The bitcoin value prolonged its steep decline at the moment after a multi-month lengthy slide that erased greater than half of its worth from its October peak, with the bitcoin value now buying and selling close to $66,000 following a pointy sell-off that pushed costs towards $60,000.

Since roughly December 2025, the bitcoin value has adopted a reasonably easy downward trajectory, falling from ranges above $100,000 right into a unstable vary that has saved merchants centered on whether or not the market has reached a sturdy flooring.

Bitcoin value dropped under the psychological mark of $70,000 on Feb. 5, triggering intense promoting stress throughout spot and derivatives markets. The decline has been pushed by macroeconomic uncertainty, institutional derisking, and turbulence in expertise shares that always commerce in tandem with crypto threat urge for food.

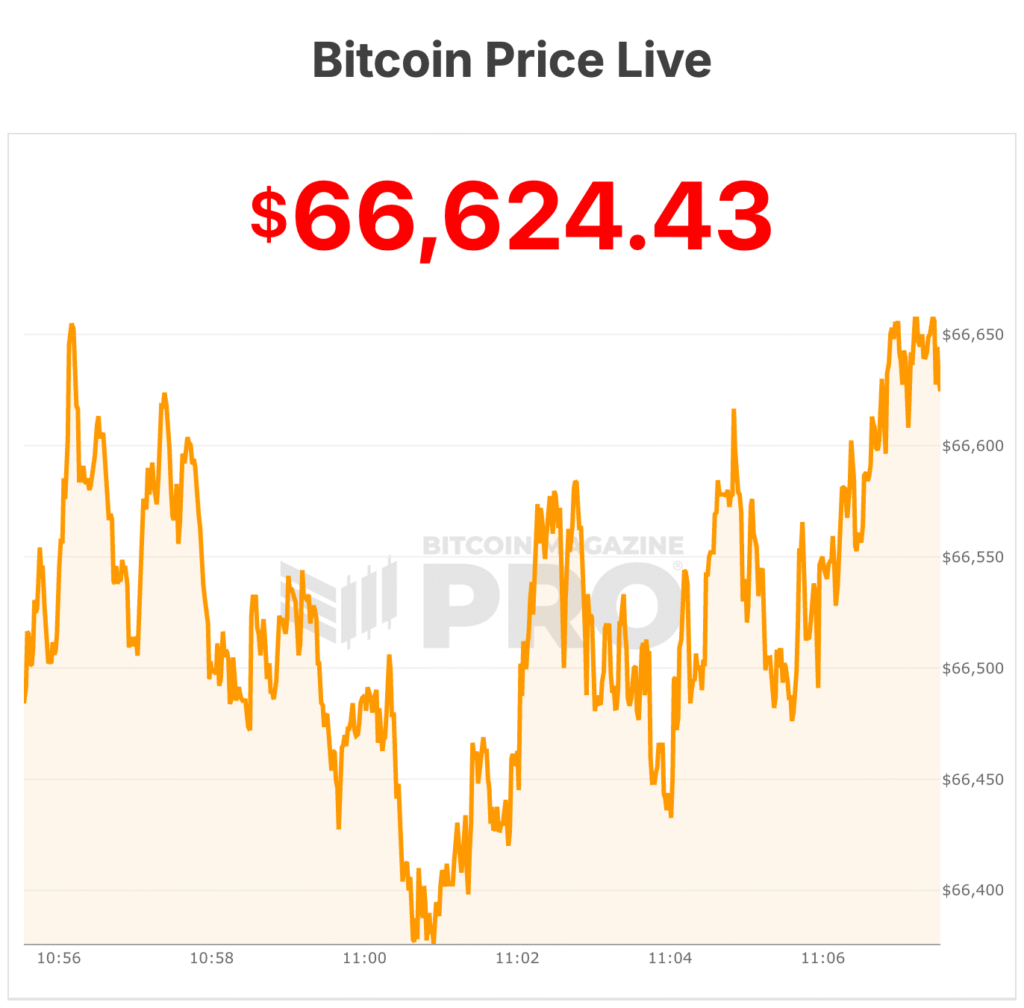

For the reason that sell-off, Bitcoin value has struggled to regain momentum, hovering across the $66,000 to $67,000 stage whereas buying and selling swings between $66,000 and $72,000 stay frequent.

K33: Bitcoin value could also be at a ‘native backside’

Analysis and brokerage agency K33 argued this week that the plunge towards $60,000 might have marked a neighborhood backside, citing what it described as “capitulation-like circumstances” throughout quantity, funding charges, choices skews, and exchange-traded fund flows.

K33 Head of Analysis Vetle Lunde pointed to a “huge checklist of maximum outliers” that accompanied the transfer, in accordance with reporting from The Block. Commerce volumes reached the ninety fifth percentile, whereas funding charges collapsed to ranges final seen through the March 2023 U.S. banking disaster. Choices skews rose to readings beforehand related to probably the most intense stress of the 2022 bear market.

Momentum indicators additionally entered uncommon territory. After persistent promoting since Jan. 20, Bitcoin’s day by day Relative Power Index fell to fifteen.9, some of the oversold readings since 2015. RSI measures the velocity and magnitude of current value modifications on a scale from 0 to 100, with values under 30 typically seen as oversold.

Lunde famous that earlier extremes in March 2020 and November 2018 coincided with main cycle lows.

Sentiment gauges mirrored related pressure. The Crypto Concern & Greed Index fell to six through the sell-off, its second-lowest stage on file, underscoring the depth of pessimism as Bitcoin value approached $60,000.

The worth motion got here with what Lunde known as “hyperactive buying and selling.” Two-day spot quantity reached $32 billion on Feb. 6, among the many highest ever recorded. Feb. 5 and Feb. 6 marked back-to-back ninety fifth percentile quantity periods, a sample seen solely as soon as up to now 5 years through the FTX collapse.

K33 mentioned such outlier days typically align with native value extremes, although consolidation and retests can comply with.

Derivatives markets mirrored the stress. Every day annualized funding charges in Bitcoin perpetual swaps fell to -15.46% on Feb. 6, the bottom since March 2023, whereas the seven-day common annualized funding charge dropped to -3.5%, its weakest since September 2024.

Choices positioning moved into what Lunde described as “excessive defensive territory,” just like intervals surrounding the Luna collapse, the 3AC unwind, and the FTX failure.

ETF exercise additionally surged. BlackRock’s iShares Bitcoin Belief (IBIT) recorded its largest day by day buying and selling quantity on Feb. 5, surpassing $10 billion with 284.4 million shares traded. The identical day ranked because the fifth-largest day by day outflow since spot Bitcoin ETFs launched, contributing to internet weekly outflows of 13,670 BTC regardless of inflows later within the week.

Taken collectively, K33 mentioned the breadth of volatility, quantity, yields, skews, and ETF flows helps $60,000 as a high-probability backside. The agency expects the Bitcoin value to enter a protracted consolidation part lasting weeks or months, seemingly between $60,000 and $75,000, with elevated odds of a retest of assist however restricted expectation of additional draw back.

Bitcoin billionaires are shopping for the dip

Some long-term business figures have framed the downturn as a chance. Val Vavilov, co-founder of Bitfury and an early cryptocurrency adopter, mentioned the newest market rout supplied an opportunity to rebalance and add publicity.

“For us, the autumn in Bitcoin is a chance to rebalance our portfolio and buy a specific amount of Bitcoin at a low value,” he mentioned in accordance to Bloomberg, whereas noting Bitcoin stays just one element of a broader technique that now consists of synthetic intelligence information facilities.

Technical analysts stay centered on key ranges. After the rebound from $60,000, resistance sits close to $71,800, with $74,500 representing a Fibonacci retracement stage.

Additional resistance stands close to $79,000 and $84,000.

On the draw back, bulls are watching $65,650 and $63,000 as nearer-term assist, whereas $60,000 stays the most important flooring above the 0.618 Fibonacci retracement at $57,800, in accordance with Bitcoin Journal Professional information.

On the time of writing, the bitcoin value is $66,624.