Be a part of Our Telegram channel to remain updated on breaking information protection

Try urged MSCI to rethink a proposal to take away Bitcoin treasury corporations from its indexes, warning that it might scale back traders’ entry to ”the fastest-growing a part of the worldwide economic system.”

Try was responding to MSCI’s determination to think about excluding corporations with greater than 50% of their belongings in crypto from benchmark eligibility. A call is due on Jan. 15.

Try, the 14th-largest listed BTC treasury agency, mentioned in a letter to CEO Henry Fernandez that the edge can also be “unworkable,” arguing Bitcoin volatility would consistently push corporations above and under the restrict.

MSCI had mentioned many traders view digital-asset-treasury corporations extra like funds than working companies, which might make them ineligible for inclusion in MSCI’s fairness indexes.

The letter comes as analysts warn that the removing of corporations corresponding to Technique, Metaplanet, and others from inventory indexes can be a significant blow to the crypto trade.

JPMorgan mentioned Technique’s removing might set off as much as $2.8 billion of outflows for the company Bitcoin purchaser’s inventory, with as much as $12 billion in danger if different index suppliers comply with MSCI’s lead.

Massive Bitcoin Firms Are Taking part in A Main Half In The AI Growth

Try CEO Matt Cole rejected MSCI’s view that enormous crypto treasury corporations signify funding funds, and pointed to how Bitcoin miners, which regularly have giant quantities of BTC on their stability sheets, are serving to facilitate the AI growth with their surplus vitality and infrastructure.

— Matt Cole (@ColeMacro) December 5, 2025

“Among the corporations with the most important Bitcoin holdings are miners who’re turning into essential AI infrastructure suppliers,” Cole mentioned.

“All these miners are quickly diversifying their information facilities to supply energy and infrastructure for AI computing,” he added. “However at the same time as AI income is available in, their Bitcoin will stay, and your exclusion would too, curbing shopper participation within the fastest-growing a part of the worldwide economic system.”

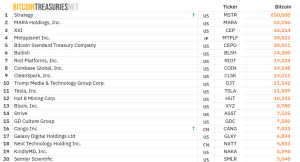

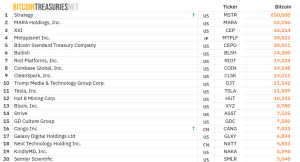

High 20 BTC DATs (Supply: Bitcoin Treasuries)

Cole additionally mentioned that a number of Bitcoin miners have not too long ago develop into “distributors of alternative for tech giants’ computing wants, and that these corporations are “ideally positioned” to fulfill the rising vitality demand from AI corporations.

BTC Structured Finance Is Rising

Cole additionally mentioned that the removing of crypto treasury corporations would lower off corporations that provide traders an analogous product to a wide range of structured notes linked to Bitcoin’s returns which are at the moment provided by conventional finance giants corresponding to JPMorgan, Morgan Stanley, and Goldman Sachs.

“Bitcoin structured finance is as actual a enterprise for us as it’s for JPMorgan,” he mentioned. “It could be uneven for us to compete in opposition to conventional financiers weighed down by a better price of capital from passive index suppliers’ penalties on the very Bitcoin enabling our choices.”

`Unworkable’ 50% Threshold

Cole elaborated on his rivalry that MSCI’s 50% threshold is “unworkable in apply.”

“Tying index inclusion to a numeric threshold for famously unstable belongings might trigger extra frequent turnover in funds benchmarked to MSCI’s merchandise,” he wrote.

That, based on Cole, would increase the administration prices and improve the danger of monitoring errors as corporations “flicker out and in of funds in proportion to their holdings’ volatility.”

Along with the elevated administration and monitoring errors, Try’s CEO mentioned that it’ll even be tough to measure when an organization’s holdings attain 50%.

“There are an rising number of devices by which corporations achieve that publicity, many advanced,” the CEO mentioned.

“If an organization holds Bitcoin structured merchandise like JPMorgan’s or Technique’s, does that rely towards the 50%?” he requested. “Would it not fluctuate relying on the product, or would devices past spot holdings supply prepared methods of avoiding MSCI’s rule?”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection