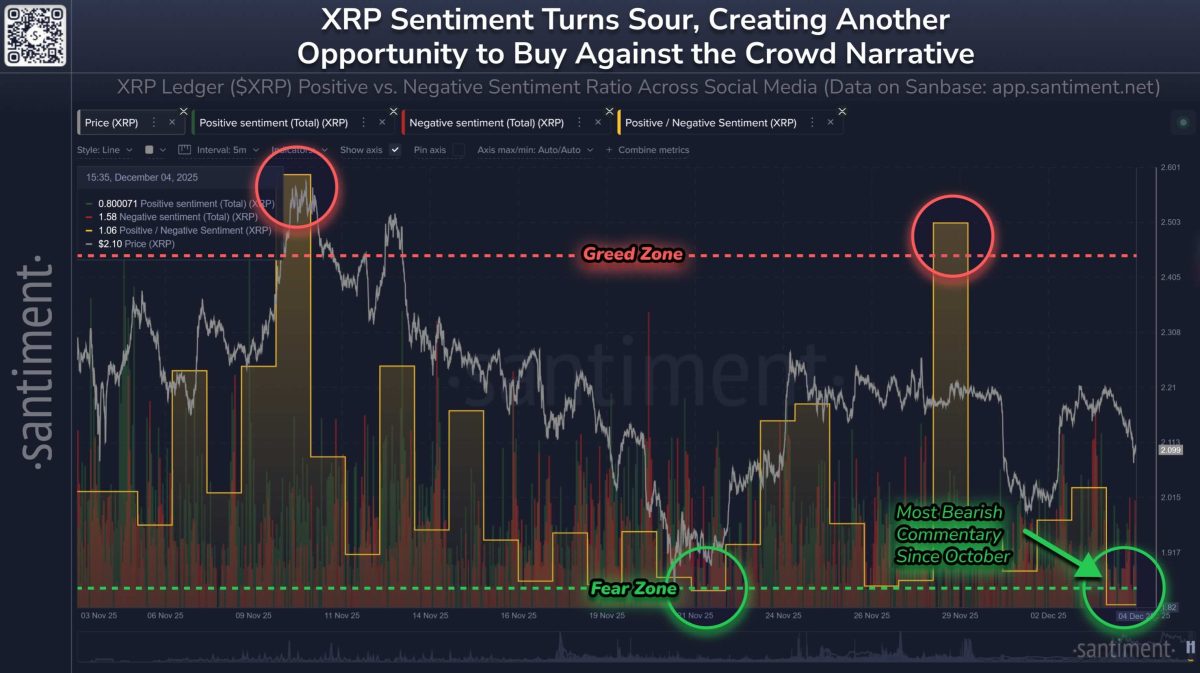

- Santiment information reveals XRP firmly within the “worry zone,” with bearish commentary far outweighing bullish exercise.

- Analysts warn of weakening market construction, noting that XRP trades below key resistance ranges and a possible breakdown below $2.

XRP has seen its social sentiment drop considerably, amid a 31% value correction over the past two months. Even right this moment, the XRP value faces a significant drop and is as soon as once more testing the essential help at $2.0. The sentiment close to the cryptocurrency has hit a brand new low since October 2025.

XRP Concern Sentiment Peaks Amid Worth Drop

Blockchain analytics platform Santiment says XRP is experiencing its highest ranges of worry, uncertainty, and doubt (FUD) since October 2025. This comes after a 31% decline over the previous two months.

As per the social metrics shared by Santiment, the bearish commentary on XRP has sharply exceeded bullish dialogue. This has pushed the XRP within the “worry zone.”

As proven within the above determine, the sentiment indicator reveals two totally different extremes. The purple markers point out unusually excessive bullish feedback (“greed zone”) and inexperienced markers present abnormally excessive bearish feedback (“worry zone”).

Santiment reported that the final time XRP reached an identical stage of worry, on November 21, the value rallied by 22% inside three days earlier than sentiment flipped to greed. Thus, it famous that present circumstances might current an identical setup. It signifies a possible alternative if market sentiment follows previous patterns.

XRP Faces A Litmus Take a look at

XRP value stays below stress close to the decrease finish of the $2 vary as broader market sentiment stays fragile. The token is buying and selling at $2.08, down greater than 3% to this point in December, with bears making an attempt to push the value under the important thing $2 help stage.

Analyst Mr. Xoom famous that XRP’s market construction stays weak regardless of the temporary reduction rally on December 2–3, which produced an 8% acquire. He added that many crypto property are at the moment positioned simply beneath main resistance zones.

Based on the evaluation, a descending trendline from XRP’s summer season peak continues to dictate value motion and coincides with a possible draw back goal close to $1.35. This outlook turns into extra possible if XRP loses the crucial $1.85–$2.00 help vary.

Then again, spot XRP ETF inflows have remained within the optimistic territory for 14 consecutive days in a row. Inside a month of launch, the flows throughout all 4 ETFs, have reached previous $850 million, and is approaching the $1 billion milestone very quick.

In the meantime, the flows into Bitcoin ETFs and Ethereum ETFs have flipped into the unfavourable territory. This reveals that institutional sentiment is at the moment leaning in favour of XRP.