- EasyA co-founders declare XRP tokenization will make the world’s wealthiest buyers richer.

- Ripple expands into DeFi by creating tokenization RWA initiatives to make XRP a bridge forex for world liquidity.

Phil and Dom Kwok, co-founders of EasyA, argued that asset tokenization may rework entry to world wealth via XRP. Phil, who can also be a crypto analyst, defined that asset tokenization will give each billionaire entry to prompt liquidity.

Wealthy Buyers to Unlock Extra Wealth with XRP Tokenization

Referencing a Monetary Occasions report, the analyst highlighted a paradox in wealth administration. “The trick to being a multibillionaire is having zero liquidity,” Phil Kwok wrote in an X publish.

Phil sees this as a constructive sign for crypto as a result of tokenization affords an answer to real-world issues. He defined that tokenization entails changing real-world property (RWAs) into digital tokens on a blockchain, making them divisible, tradable, and all the time accessible.

This addresses the liquidity challenge by permitting billionaires to unlock worth from their holdings with out promoting them outright.

Phil extends the good thing about tokenization past billionaires to most of the people. Notably, tokenization democratizes entry to high-value property via fractional possession.

The analyst defined that this inclusivity is a game-changer, because it lowers the entry barrier. It additionally faucets into retail investor demand, a market far bigger than the ultra-rich phase.

Phil added that crypto will not play second fiddle to conventional finance (TradFi), which depends on gradual, centralized techniques with excessive prices and restricted buying and selling hours.

To Phil, some great benefits of tokenizing property on blockchains place crypto as a superior different, probably overtaking TradFi in effectivity and adoption.

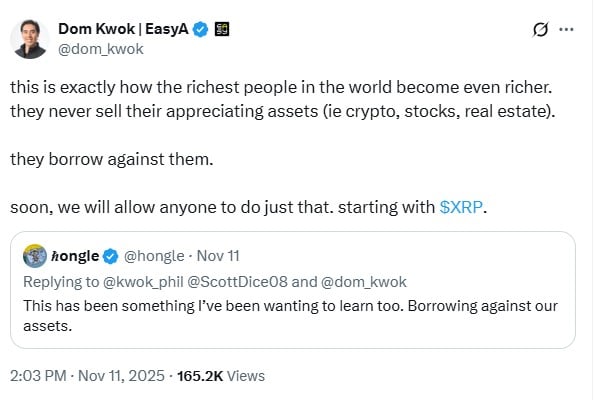

Increasing on Phil’s statements, Dom Kwok centered on how billionaires handle their wealth. Dom said that the world’s wealthiest people develop richer by by no means promoting their appreciating property, resembling shares or actual property.

Dom revealed that EasyA plans to make this mannequin out there to everybody, starting with XRP, the Ripple-backed coin.

XRP Expands Its Position in DeFi

The feedback from Phil align with rising curiosity in crypto-backed loans to permit individuals to entry money with out promoting their crypto. Underneath this technique, customers can lock up cash like XRP as collateral.

They will additionally borrow stablecoins or fiat forex, and repay later, retaining any beneficial properties if the value of the coin rises. This method, nevertheless, permits billionaires to defer taxes. Nonetheless, some group members have raised issues about market danger and liquidation.

Dom, nevertheless, prompt that future borrowing techniques ought to permit customers to customise their margin of security. Because of this, conservative buyers can borrow much less and scale back their liquidation danger.

The feedback from the EasyA founders align with a broader XRP motion into decentralized finance (DeFi) and tokenization infrastructure.

Ripple continues to develop tokenization RWA initiatives, aiming to make XRP a bridge forex for world liquidity. In a current examine we reported on, Ripple CEO Brad Garlinghouse mentioned XRP positions as a powerful candidate for RWA tokenization.

In the meantime, Ripple predicted in an April report that the tokenization market may attain $18.9 trillion by 2033. To additional broaden its tokenization push, Ripple is planning to set up a Nationwide Belief financial institution.

Really useful for you: