FedEx Company’s (NYSE: FDX) second-quarter report underscored its resilience in a difficult market surroundings characterised by uneven demand, tariff tensions, and rising competitors. Administration issued cautious steering, citing freight market weak point and operational headwinds in sure segments, even whereas making progress in community optimization and price self-discipline. Though freight demand stays a priority, FedEx sees long-term features from restructuring and digital investments.

Q2 Consequence

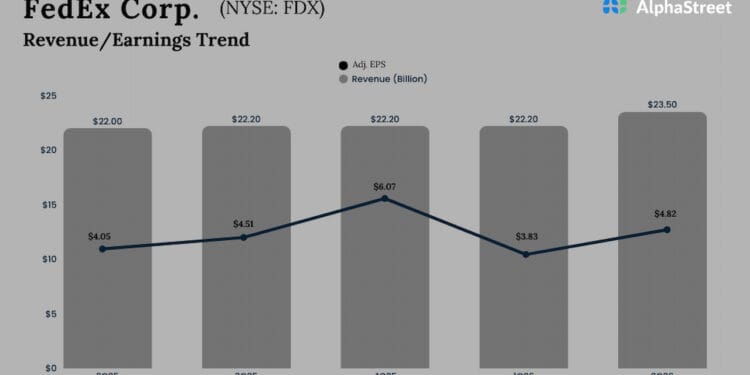

The cargo large’s second-quarter earnings, excluding particular objects, elevated to $4.82 per share from $4.05 per share within the year-ago quarter, exceeding Wall Avenue’s expectations. On a reported foundation, web revenue was $956 million or $4.04 per share within the November quarter, in comparison with $741 million or $3.03 per share in Q2 2025. The underside-line progress was pushed by a 7% progress in revenues to $23.5 billion, which is above analysts’ forecasts.

The corporate’s inventory rallied on Thursday quickly after the announcement, however pulled again later, and the downturn prolonged into the pre-market on Friday. Investor sentiment was dampened by the administration’s cautious revenue forecast for the present quarter, citing incremental prices. After coming into 2025 on a low word and dropping additional momentum within the early months, FDX bounced again and has been in restoration mode since then. It has gained about 28% prior to now six months.

Combined View

The FedEx administration stated it expects profitability to be impacted within the present quarter by extra prices associated to the sudden grounding of its MD-11 fleet as a consequence of security issues. Regardless of headwinds like nationwide air visitors constraints, weak point within the industrial economic system, and world commerce uncertainties, the corporate raised the midpoint of its FY26 forecasts. Fiscal-2026 income is anticipated to develop 5-6% now. The steering for unadjusted earnings per share for 2026 is $14.80 to $16.00, and adjusted earnings are anticipated to be within the vary of $17.80 per share to $19.0 per share.

From FedEx’s Q2 2026 Earnings Name:

“Excessive single-digit income progress, margin enlargement, and excessive teenagers adjusted EPS progress. Fairly remarkably, we did this whereas navigating a number of exterior headwinds, together with the sudden grounding of our MD-11 fleet, nationwide air visitors constraints, weak point within the industrial economic system, and naturally, the impression of world commerce coverage adjustments. We’re extraordinarily happy with our Q2 efficiency, particularly within the face of those challenges. It’s a direct impact of the rigor now we have embedded into our tradition over the previous a number of years and the ensuing transformation from Community 2.0, Tricolor, and structural value reductions, all enabled by knowledge and know-how.

Spin Off

In the meantime, the FedEx Freight enterprise stays a drag on general efficiency amid continued stress on shipments. The administration is getting ready to spin off this underperforming division as a individually listed public firm. In the newest quarter, FedEx Freight’s income dropped 2% as a consequence of decrease common each day shipments.

The typical value of FedEx shares for the previous twelve months is $242.13. The inventory traded decrease on Friday afternoon, after opening the session decrease. It has gained 9% since final month.