US President Donald Trump’s newest promise of a tariff-funded “dividend” despatched shockwaves by markets Monday, and merchants in digital belongings moved rapidly to cost in the opportunity of further money in American pockets.

Associated Studying

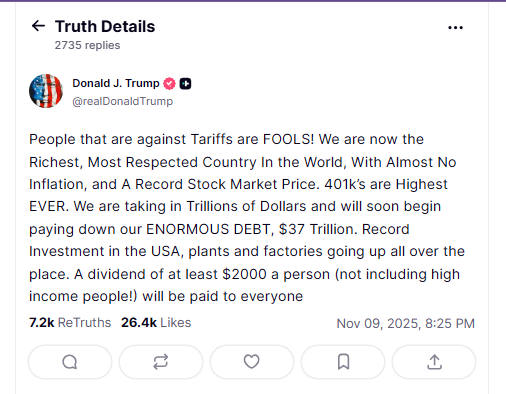

The plan would pay not less than $2,000 to most adults and has been described as a part of a broader push to make use of tariff receipts for direct funds.

Tariff Dividend Sparks Market Strikes

In response to reviews, the proposal is being introduced as a approach to convert tariff income into direct funds to residents, with proponents linking the transfer to stronger client spending and better danger urge for food amongst buyers.

Trump stated the federal government might afford the new payout as a result of tariffs had introduced in huge income and since factories throughout the nation had been attracting report ranges of funding. He talked about that the cash would go to most Individuals, besides these incomes larger incomes.

“Folks which are in opposition to tariffs are fools,” Trump wrote in his Fact Social publish. “We’re taking in trillions of {dollars} and can quickly start paying down our huge debt, $37 trillion.”

Trump additionally pointed to report highs in 401(ok) financial savings and the inventory market, saying tariffs helped the financial system develop as an alternative of slowing it down.

The determine being cited publicly as backing for this system is about $400 billion, although analysts and finances specialists say the mathematics and authorized pathway stay unclear.

Crypto Costs Tick Greater

The cryptocurrency market reacted inside hours following information of the dividend. Bitcoin climbed above $106,000, whereas Ether moved into the mid-thousands, reflecting a brief, sharp raise in sentiment amongst merchants who anticipate recent liquidity might movement into danger belongings.

These worth strikes adopted per week when some crypto indexes had fallen sharply, so the announcement helped reverse a part of that pullback.

Market watchers stated the response was pushed extra by sentiment than by a confirmed funding mechanism. Some commentators in contrast the potential impact to previous stimulus checks, noting that when households get direct dividend funds they typically increase spending and, in some instances, channel cash into markets.

Nonetheless, regulators and finances specialists are asking how the plan would work below present regulation and whether or not tariff receipts are a dependable supply for recurring payouts.

Associated Studying

Change Exercise Up

Merchants on exchanges confirmed elevated exercise, and a handful of altcoins recorded positive factors as momentum merchants piled in. Quantity spiked on some platforms as short-term consumers tried to experience the sentiment.

Observers cautioned that rallies tied to political bulletins might be risky and should fade if the coverage stalls in Congress or runs into authorized challenges.

Authorized and political questions are entrance and middle. Treasury officers have prompt components of the payout might be dealt with by tax adjustments already on the books, whereas court docket challenges over the scope of tariff powers might complicate any fast roll-out.

Featured picture from Unsplash, chart from TradingView