy Penguins as per Golden Bronny.

The BAYC ground value has been resilient all these years and the value has been trending a bit of as cautious consumers step in to stabilize the market. If there’s a continued shopping for exercise, it may hold the scenario contained for BAYC holders and make the correction notably much less extreme for them.

The pressured liquidations on Blur could have a strain on the Pudgy Penguins NFT ground value. As of now, the ground value of the NFT stands at 10.28 ETH ($45,450) which has dropped 4.1% within the final 24 hours and has come down by 19.6% within the final 7 days as per CoinGecko.

These liquidations may negatively have an effect on the investor confidence within the PENGU token and may trigger short-term value drops. As of now, the value of PENGU token stands at $0.03083 which is down by 3.6% within the final 24 hours.

Will This Have an effect on Canary Capital PENGU ETF?

The Canary Capital PENGU ETF has not been accredited but and is beneath SEC (Securities and Alternate Fee) overview. The choice has been postponed till October 12, 2025. This delay is part of broader warning from the company concerning cryptocurrency and NFT-related ETFs as they assess and consider the regulatory, custody, and valuation challenges.

This problem (pudgy Penguin NFT liquidation) can negatively impression the ETF’s approval. Compelled liquidation highlights market volatility and dangers round NFT valuation. This can make the SEC extra cautious as such situations increase considerations about stability, investor safety and liquidity within the ETF construction which could decelerate the regulatory clearance. Nonetheless, then again, a well-managed intervention or stabilization within the NFTs and token market may enhance the whole situation.

Additionally Learn: OKB Climbs Previous $200 Mark Amid Rising Momentum