Sneaker large NIKE, Inc. (NYSE: NKE) entered the fiscal 12 months going through heightened competitors and shifting client preferences. Its upcoming second-quarter outcomes are anticipated to replicate these evolving trade dynamics and the corporate’s push to reignite development by way of product innovation and operational resets. Administration can also be working to offset the twin pressures of inflation-driven client warning and better tariffs on imported items.

Estimates

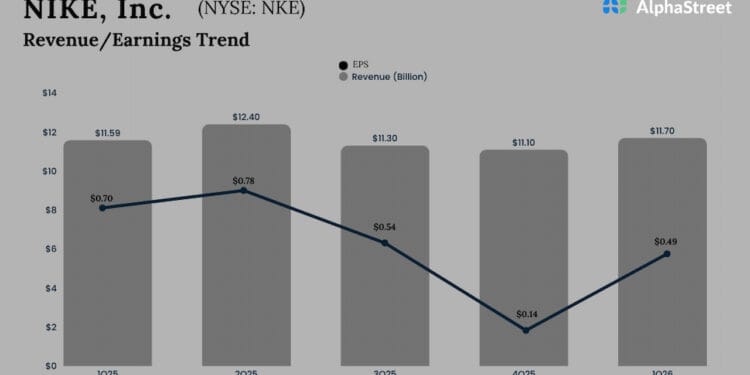

Nike’s second-quarter report is slated for launch on Thursday, December 18, at 4:15 pm ET. It’s estimated that Q2 earnings declined sharply to $0.38 per share from $0.78 per share within the year-ago quarter. Market watchers are in search of complete revenues of $12.21 billion for the November quarter, in comparison with $12.35 billion reported in Q2 2025. Up to now two years, the corporate’s quarterly earnings have recurrently crushed estimates.

Nike shares have been risky this 12 months, characterised by sustained weak point and solely short-lived rebounds. Though NKE has sustained a few of its mid-year good points, the inventory is down 9% because the starting of 2025. The current enchancment in investor sentiment displays confidence in administration’s efforts to streamline operations. From an funding perspective, the value drop presents a possibility to purchase this blue-chip inventory, which additionally pays a modest dividend.

Blended Consequence

Signalling a possible rebound after a difficult 12 months, Nike reported a rise in income for the primary quarter of fiscal 2026, with gross sales rising to $11.72 billion from $11.59 billion in Q1 2025. The highest line beat estimates, persevering with the current pattern. Web revenue declined to $727 million or $0.49 per share within the August quarter from $1.05 billion or $0.70 per share a 12 months earlier, however exceeded expectations.

“We’re working to search out the correct assortment and advertising combine to persistently deliver shoppers again to our digital ecosystem. For our firm, our dimension, with 3 manufacturers that serve shoppers in almost 190 international locations, not all sports activities, channels, or international locations will get well on the identical timelines. I spent lots of time reflecting on the final a number of months. What retains me grounded is each time I return from a significant sporting occasion, assembly with athletes, or being within the market. I’m much more satisfied that the Win Now actions are completely the correct focus for our groups,” Nike’s CEO Elliott Hill mentioned within the Q1 FY26 earnings name.

Again on Monitor?

Nike’s Win Now turnaround plan, formulated by Elliott after taking the helm in late 2024, focuses on returning to the corporate’s roots: serving athletes, reviving wholesale partnerships, and innovating its portfolio. Now, product improvement and advertising are centered round efficiency and sport relatively than way of life alone. After drifting away from wholesale partnerships and leaning closely on a DTC-focused gross sales mannequin, the corporate is as soon as once more re-engaging with its companions. On the similar time, Nike merchandise are receiving a contemporary wave of innovation, the absence of which had drawn criticism beforehand.

On Friday, Nike shares opened at $68.17 and traded decrease principally throughout the session. The common inventory worth for the previous 12 months is $69.02. NKE has misplaced round 12% since final 12 months.