Key Highlights

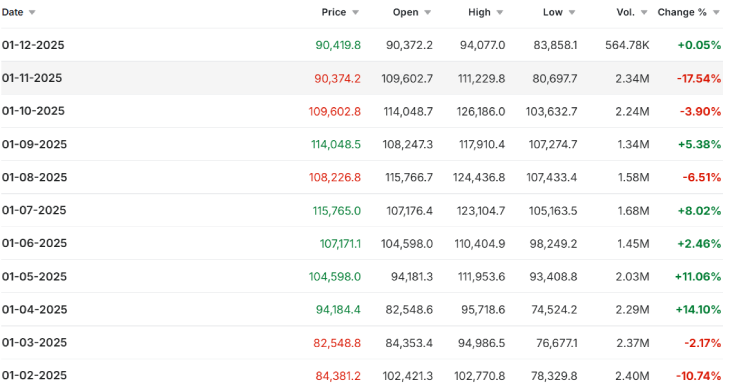

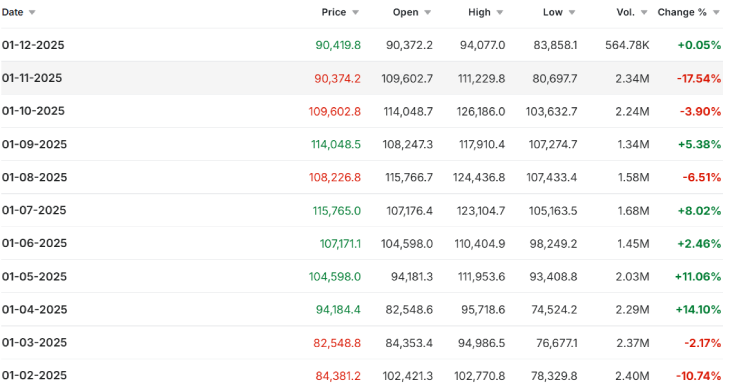

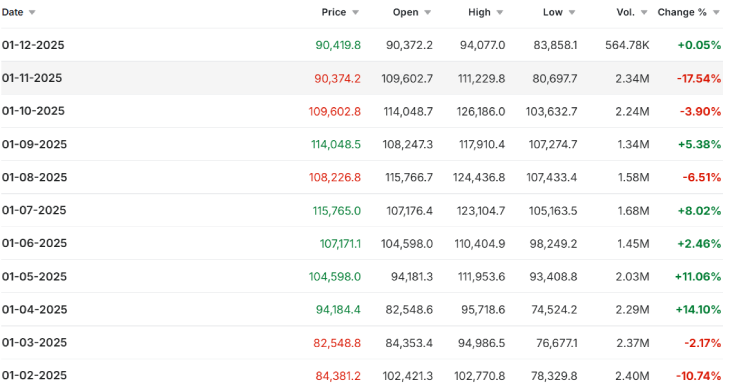

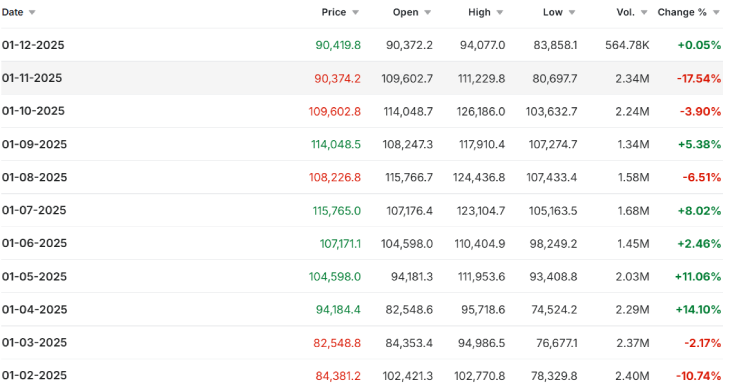

- In November, Bitcoin dropped by 17.54% attributable to large liquidation occasions(Like October 10) and intense sell-off strain

- After the most important downward development in November, institutional funding additionally depleted from Bitcoin ETFs, witnessing $3.57 billion

- Regardless of this downfall, Tom Lee shared a bullish outlook for the cryptocurrency market, saying the supercycle continues to be lively

Preparations for Christmas Eve have already begun after Thanksgiving in November, with Christmas timber being lit up all over the world. Whereas different sectors are busy wrapping up 2025, the cryptocurrency sector continues to be struggling to get better from the largest crash of the 12 months in November, triggered by large liquidations and intense promoting strain.

Regardless of the dip in Bitcoin’s worth, specialists like Justin Lee are nonetheless bullish about its future as they’re forecasting that Bitcoin might observe an upward trajectory within the upcoming months.

“Not-So-Good November”: Bitcoin Fell Under $81,000 with Large Liquidation

The cryptocurrency market witnessed the largest liquidation of its historical past on October 10 after U.S. President Donald Trump declared a 100% tariff on China. Following this announcement, over $19 billion value of cryptocurrency funding was worn out from the market in a single day, in line with Coinglass.

After poor efficiency in October, the cryptocurrency market acquired a tough begin in November, the place the largest cryptocurrency was barely seen buying and selling above $110,000. Like this wasn’t sufficient, some unlucky occasions have triggered the largest downfall of the 12 months.

In keeping with CoinMarketCap, Bitcoin has witnessed a pointy decline all through November, together with its fall under $80,000 on November 21. This was a seventh-month low and worn out over 35% of the cryptocurrency’s worth from its peak at $126,000 in October.

There are lots of elements behind this sell-off, which led to a lack of roughly $1 trillion in market capitalisation from the cryptocurrency market. Nonetheless, one of many main causes behind this downward development was triggered by a change in expectations for U.S. financial coverage. Launched Federal Reserve assembly minutes launched on November 20 revealed low probabilities of reducing rates of interest. This hesitation has damaged traders’ confidence in extremely risky belongings like cryptocurrencies. Including to this, the information associated to the U.S. jobs report has additionally lowered the probabilities of near-term price cuts.

Other than this, the turmoil within the crypto market additionally shook the institutional traders’ confidence as they began pulling out their investments from crypto-based ETPs. Bitcoin exchange-traded funds (ETFs), together with BlackRock’s iShares Bitcoin Belief ETF and Constancy’s fund, noticed large outflows totaling $3.7 billion in November, with day by day peaks hitting $75 million.

Crypto whales and main funds additionally participated on this promoting, which intensified the downward strain on the worth.

The declining worth of Bitcoin additionally sparked a sequence of automated sell-offs out there. As Bitcoin fell under key technical help ranges at $100,000 after which $90,000, it compelled the liquidation of billions of {dollars} in leveraged positions positioned by merchants who had been anticipating the worth to rise.

On the worst day, like November 21, over 140,000 merchants had their positions liquidated, with between $500 million and $700 million in lengthy positions being worn out.

Other than this, the European Systemic Danger Board (ESRB) has lately raised a warning on stablecoin. This has additionally impacted the crypto market.

Altcoins like Ethereum and Solana additionally adopted Bitcoin’s downward development with main losses, proving their correlation. Additionally, this bearish run broken the inventory worth of Technique, the largest Bitcoin holding public firm.

Will Bitcoin Comply with a Downward Trajectory in December?

On the time of scripting this, Bitcoin is displaying an indication of restoration as it’s at the moment buying and selling at round $91,558 with a tiny surge of 1.3%. Nonetheless, its whole market capitalization nonetheless sits under $2 trillion.

In keeping with Tom Lee, co-founder and Head of Analysis at Fundstrat World Advisors, the supercycle within the cryptocurrency market continues to be lively regardless of the market’s volatility in November. He affirmed that the current decline and restoration interval present extra upside potential forward.

In his forecast, he talked about that the true golden age of cryptocurrencies has solely simply begun. He set 2026 worth targets of $300,000 for Bitcoin and $20,000 for Ethereum. If that is true, BTC might see some upswing on this month, resembling breaking the psychological mark of $100,000.

British multinational financial institution Commonplace Chartered has lowered its 2025 year-end worth forecast for Bitcoin by half, from $200,000 to $100,000. The financial institution’s analysts said that the aggressive company shopping for development, exemplified by companies like Technique, has largely run its course.

(Supply: CME Group)

Other than this, the CME Group indicator exhibits an 89% likelihood of a 25bp Fed price lower on the December 10-11 FOMC assembly, in line with the CME FedWatch Device. This is able to decrease the federal funds price to three.50% to three.75%.

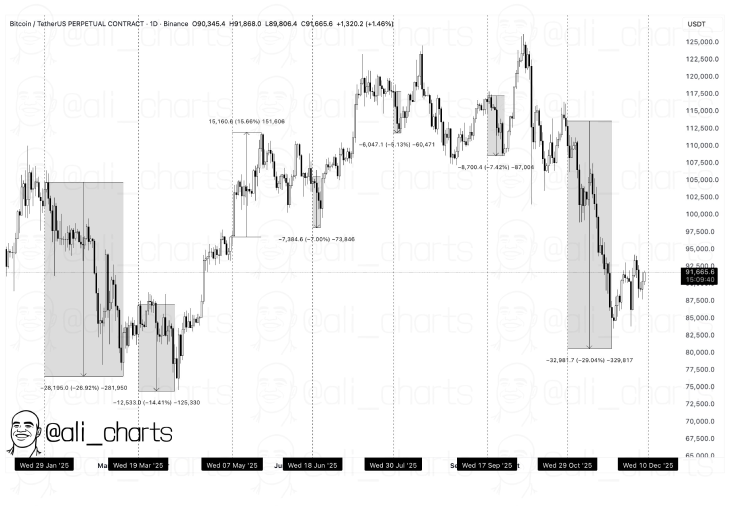

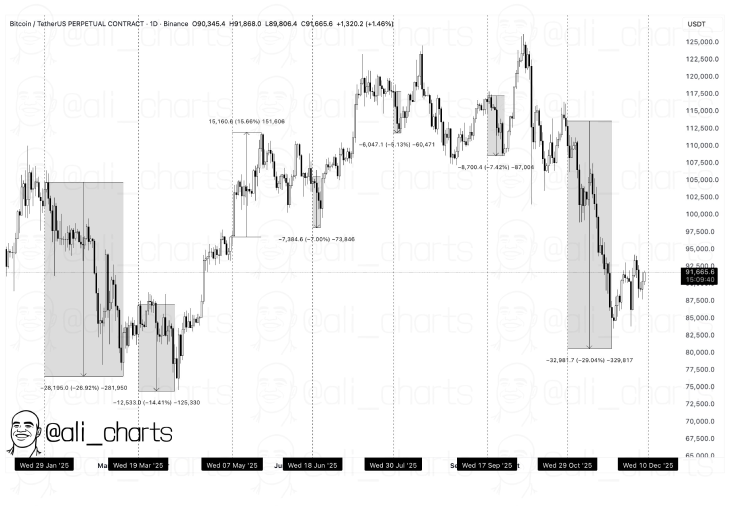

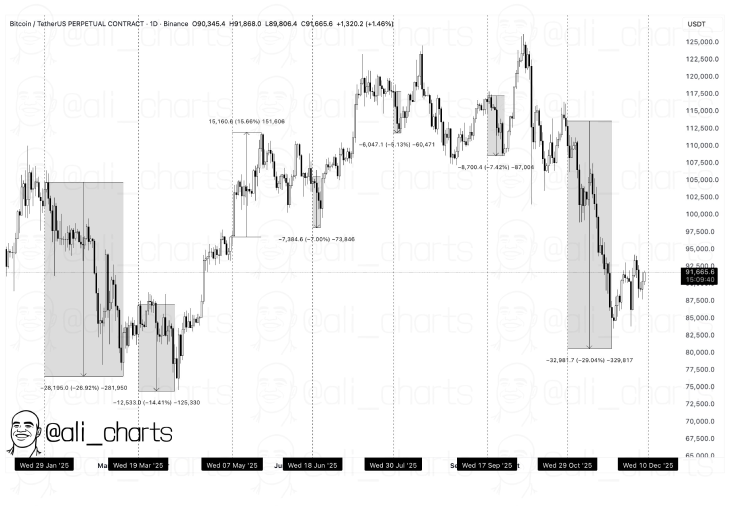

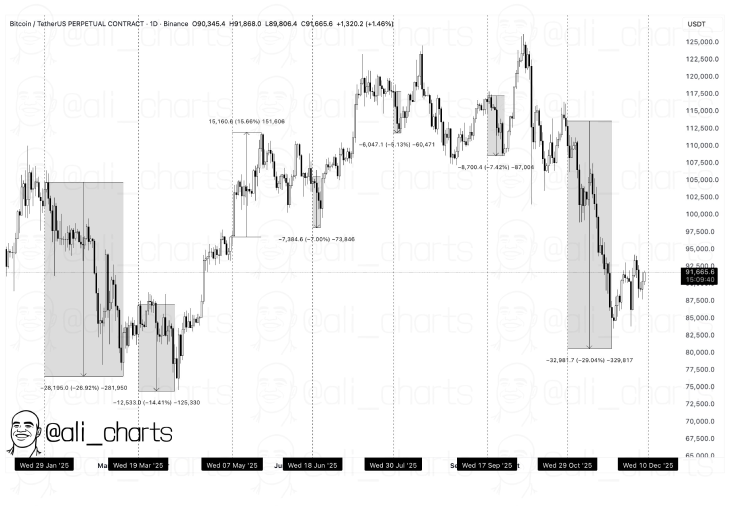

(Supply: Ali on X)

Nonetheless, all through 2025, BTC has proven a constant tendency to drop after conferences of the Federal Reserve. In keeping with market analyst Ali, out of seven Federal Open Market Committee (FOMC) conferences held thus far this 12 months, 6 have resulted in fast worth corrections for Bitcoin. Just one assembly was adopted by a short-term rally.

Additionally Learn: Macro Forces Drive Bitcoin Worth Restoration For $100,000 Breakout

Key Highlights

- In November, Bitcoin dropped by 17.54% attributable to large liquidation occasions(Like October 10) and intense sell-off strain

- After the most important downward development in November, institutional funding additionally depleted from Bitcoin ETFs, witnessing $3.57 billion

- Regardless of this downfall, Tom Lee shared a bullish outlook for the cryptocurrency market, saying the supercycle continues to be lively

Preparations for Christmas Eve have already begun after Thanksgiving in November, with Christmas timber being lit up all over the world. Whereas different sectors are busy wrapping up 2025, the cryptocurrency sector continues to be struggling to get better from the largest crash of the 12 months in November, triggered by large liquidations and intense promoting strain.

Regardless of the dip in Bitcoin’s worth, specialists like Justin Lee are nonetheless bullish about its future as they’re forecasting that Bitcoin might observe an upward trajectory within the upcoming months.

“Not-So-Good November”: Bitcoin Fell Under $81,000 with Large Liquidation

The cryptocurrency market witnessed the largest liquidation of its historical past on October 10 after U.S. President Donald Trump declared a 100% tariff on China. Following this announcement, over $19 billion value of cryptocurrency funding was worn out from the market in a single day, in line with Coinglass.

After poor efficiency in October, the cryptocurrency market acquired a tough begin in November, the place the largest cryptocurrency was barely seen buying and selling above $110,000. Like this wasn’t sufficient, some unlucky occasions have triggered the largest downfall of the 12 months.

In keeping with CoinMarketCap, Bitcoin has witnessed a pointy decline all through November, together with its fall under $80,000 on November 21. This was a seventh-month low and worn out over 35% of the cryptocurrency’s worth from its peak at $126,000 in October.

There are lots of elements behind this sell-off, which led to a lack of roughly $1 trillion in market capitalisation from the cryptocurrency market. Nonetheless, one of many main causes behind this downward development was triggered by a change in expectations for U.S. financial coverage. Launched Federal Reserve assembly minutes launched on November 20 revealed low probabilities of reducing rates of interest. This hesitation has damaged traders’ confidence in extremely risky belongings like cryptocurrencies. Including to this, the information associated to the U.S. jobs report has additionally lowered the probabilities of near-term price cuts.

Other than this, the turmoil within the crypto market additionally shook the institutional traders’ confidence as they began pulling out their investments from crypto-based ETPs. Bitcoin exchange-traded funds (ETFs), together with BlackRock’s iShares Bitcoin Belief ETF and Constancy’s fund, noticed large outflows totaling $3.7 billion in November, with day by day peaks hitting $75 million.

Crypto whales and main funds additionally participated on this promoting, which intensified the downward strain on the worth.

The declining worth of Bitcoin additionally sparked a sequence of automated sell-offs out there. As Bitcoin fell under key technical help ranges at $100,000 after which $90,000, it compelled the liquidation of billions of {dollars} in leveraged positions positioned by merchants who had been anticipating the worth to rise.

On the worst day, like November 21, over 140,000 merchants had their positions liquidated, with between $500 million and $700 million in lengthy positions being worn out.

Other than this, the European Systemic Danger Board (ESRB) has lately raised a warning on stablecoin. This has additionally impacted the crypto market.

Altcoins like Ethereum and Solana additionally adopted Bitcoin’s downward development with main losses, proving their correlation. Additionally, this bearish run broken the inventory worth of Technique, the largest Bitcoin holding public firm.

Will Bitcoin Comply with a Downward Trajectory in December?

On the time of scripting this, Bitcoin is displaying an indication of restoration as it’s at the moment buying and selling at round $91,558 with a tiny surge of 1.3%. Nonetheless, its whole market capitalization nonetheless sits under $2 trillion.

In keeping with Tom Lee, co-founder and Head of Analysis at Fundstrat World Advisors, the supercycle within the cryptocurrency market continues to be lively regardless of the market’s volatility in November. He affirmed that the current decline and restoration interval present extra upside potential forward.

In his forecast, he talked about that the true golden age of cryptocurrencies has solely simply begun. He set 2026 worth targets of $300,000 for Bitcoin and $20,000 for Ethereum. If that is true, BTC might see some upswing on this month, resembling breaking the psychological mark of $100,000.

British multinational financial institution Commonplace Chartered has lowered its 2025 year-end worth forecast for Bitcoin by half, from $200,000 to $100,000. The financial institution’s analysts said that the aggressive company shopping for development, exemplified by companies like Technique, has largely run its course.

(Supply: CME Group)

Other than this, the CME Group indicator exhibits an 89% likelihood of a 25bp Fed price lower on the December 10-11 FOMC assembly, in line with the CME FedWatch Device. This is able to decrease the federal funds price to three.50% to three.75%.

(Supply: Ali on X)

Nonetheless, all through 2025, BTC has proven a constant tendency to drop after conferences of the Federal Reserve. In keeping with market analyst Ali, out of seven Federal Open Market Committee (FOMC) conferences held thus far this 12 months, 6 have resulted in fast worth corrections for Bitcoin. Just one assembly was adopted by a short-term rally.

Additionally Learn: Macro Forces Drive Bitcoin Worth Restoration For $100,000 Breakout