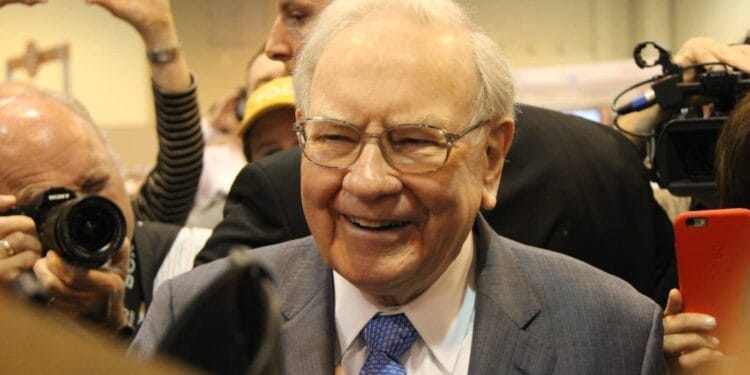

Picture supply: The Motley Idiot

Warren Buffett’s each transfer is analysed underneath a microscope — and with good motive. Because the driving pressure behind Berkshire Hathaway, he’s created one of the vital profitable funding information in historical past.

However what does his newest buying and selling exercise reveal? And are there classes right here for UK traders?

Whereas Buffett doesn’t sometimes put money into UK-listed corporations, many shares on the FTSE 100 have related traits to these in his portfolio — world attain, pricing energy, and constant money era.

Particularly, two current Berkshire Holdings — Johnson & Johnson and Constellation Manufacturers — remind me of UK equivalents AstraZeneca and Unilever (LSE: ULVR).

Right here’s why they could be value contemplating for UK traders.

A defensive pharma choose

Buffett trimmed his place in healthcare big J&J a couple of years in the past however the logic behind proudly owning large-cap pharma stays. Corporations like these profit from broad moats, excessive limitations to entry, and merchandise individuals depend on whatever the financial cycle.

In that sense, AstraZeneca matches the invoice. The agency has constructed a various drug portfolio and is investing in oncology, immunology, and uncommon ailments remedies. It additionally boasts spectacular financials: income grew 12% within the second quarter of 2025 and earnings per share climbed 27%.

Though the dividend yield is a modest 2.2%, the payout ratio is well-covered by earnings and has room to develop. The price-to-earnings (P/E) ratio of 19.7 could look excessive at first look, however is arguably justified by the corporate’s sturdy pipeline of long-term progress potential.

One threat? Drug growth failures and regulatory hurdles can hit income and sentiment laborious — however for traders searching for Buffett-style defensiveness, AstraZeneca is one to contemplate.

At all times in demand

Buffett has been growing Berkshire’s place in Constellation Manufacturers not too long ago. His love for well-known branded shopper merchandise stems from their pricing energy, consistency, and model loyalty — traits additionally present in UK shopper items big Unilever.

With family names like Dove, Hellmann’s, and Persil in its portfolio, Unilever enjoys broad world publicity. In Q2 2025, turnover rose 3.3% yr on yr, pushed by a return to quantity progress. Regardless of inflationary strain, it maintained working margins above 16% — spectacular for an organization on this house.

The three.4 % dividend yield, backed by a payout ratio of round 75%, gives strong passive earnings potential. And whereas the share worth has struggled lately, a ahead P/E ratio of 17 suggests the worst could already be priced in.

The present aggressive panorama is difficult, although, and poses dangers to Unilever’s backside line. Altering shopper tastes and competitors from personal labels may proceed to weigh on income. Over an prolonged interval, this might threaten a dividend minimize if debt piles up.

Nonetheless, when wanting on the larger image, I consider the dimensions and model energy of the corporate are sufficient to maintain it resilient.

Sustainable high quality

Buffett’s funding rules — purchase high quality, maintain lengthy, ignore the noise – proceed to resonate.

Whereas Berkshire Hathaway might not be snapping up FTSE 100 shares, companies like AstraZeneca and Unilever share lots of the identical strengths as his US holdings.

For affected person UK traders, following his philosophy would possibly simply repay.

Picture supply: The Motley Idiot

Warren Buffett’s each transfer is analysed underneath a microscope — and with good motive. Because the driving pressure behind Berkshire Hathaway, he’s created one of the vital profitable funding information in historical past.

However what does his newest buying and selling exercise reveal? And are there classes right here for UK traders?

Whereas Buffett doesn’t sometimes put money into UK-listed corporations, many shares on the FTSE 100 have related traits to these in his portfolio — world attain, pricing energy, and constant money era.

Particularly, two current Berkshire Holdings — Johnson & Johnson and Constellation Manufacturers — remind me of UK equivalents AstraZeneca and Unilever (LSE: ULVR).

Right here’s why they could be value contemplating for UK traders.

A defensive pharma choose

Buffett trimmed his place in healthcare big J&J a couple of years in the past however the logic behind proudly owning large-cap pharma stays. Corporations like these profit from broad moats, excessive limitations to entry, and merchandise individuals depend on whatever the financial cycle.

In that sense, AstraZeneca matches the invoice. The agency has constructed a various drug portfolio and is investing in oncology, immunology, and uncommon ailments remedies. It additionally boasts spectacular financials: income grew 12% within the second quarter of 2025 and earnings per share climbed 27%.

Though the dividend yield is a modest 2.2%, the payout ratio is well-covered by earnings and has room to develop. The price-to-earnings (P/E) ratio of 19.7 could look excessive at first look, however is arguably justified by the corporate’s sturdy pipeline of long-term progress potential.

One threat? Drug growth failures and regulatory hurdles can hit income and sentiment laborious — however for traders searching for Buffett-style defensiveness, AstraZeneca is one to contemplate.

At all times in demand

Buffett has been growing Berkshire’s place in Constellation Manufacturers not too long ago. His love for well-known branded shopper merchandise stems from their pricing energy, consistency, and model loyalty — traits additionally present in UK shopper items big Unilever.

With family names like Dove, Hellmann’s, and Persil in its portfolio, Unilever enjoys broad world publicity. In Q2 2025, turnover rose 3.3% yr on yr, pushed by a return to quantity progress. Regardless of inflationary strain, it maintained working margins above 16% — spectacular for an organization on this house.

The three.4 % dividend yield, backed by a payout ratio of round 75%, gives strong passive earnings potential. And whereas the share worth has struggled lately, a ahead P/E ratio of 17 suggests the worst could already be priced in.

The present aggressive panorama is difficult, although, and poses dangers to Unilever’s backside line. Altering shopper tastes and competitors from personal labels may proceed to weigh on income. Over an prolonged interval, this might threaten a dividend minimize if debt piles up.

Nonetheless, when wanting on the larger image, I consider the dimensions and model energy of the corporate are sufficient to maintain it resilient.

Sustainable high quality

Buffett’s funding rules — purchase high quality, maintain lengthy, ignore the noise – proceed to resonate.

Whereas Berkshire Hathaway might not be snapping up FTSE 100 shares, companies like AstraZeneca and Unilever share lots of the identical strengths as his US holdings.

For affected person UK traders, following his philosophy would possibly simply repay.