Key Takeaways

- WisdomTree has determined to finish its bid to launch an XRP exchange-traded fund (ETF) within the US.

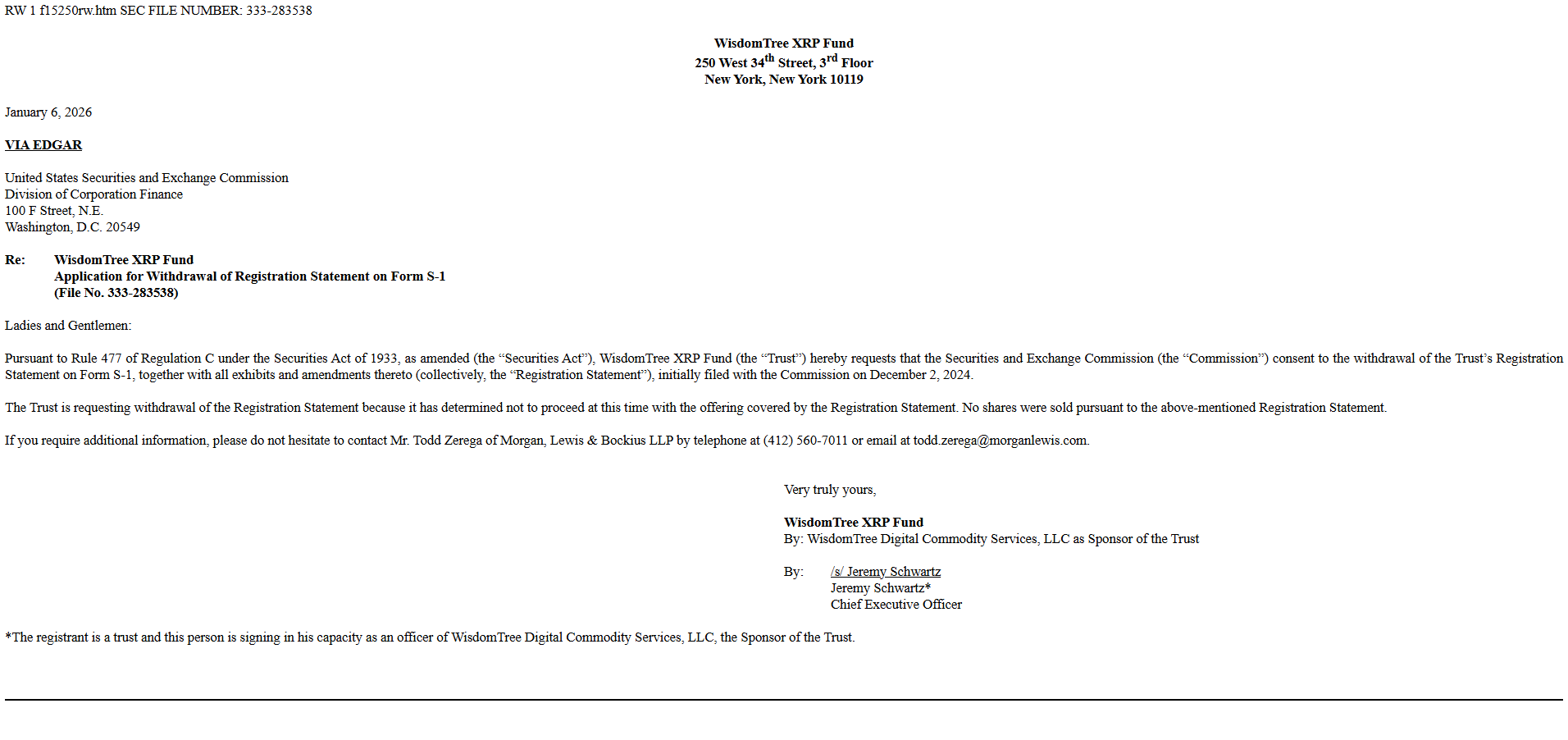

- The appliance withdrawal was made by way of a request filed to the Securities and Trade Fee (SEC).

Share this text

WisdomTree submitted a submitting to the SEC this week in search of to withdraw its software to launch the WisdomTree XRP Fund, an exchange-traded fund tied to the fourth-largest digital asset.

The New York-based asset supervisor entered the US XRP ETF race in late 2024. Forward of its SEC submitting, the agency had already launched WisdomTree Bodily XRP (XRPW) in Europe, the place the product now trades on main venues together with Deutsche Börse Xetra, the Swiss Trade, and Euronext.

WisdomTree’s determination to halt its XRP ETF push follows the same transfer by CoinShares, Europe’s largest digital asset funding agency, which filed to withdraw a number of US ETF proposals, together with merchandise tied to XRP, Solana, and Litecoin.

The choice comes as competitors within the XRP ETF market, whereas restricted in quantity, has already consolidated round early movers.

Since their debuts, US-listed XRP ETFs have drawn $1.2 billion in inflows and now maintain almost $1.5 billion in internet belongings, per SoSoValue. Canary Capital at the moment leads the group, with Bitwise, Franklin Templeton, and Grayscale not far behind.

XRP ETFs have continued to document regular inflows, however on a much smaller scale than Bitcoin, which stays probably the most liquid and institutionally demanded digital asset.

On the identical time, subdued danger urge for food has provided little help for the enlargement of digital asset ETF merchandise. This may increasingly immediate some sponsors to double down on established choices quite than pursue incremental launches.

Regardless of difficult market situations and delicate investor demand, some huge gamers seem prepared to maneuver forward with crypto ETF plans. Morgan Stanley, which manages roughly $1.8 trillion in belongings, just lately filed with the SEC to launch ETFs linked to Bitcoin, Ether, and Solana.