Is crypto in a bear market? Is the four-year cycle damaged? Will Bitcoin reclaim $100,000 earlier than year-end? Might 2026 convey a few supercycle? These are all questions being requested by merchants and traders as we shut out the yr, following an ongoing interval of bearish value motion all through the crypto market.

Following surprisingly bullish US CPI information yesterday, coupled with an rate of interest lower from the Financial institution of England, traders responded cautiously optimistically, with Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

coloration: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px strong #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavourable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavourable {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable {

coloration: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable::earlier than {

border-top: 4px strong #A90C0C !necessary;

}

1.10%

Bitcoin

BTC

Worth

$87,934.40

1.10% /24h

Quantity in 24h

$50.81B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

climbing +1.2% in a single day and at present buying and selling slightly below $88,000.

Simply yesterday, the mixed crypto market cap was precariously near $3 trillion. Nonetheless, a +1.5% spike has taken it again towards $3.1 trillion, giving it a bit respiratory room from shedding that key stage, which might push it again into the $2 trillion vary.

Crypto Worry and Greed Chart

1y

1m

1w

24h

Is Crypto in a Bear Market? Causes Why Poor Worth Motion Might Proceed Into 2026

A controversial opinion is that crypto has been in a bear marketplace for a yr now. There may be some proof to help this: among the many high 50 digital property with a full yr of value historical past, solely privateness tokens Zcash (ZEC) and Monero (XMR) are within the inexperienced, together with BNB.

Bitcoin is down -14% year-to-date, whereas the remaining, together with family names corresponding to DOT, LINK, ADA, SOL, and

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

coloration: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px strong #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavourable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavourable {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable {

coloration: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable::earlier than {

border-top: 4px strong #A90C0C !necessary;

}

1.44%

Ethereum

ETH

Worth

$2,980.10

1.44% /24h

Quantity in 24h

$27.23B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

, are down between -50% and -80% over the identical interval.

In This fall 2025 alone, Bitcoin dropped by greater than -30% after falling beneath $90,000 because it at present ranges between $85,000 and $88,000. Whereas this stage of pullback is typical throughout bull runs, the correction additionally broke a key help stage, prompting many famend analysts to show bearish within the mid-term.

One outstanding analyst, Peter Brandt, has even known as for BTC to crash to $25,000 in 2026, arguing that every bull run brings diminishing returns to the main digital asset and that earlier parabolic runs have all declined by <80%. Brandt additional states that the present parabolic advance has been violated and {that a} 20% decline from the all-time excessive would convey the value to $25,240.

And whereas the US and UK are slashing rates of interest, the Financial institution of Japan is elevating its charges to the very best ranges in 5 years, including additional uncertainty among the many international markets, because it may have an effect on the Yen carry commerce, which is a well-liked funding technique the place merchants borrow Japanese Yen (JPY) at tremendous low rates of interest and convert it to purchase higher-yielding property in different currencies like USD.

JUST IN

: Financial institution of Japan hikes charge to highest stage in 30 years

pic.twitter.com/5Rdwz2eOEO

— Barchart (@Barchart) December 19, 2025

World financial uncertainty, the continued battle in Ukraine, and rising tensions between the US and Venezuela are among the many causes to be involved concerning the state of crypto in 2026, and ongoing bearish value motion suggests a sure to the query Is crypto in a bear market?’

Catalysts that Might Deliver A few Supercycle in 2026

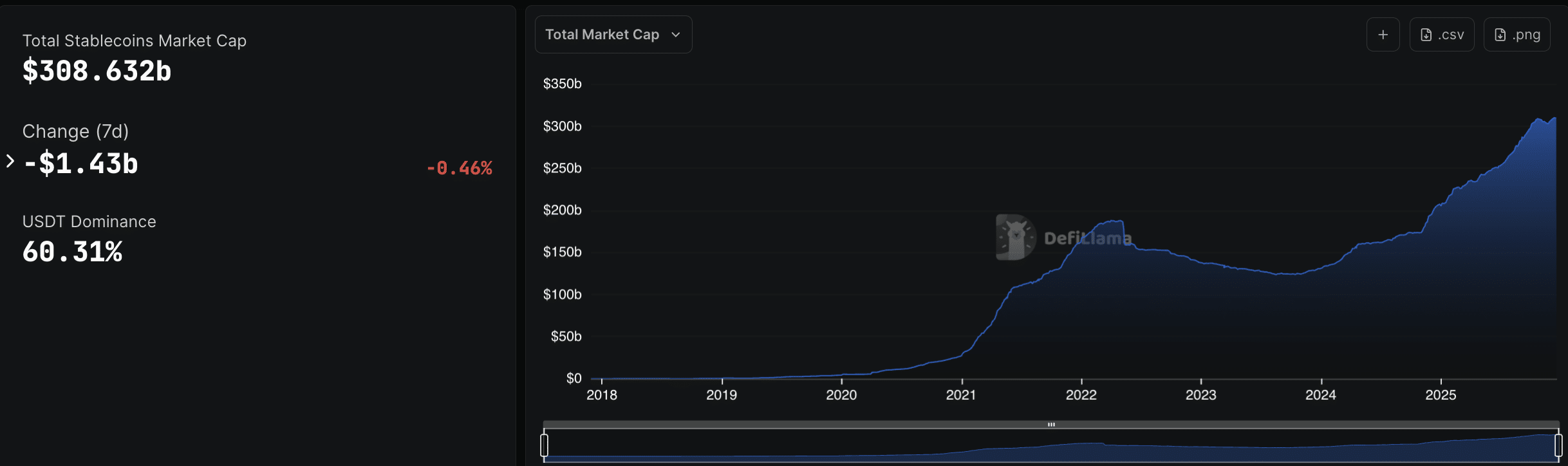

Liquidity is vital, and for everybody shouting that there’s at present no liquidity available in the market, the truth is that the stablecoin market cap has almost doubled prior to now twelve months, going from $165Bn to simply over $300Bn at the moment.

A bullish spin on the query of liquidity might be framed as: now greater than ever, your entire crypto ecosystem has an abundance of dry powder able to enter speculative crypto property at a second’s discover.

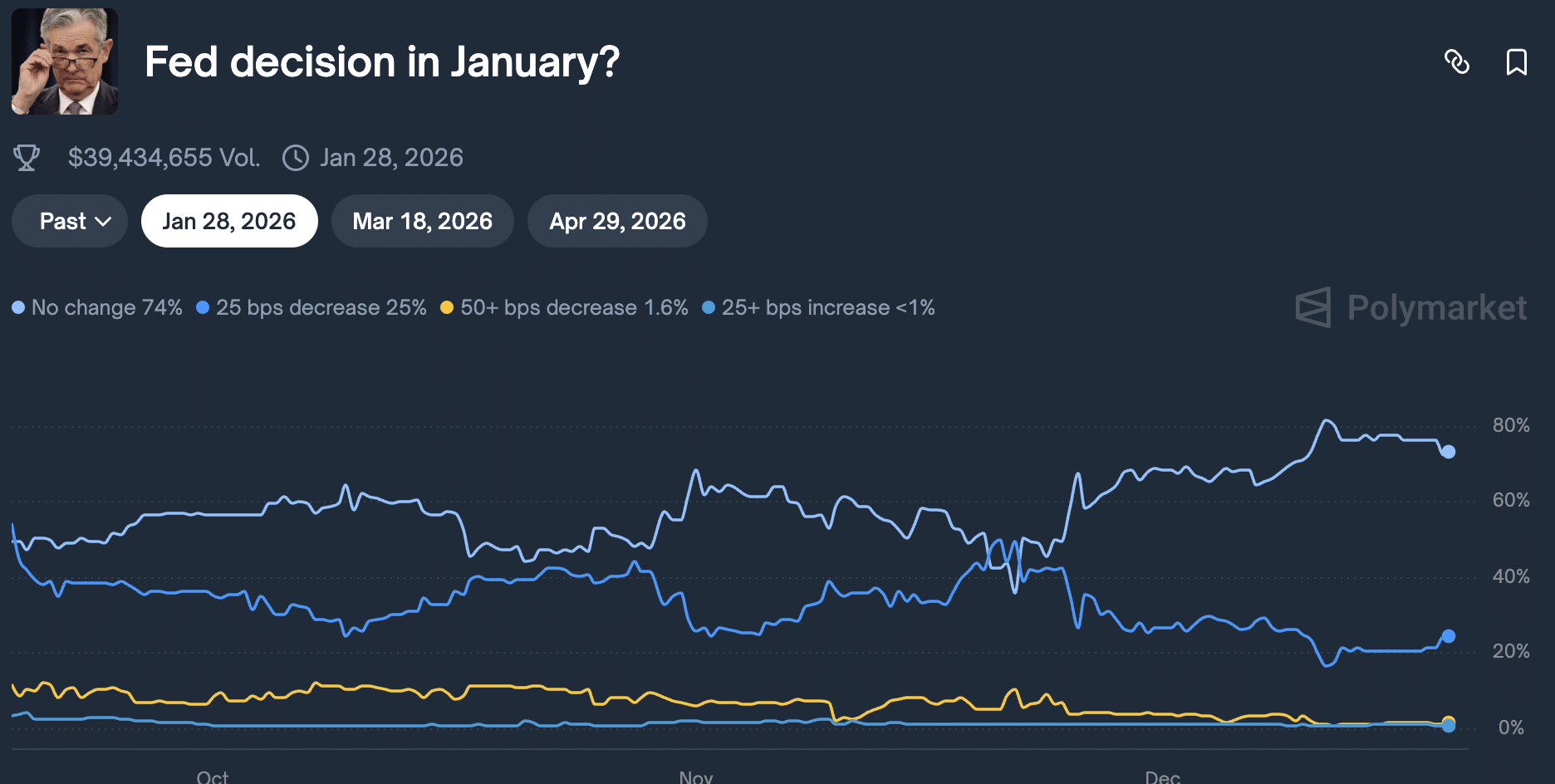

Then there may be the US; no matter how folks really feel, it stays the nation to which everybody seems when speculating about future international market actions. It has made three rate of interest cuts in 2025, and Polymarket is now pricing a recent lower for January, which might maintain the Federal Reserve’s quantitative easing (QE) coverage in place.

QE usually will increase liquidity in risk-on environments by increasing the cash provide and injecting it into the monetary system. With decrease returns on protected property like bonds, traders typically shift capital into riskier markets, together with shares and cryptocurrencies, throughout QE searching for increased yields.

Low rates of interest and ample liquidity are inclined to create a “risk-on” sentiment, wherein traders really feel extra comfy allocating capital to speculative property corresponding to Bitcoin and the broader crypto market. Traditionally, intervals of great QE, such because the COVID-19 2020-2022 interval, have coincided with crypto bull runs.

Help for the supercycle thesis has been voiced by business leaders corresponding to Binance founder CZ and Bitmine CEO Tom Lee, in addition to quite a few outstanding analysts and merchants.

CZ says crypto may enter a supercycle by 2026, pushed by U.S. politics, Fed easing, and institutional adoption.

Bullish

pic.twitter.com/KbmACNTFcc

— Bitcoin Teddy (@Bitcoin_Teddy) December 16, 2025

DISCOVER: Prime 20 Crypto to Purchase in 2025

Inflation Hedge Narrative and Regulatory Developments: Extra Causes Why Crypto May Explode in 2026

Some traders view Bitcoin and different scarce crypto property as a hedge in opposition to inflation, shopping for crypto when cash is being printed as a result of they fear that fiat currencies would possibly weaken. This narrative will get stronger throughout QE cycles.

You solely need to look again to 2021, on the peak of the final US QE cycle, which additionally noticed the largest crypto bull run in historical past. Optimistic crypto merchants argue that 2026 will mark the beginning of the subsequent QE cycle and due to this fact reject the declare that 2025 was the bull run, because it was a yr of Quantitative Tightening.

The market construction invoice (readability act) will move subsequent month!

That is what the US Crypto Trade and HODL are ready for!

pic.twitter.com/kvB6hwnPVB

— Kenny Nguyen (@mrnguyen007) December 19, 2025

Moreover, the White Home just lately confirmed that the Digital Asset Market CLARITY Act shall be taken up by the Senate as early as January. This isn’t a last vote; it’s the committee stage, the place the invoice is amended and finalized earlier than it reaches the ground. Early indicators point out that the invoice will move with relative ease.

The CLARITY Act goals to make clear which tokens are handled as securities and which as commodities, and to separate oversight between the SEC and the CFTC evenly. If it passes, crypto firms within the US will lastly obtain a extra clear regulatory framework somewhat than regulation by protracted court docket circumstances.

EXPLORE: Greatest Meme Coin ICOs to Spend money on 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish Will 2026 See Stablecoin and Fee Reduce Supercycle or Is Crypto in a Bear Market? appeared first on 99Bitcoins.

: Financial institution of Japan hikes charge to highest stage in 30 years

: Financial institution of Japan hikes charge to highest stage in 30 years