Be part of Our Telegram channel to remain updated on breaking information protection

CoinShares has withdrawn its utility for a staked Solana ETF (exchange-traded fund) with the US Securities and Trade Fee (SEC).

The withdrawal comes at a time of accelerating competitors within the crypto ETF phase and with regulatory necessities evolving.

“The Registration Assertion sought to register shares to be issued in reference to a transaction that was finally not effectuated,” a Nov. 28 submitting stated. ”No shares had been bought, or can be bought, pursuant to the above-mentioned Registration Assertion.”

Solana ETFs See Sturdy Begin As Traders Chase Excessive Yields

The primary staked Solana ETF, issued by REX-Osprey, debuted within the US in June. That was adopted by the launch of an identical product from Bitwise in October.

Bitwise’s fund launched with almost $223 million in belongings on its first day of buying and selling, and picked up roughly 50% of the worth that the REX-Osprey ETF had racked up over a few months, in accordance with Bloomberg ETF analyst Eric Balchunas.

$BSOL is starting life with $220m in belongings. Spectacular, already half the dimensions of $SSK. Shocked they did not maintain off tho and have it are available on Day One to get quantity and flows greater. Excellent news is now we’ll have solely natural, simpler to measure true demand pic.twitter.com/bHXQuCRw1Z

— Eric Balchunas (@EricBalchunas) October 28, 2025

A number of different staked Solana ETFs have since entered the US market.

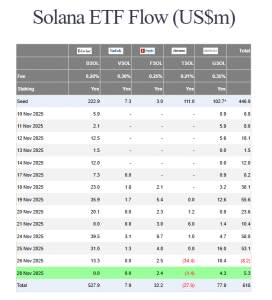

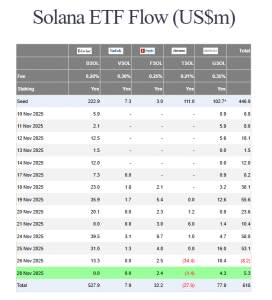

Collectively, the SOL funding merchandise have seen greater than $369 million in capital flows in November. Solana ETFs additionally managed to buck the pattern seen with spot Bitcoin and Ethereum ETFs that skilled file outflows in October and November amid the current market stoop.

The robust efficiency is underpinned partially by the 5-7% staking rewards on provide.

US SOL ETF flows (Supply: Farside Traders)

Knowledge from Farside Traders exhibits that since Nov. 10, the funds have solely seen web every day outflows on Nov. 26, when $8.2 million left the funding merchandise.

The funds resumed their inflows streak within the newest buying and selling session, with buyers injecting $5.3 million into the ETFs. On the day, Grayscale’s GSOL led the cost with $4.3 million inflows. Constancy’s FSOL was the one different SOL ETF to see inflows on the day, with $2.4 million getting into its reserves.

21Shares’ TSOL was the one fund to file outflows yesterday, with $1.4 million leaving its reserves. This fund was additionally liable for breaking the funds’ web every day inflows streak the day earlier than, after buyers withdrew $34.4 million from the fund on the day.

SOL Value Trades In A Downtrend

Regardless of the continued inflows for SOL ETFs, the altcoin that the funds observe has seen its worth slide in current weeks. Over the previous month, SOL’s worth has plummeted over 28%, coinciding with the broader crypto market pullback.

SOL every day chart (Supply: GeckoTerminal)

Knowledge from GeckoTerminal exhibits that SOL trades in a medium-term downtrend. Technical indicators corresponding to short-term Exponential Shifting Averages (EMAs), the Shifting Common Convergence Divergence (MACD), and the Relative Power Index (RSI) present that bears nonetheless have a good grip on the altcoin’s worth.

Nonetheless, SOL is trying to interrupt above the higher boundary of the descending worth channel. A breach of this barrier might result in a bullish shift in momentum and energy for SOL.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection