Be part of Our Telegram channel to remain updated on breaking information protection

The Worldwide Financial Fund (IMF) warned that rising stablecoin adoption may weaken central banks’ management over financial coverage and threaten nations’ monetary sovereignty.

Whereas stablecoin adoption makes funds quicker and cheaper for folks, ”it decreases a rustic’s central financial institution means to regulate its financial coverage and function lender of final resort,” the IMF mentioned in a weblog submit that highlighted the findings of a 56-page report on the subject.

The promise that stablecoins supply additionally comes with dangers of “international locations shedding management over capital flows,” it added.

Stablecoins Can ‘Penetrate An Economic system Quickly’

Traditionally, buyers who wished to carry US {dollars}, or every other fiat forex apart from their nation’s personal, have been required to carry money or open particular financial institution accounts.

However stablecoins allow anybody to achieve entry to the underlying asset that it represents on-chain, one thing the IMF mentioned permits the cryptos to “penetrate an financial system quickly through the web and smartphones.”

The cross-border nature of stablecoins may simplify remittances and funds but additionally complicate financial coverage and monetary stability in rising markets. A brand new IMF report explores the challenges and alternatives. https://t.co/eVss5tPsFn pic.twitter.com/ERq3MwxPTz

— IMF (@IMFNews) December 4, 2025

“The usage of international currency-denominated stablecoins, particularly in cross-border contexts, may result in forex substitution and probably undermine financial sovereignty, significantly within the presence of unhosted wallets,” the IMF mentioned.

It cited residents in areas like Africa, the Center East, Latin America, and the Caribbean, who’re more and more holding their cash in stablecoins as a substitute of native foreign-currency financial institution accounts. That’s typically due to worries over monetary instability and even survival, it mentioned.

The IMF additionally mentioned that it’s changing into harder for central banks to information their nation’s financial coverage since they don’t have correct knowledge from native FX accounts.

CBDC’s Face Issue Competing With Stablecoins

Given the truth that stablecoins function on a distributed ledger and there’s no central third occasion wanted to course of and validate transactions, a central financial institution would have little or no management if stablecoin adoption and utilization proceed to rise.

In an try to achieve again a few of the management misplaced to stablecoins, many central banks have proposed creating their very own central financial institution digital currencies (CBDCs). These tokens are much like stablecoins, however are issued and maintained through a central financial institution. Which means a central financial institution would additionally be capable to higher monitor and prohibit transaction exercise.

However the IMF warned that if international currency-denominated stablecoins develop into entrenched by means of funds companies, native options corresponding to a CBDC would discover it troublesome to compete.

US Greenback Stablecoins Dominate The Market

The stablecoin market has grown to about $316 billion this yr, in keeping with CoinMarketCap.

It gained momentum after US President Donald Trump signed the GENIUS Act into regulation, offering regulatory readability within the US for the primary time.

That readability ignited a stablecoin frenzy, with a number of main conventional monetary corporations launching their very own tokens.

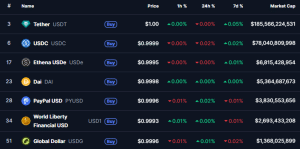

At the moment, stablecoins pegged to the US greenback account for over 90% of the market. Main the sector are Tether’s USDT and Circle’s USDC. Mixed, these two stablecoins have a capitalization of greater than $250 billion, knowledge from CoinMarketCap reveals.

High stablecoins by market cap (Supply: CoinMarketCap)

With the rise in stablecoins and the dominance of USD-pegged tokens, the European Central Financial institution (ECB) just lately flagged the potential dangers of the continued progress of those cryptos.

“Important progress in stablecoins may trigger retail deposit outflows, diminishing an vital supply of funding for banks and leaving them with extra risky funding total,” the ECB mentioned.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection