Bitcoin is buying and selling beneath the important thing $90,000 stage after failing to interrupt above essential provide and shedding its grip on necessary demand zones. The current bullish hypothesis has shortly pale as promoting stress returns, sparking a wave of panic throughout the market. Traders, rattled by renewed volatility and macroeconomic instability, have begun offloading their positions, including gasoline to the continuing correction.

Fears of a world recession and escalating commerce warfare tensions proceed to rattle monetary markets, and Bitcoin is as soon as once more among the many hardest-hit property. Regardless of moments of energy in current weeks, the main cryptocurrency has struggled to carry larger floor, and its incapability to reclaim $90K has intensified bearish sentiment.

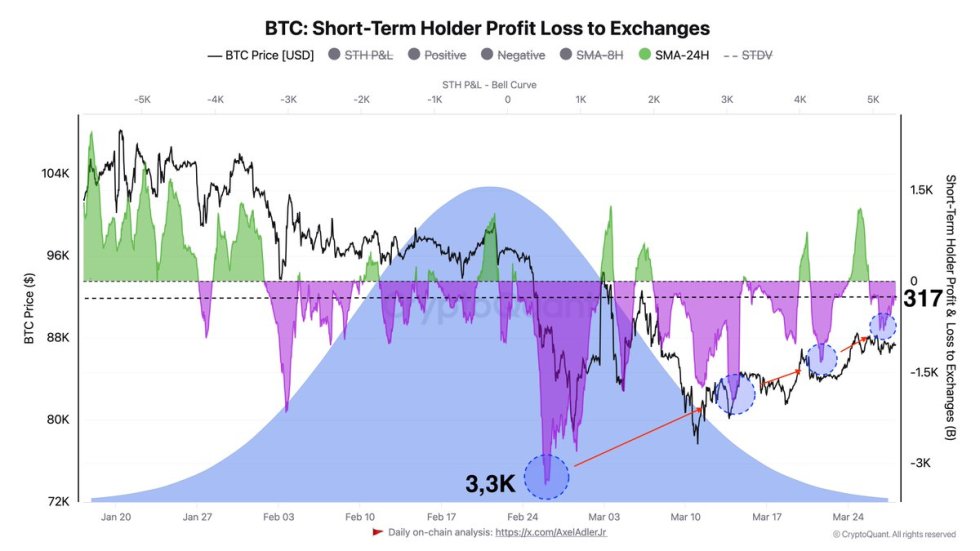

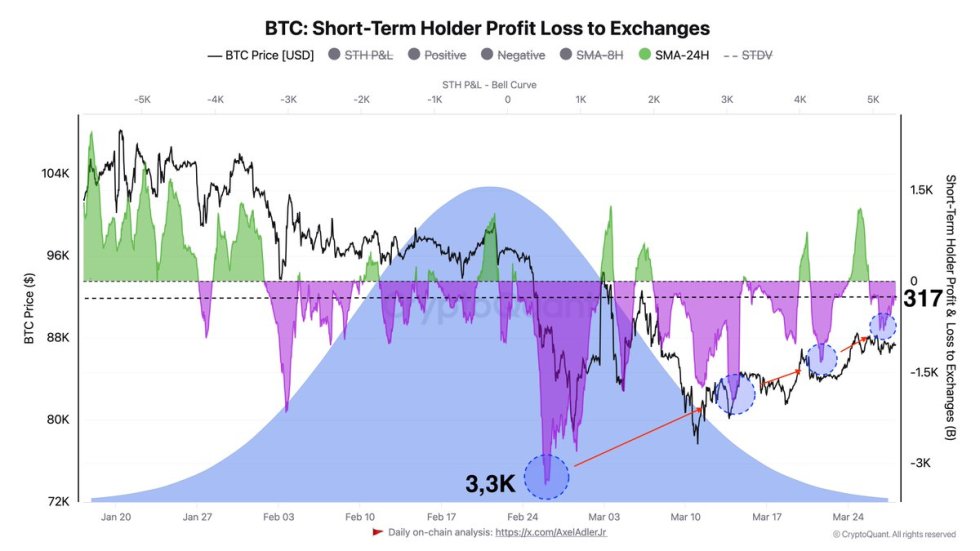

Nonetheless, on-chain information from CryptoQuant gives a nuanced perspective. The Bitcoin Quick-Time period Holder Revenue Loss to Exchanges metric reveals that the typical each day quantity of losses realized by short-term holders (STH) on exchanges has decreased tenfold. Nonetheless, with no restoration above $90K, Bitcoin stays susceptible. Bulls should step in quickly to keep away from additional draw back in an more and more fragile market.

Bitcoin Holds $85K As Capitulation Pattern Cools Off

Bitcoin is buying and selling above the $85,000 stage, sustaining a crucial help zone, however momentum is fading quick. Regardless of current makes an attempt to rally, BTC has failed to achieve traction and push larger, leaving bulls in a susceptible place. Bears at the moment are testing the energy of the $85K stage, and a breakdown beneath this zone might verify a deeper retrace and open the door to additional losses.

Analysts stay divided on Bitcoin’s subsequent transfer. Some warn that if BTC fails to reclaim $90,000 within the coming days, the present value motion might mark the start of a broader downtrend. Others see potential for a bullish breakout if momentum returns and value clears the heavy provide zone above $90K. For now, the market stays caught in a tense standoff.

Amid the uncertainty, on-chain information gives some encouraging alerts. Prime analyst Axel Adler shared insights on X, pointing to a key shift in short-term holder habits. In accordance with Adler, the typical each day quantity of losses realized by short-term holders (STH) on exchanges has decreased tenfold. This implies that investor willingness to lock in losses is fading, signaling that the capitulation part for this cohort could also be nearing its finish.

The decline in realized losses typically marks a turning level in market cycles, as panic promoting dries up and stronger arms start to take management. Nonetheless, Bitcoin’s capacity to carry above $85K and reclaim $90K will decide whether or not a real restoration is in play or if extra draw back is forward. As stress builds, bulls and bears proceed to battle for path — and the subsequent main transfer is probably going simply across the nook.

Bulls Battle To Regain Momentum

Bitcoin is at the moment buying and selling at $85,000 after breaking beneath each the 4-hour 200 transferring common (MA) and exponential transferring common (EMA) — a bearish technical growth that has triggered a wave of concern throughout the market. The lack of these key help ranges suggests weakening momentum, and merchants now anticipate a doable retest of the $83,000 zone, a stage that beforehand acted as a short-term demand space.

The failure to carry above these transferring averages has added stress on bulls, who should now defend the $85K stage to keep away from additional draw back. If $85K is misplaced, it might open the door to a sharper correction and a breakdown in market construction.

Nonetheless, the outlook isn’t solely bearish. If Bitcoin can maintain $85K and reclaim the $87K stage within the coming periods, momentum might shortly flip in favor of the bulls. A breakout above $87K would set the stage for a possible surge previous the $90K resistance — a stage that continues to be crucial for confirming a bullish continuation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Bitcoin is buying and selling beneath the important thing $90,000 stage after failing to interrupt above essential provide and shedding its grip on necessary demand zones. The current bullish hypothesis has shortly pale as promoting stress returns, sparking a wave of panic throughout the market. Traders, rattled by renewed volatility and macroeconomic instability, have begun offloading their positions, including gasoline to the continuing correction.

Fears of a world recession and escalating commerce warfare tensions proceed to rattle monetary markets, and Bitcoin is as soon as once more among the many hardest-hit property. Regardless of moments of energy in current weeks, the main cryptocurrency has struggled to carry larger floor, and its incapability to reclaim $90K has intensified bearish sentiment.

Nonetheless, on-chain information from CryptoQuant gives a nuanced perspective. The Bitcoin Quick-Time period Holder Revenue Loss to Exchanges metric reveals that the typical each day quantity of losses realized by short-term holders (STH) on exchanges has decreased tenfold. Nonetheless, with no restoration above $90K, Bitcoin stays susceptible. Bulls should step in quickly to keep away from additional draw back in an more and more fragile market.

Bitcoin Holds $85K As Capitulation Pattern Cools Off

Bitcoin is buying and selling above the $85,000 stage, sustaining a crucial help zone, however momentum is fading quick. Regardless of current makes an attempt to rally, BTC has failed to achieve traction and push larger, leaving bulls in a susceptible place. Bears at the moment are testing the energy of the $85K stage, and a breakdown beneath this zone might verify a deeper retrace and open the door to additional losses.

Analysts stay divided on Bitcoin’s subsequent transfer. Some warn that if BTC fails to reclaim $90,000 within the coming days, the present value motion might mark the start of a broader downtrend. Others see potential for a bullish breakout if momentum returns and value clears the heavy provide zone above $90K. For now, the market stays caught in a tense standoff.

Amid the uncertainty, on-chain information gives some encouraging alerts. Prime analyst Axel Adler shared insights on X, pointing to a key shift in short-term holder habits. In accordance with Adler, the typical each day quantity of losses realized by short-term holders (STH) on exchanges has decreased tenfold. This implies that investor willingness to lock in losses is fading, signaling that the capitulation part for this cohort could also be nearing its finish.

The decline in realized losses typically marks a turning level in market cycles, as panic promoting dries up and stronger arms start to take management. Nonetheless, Bitcoin’s capacity to carry above $85K and reclaim $90K will decide whether or not a real restoration is in play or if extra draw back is forward. As stress builds, bulls and bears proceed to battle for path — and the subsequent main transfer is probably going simply across the nook.

Bulls Battle To Regain Momentum

Bitcoin is at the moment buying and selling at $85,000 after breaking beneath each the 4-hour 200 transferring common (MA) and exponential transferring common (EMA) — a bearish technical growth that has triggered a wave of concern throughout the market. The lack of these key help ranges suggests weakening momentum, and merchants now anticipate a doable retest of the $83,000 zone, a stage that beforehand acted as a short-term demand space.

The failure to carry above these transferring averages has added stress on bulls, who should now defend the $85K stage to keep away from additional draw back. If $85K is misplaced, it might open the door to a sharper correction and a breakdown in market construction.

Nonetheless, the outlook isn’t solely bearish. If Bitcoin can maintain $85K and reclaim the $87K stage within the coming periods, momentum might shortly flip in favor of the bulls. A breakout above $87K would set the stage for a possible surge previous the $90K resistance — a stage that continues to be crucial for confirming a bullish continuation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.