ETH, the native cryptocurrency of the Ethereum community, exhibits a slight downtick of 0.4% throughout Monday’s buying and selling session. The slowdown in restoration momentum could be linked to Bitcoin witnessing overhead provide at $108,000 and whale traders liquidating their property. Is the ETH worth poised for one more correction, or might consumers keep the restoration pattern?

Ethereum Whales Unstaking and Depositing Hundreds of thousands to Exchanges

Over the previous two weeks, the Ethereum worth bounced from a low of $2,115 to its present buying and selling worth of $2,495, projecting an 18% surge. Regardless of the bullish surge, the on-chain knowledge exhibits substantial promoting stress from large-net-worth traders.

In line with Lookonchain, two wallets, 0x14e4 and 0x26Bb, possible managed by the identical entity, just lately unstaked and withdrew 95,920 ETH (value roughly $237 million). Out of the whole, the whale has deposited 62,289 ETH (~154 million) to centralized exchanges, together with HTX, Bybit, and OKX, over the previous 20 days.

The whale nonetheless holds 33,631 ETH, which is at present value roughly $83 million, thereby growing the chance of additional sell-off. Traditionally, such a large-scale influx to the trade has led to bearish market alerts and bolstered downward stress on costs.

ETH Worth Eyes 15% Surge Earlier than Main Provide Take a look at

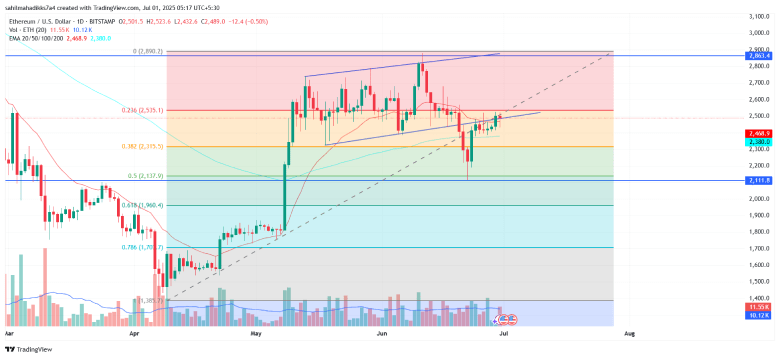

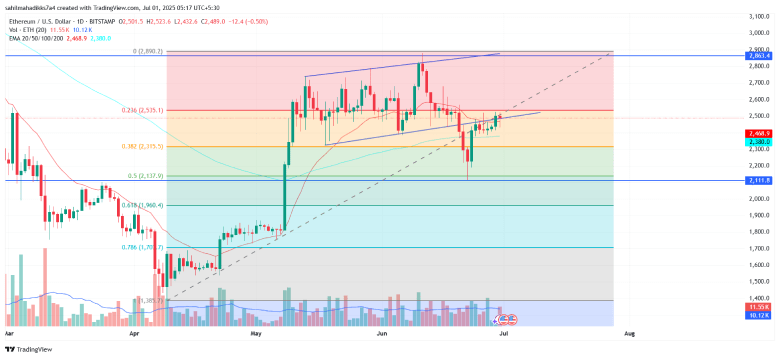

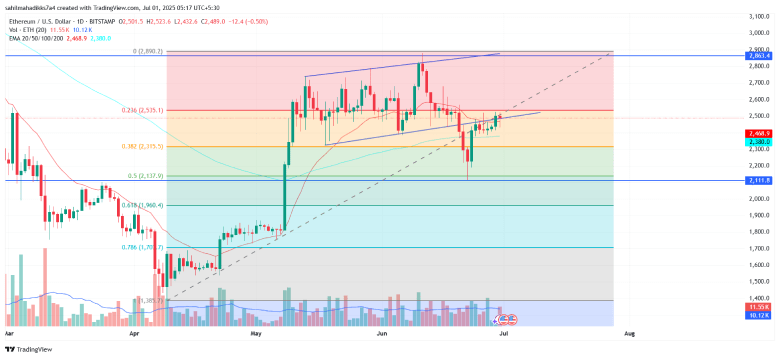

By press time, the Ethereum worth trades at $2,482 with an intraday lack of 0.4%. Regardless of the downtick, the each day candle exhibits a notable worth rejection, indicating that demand stress stays intact.

This long-tail rejection candle accentuates the ETH sustainability above the current reclaimed 20-day exponential shifting common. An acceptable follow-up will possible set off a 15% worth surge and problem the $2,865 resistance.

Nevertheless, the overhead resistance has remained a high-supply area since February 2025 and will prohibit consumers’ makes an attempt earlier than geopolitical tensions within the Center East escalate or whale promoting continues.

Moreover, if the coin worth reverts beneath the 20-day EMA at $2,500, sellers might strengthen their grip on the asset. The potential downswing will create a contemporary decrease excessive formation within the each day chart, signaling a sell-the-bounce sentiment intact amongst traders.

Additionally Learn: Bitcoin Change & OTC Reserves Hit Lows: Is a Provide-Led Breakout Subsequent?

ETH, the native cryptocurrency of the Ethereum community, exhibits a slight downtick of 0.4% throughout Monday’s buying and selling session. The slowdown in restoration momentum could be linked to Bitcoin witnessing overhead provide at $108,000 and whale traders liquidating their property. Is the ETH worth poised for one more correction, or might consumers keep the restoration pattern?

Ethereum Whales Unstaking and Depositing Hundreds of thousands to Exchanges

Over the previous two weeks, the Ethereum worth bounced from a low of $2,115 to its present buying and selling worth of $2,495, projecting an 18% surge. Regardless of the bullish surge, the on-chain knowledge exhibits substantial promoting stress from large-net-worth traders.

In line with Lookonchain, two wallets, 0x14e4 and 0x26Bb, possible managed by the identical entity, just lately unstaked and withdrew 95,920 ETH (value roughly $237 million). Out of the whole, the whale has deposited 62,289 ETH (~154 million) to centralized exchanges, together with HTX, Bybit, and OKX, over the previous 20 days.

The whale nonetheless holds 33,631 ETH, which is at present value roughly $83 million, thereby growing the chance of additional sell-off. Traditionally, such a large-scale influx to the trade has led to bearish market alerts and bolstered downward stress on costs.

ETH Worth Eyes 15% Surge Earlier than Main Provide Take a look at

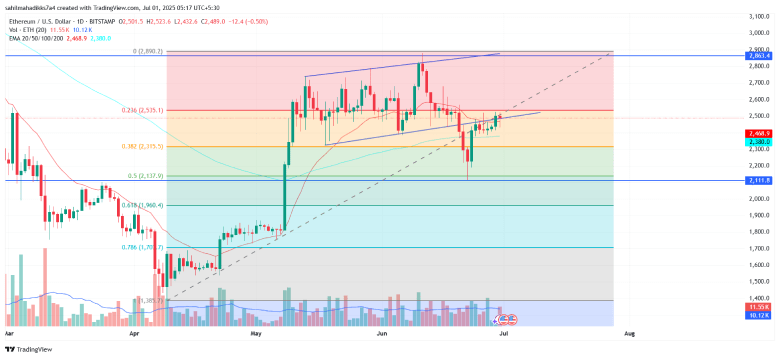

By press time, the Ethereum worth trades at $2,482 with an intraday lack of 0.4%. Regardless of the downtick, the each day candle exhibits a notable worth rejection, indicating that demand stress stays intact.

This long-tail rejection candle accentuates the ETH sustainability above the current reclaimed 20-day exponential shifting common. An acceptable follow-up will possible set off a 15% worth surge and problem the $2,865 resistance.

Nevertheless, the overhead resistance has remained a high-supply area since February 2025 and will prohibit consumers’ makes an attempt earlier than geopolitical tensions within the Center East escalate or whale promoting continues.

Moreover, if the coin worth reverts beneath the 20-day EMA at $2,500, sellers might strengthen their grip on the asset. The potential downswing will create a contemporary decrease excessive formation within the each day chart, signaling a sell-the-bounce sentiment intact amongst traders.

Additionally Learn: Bitcoin Change & OTC Reserves Hit Lows: Is a Provide-Led Breakout Subsequent?