Kraken reportedly goals to checklist its shares on a US inventory trade as early as Q1 2026, becoming a member of Coinbase, Gemini, and Bullish on public markets. Whereas Bitcoin and main altcoins commerce sideways, cash continues to movement into crypto equities and mergers, with $8.6 billion in crypto M&A offers recorded in 2025. This shift means that whereas token costs are cooling off, the enterprise aspect of crypto is heating up once more.

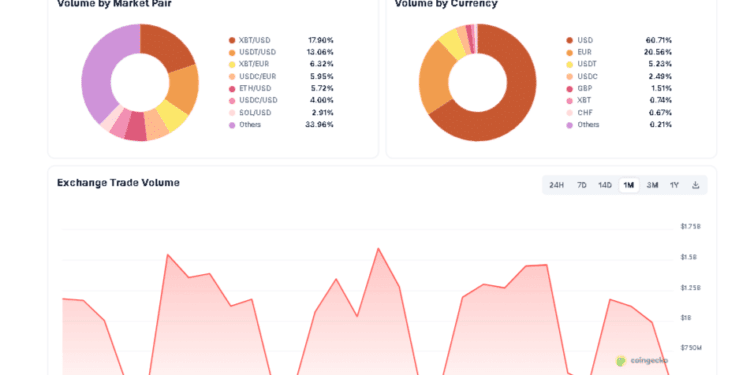

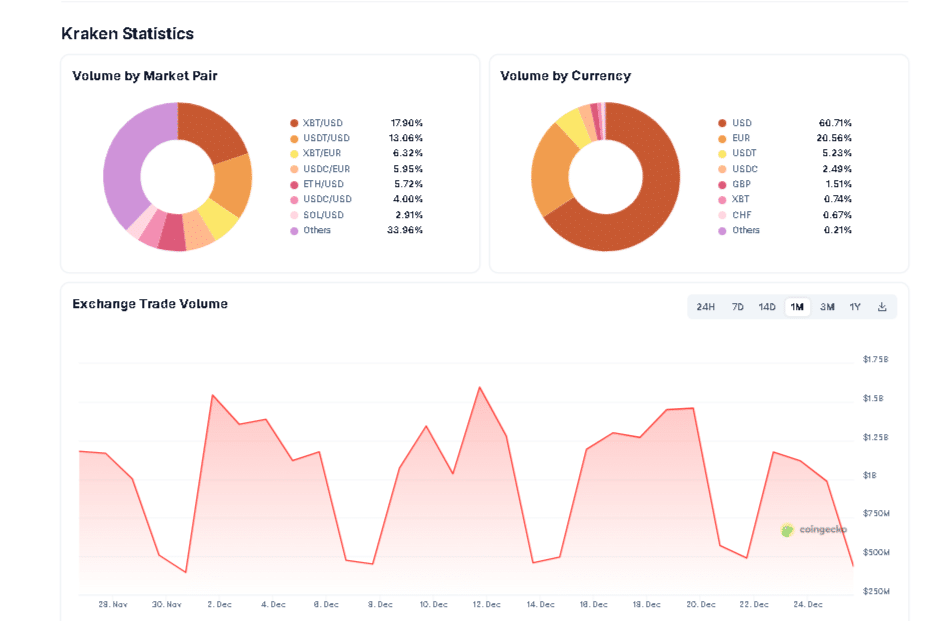

(Supply – CoinGecko, Kraken)

Whereas the Q1 2026 window is the objective for the Kraken IPO, the true story is within the personal books. Kraken is reportedly finalizing a $500 million pre-IPO spherical this month, concentrating on a $15 billion valuation. This can be a important soar from its 2022 valuation and suggests Wall Road is already pricing within the ‘regulatory thaw’ following the dismissal of the SEC’s swimsuit

Will a Kraken IPO Actually Hearth Up One other Bull Run?

Consider an IPO (preliminary public providing) as an organization opening its doorways to on a regular basis inventory buyers for the primary time. Kraken, one of many longest-running crypto exchanges, now needs to promote shares on a conventional inventory market, just like how massive banks transferring into crypto introduced the sector a brand new stamp of seriousness. Kraken is exploring an IPO as early as 2026, following the easing of stress by US regulators and the SEC’s dropping of a high-profile lawsuit.

This timing issues. In 2025, crypto corporations accomplished roughly $8.6 billion in offers, together with Kraken’s $1.5 billion acquisition of futures platform NinjaTrader, as reported by the Monetary Occasions. That sort of deal movement means that massive gamers proceed to speculate closely in crypto infrastructure, even when token charts seem unexciting.

We additionally see a wave of different listings. Circle, the corporate behind the USDC stablecoin, listed on the NYSE in June 2025, and exchanges like Gemini and Bullish additionally went public. For you as a retail investor, this opens a second route into crypto: you should purchase shares within the corporations that run the rails, not simply the cash themselves.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

How Might Kraken’s IPO Form the Subsequent Crypto Cycle?

Each crypto cycle has a narrative. Earlier cycles centered on Bitcoin halvings and pure hypothesis. This mid-stage cycle resembles a “Wall Road construct‑out,” the place exchanges, stablecoin issuers, and mining corporations checklist on inventory markets and lift regulated capital. That aligns with the broader debate we cowl relating to the crypto market’s path into 2026.

When a big trade lists, it sends a easy message to conventional buyers: crypto shouldn’t be going away. Public corporations are required to publish audited monetary statements, adhere to strict disclosure guidelines, and be accountable to regulators. That transparency provides pension funds, asset managers, and even ETF suppliers larger confidence to extend their publicity to the sector over time.

The regulatory backdrop additionally shifts. A bipartisan U.S. proposal goals to maneuver oversight of many crypto exchanges to the CFTC, as highlighted by latest studies. Extra predictable guidelines have a tendency to draw bigger, slower cash, which smooths out a few of the chaos we see in purely unregulated markets.

For you, meaning extra methods to specific a view on crypto. You may maintain Bitcoin immediately. You should buy stablecoins like USDC that sit on the middle of this new construction. Or you possibly can personal shares in exchanges and infrastructure corporations that will profit if buying and selling quantity returns.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Are the Dangers for Common Buyers as Crypto Goes Public?

Right here is the uncomfortable aspect: a Kraken IPO doesn’t assure that its inventory will carry out effectively or that token costs will rise. Coinbase’s IPO in 2021 regarded like a triumph on the prime of a bull run, then the inventory slumped because the cycle rolled over. Crypto‑linked equities nonetheless commerce like excessive‑beta tech. When Bitcoin sneezes, they catch a chilly.

Public listings can even tempt rookies into overconfidence. A inventory ticker and a Wall Road itemizing quantity don’t flip a crypto enterprise right into a secure bond. Revenues depend upon risky buying and selling volumes. Regulatory guidelines can nonetheless change. Hacks, outages, or authorized disputes can immediately influence trade earnings.

So how do you method this safely? Deal with crypto firm shares the identical method you deal with altcoins: perceive the enterprise mannequin, learn earnings studies, and keep in mind they correlate with the broader crypto cycle we discover in our U.S. regulation protection and our items on the 2026 supercycle debate.

Kraken’s push towards the general public markets exhibits that crypto’s company layer is maturing, whilst costs fluctuate. When you keep curious, handle threat, and deal with schooling over FOMO, you possibly can journey this mid‑cycle construct‑out with out dropping sleep.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation

The submit Kraken IPO Plan Indicators Recent Mid‑Cycle Push for Crypto appeared first on 99Bitcoins.