Be part of Our Telegram channel to remain updated on breaking information protection

The Uniswap value soared 28% over the previous 24 hours to commerce at $8.42 as of two:29 a.m. EST on buying and selling quantity that soared 584% to $3.3 billion.

This comes as Uniswap Labs with Uniswap Basis pushed a brand new proposal, UNIfication, which goals to reshape the decentralized change’s construction and future route.

The governance proposal submitted by Uniswap founder Hayden Adams seeks to activate protocol charges, introduce a UNI-burning mechanism, and realign incentives throughout the ecosystem.

At present, I’m extremely excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal activates protocol charges and aligns incentives throughout the Uniswap ecosystem

Uniswap has been my ardour and singular focus for… pic.twitter.com/Ee9bKDric5

— Hayden Adams 🦄 (@haydenzadams) November 10, 2025

The announcement boosted investor confidence, with the UNI token surging to a two-month excessive. Based on the proposal, on the launch of UNIfication, charges will apply to Uniswap v2 and main v3 swimming pools on Ethereum.

For v2, liquidity suppliers (LPs) will earn 0.25% per commerce, with 0.05% allotted to the protocol. For v3, governance will accumulate one-fourth or one-sixth of the liquidity supplier charges, based mostly on the payment tier.

The proposal requires a burn of 100 million UNI, price $842 million at present costs, from the Uniswap treasury as a retroactive burn. This represents the quantity that may have been burned if charges had been lively for the reason that protocol’s begin.

Uniswap may go parabolic if the payment swap is activated.

Even simply counting v2 and v3, with $1T in YTD quantity, that’s about $500M in annual burns if quantity holds.

Exchanges maintain $830M, so even with unlocks, a provide shock appears inevitable. Appropriate me if I’m flawed. https://t.co/39QjJsw9uQ pic.twitter.com/3FQzAmuOP3

— Ki Younger Ju (@ki_young_ju) November 11, 2025

The proposal brings in permanency into the expansion funding mannequin, as from 2026 the agency governance would allocate a 20 million UNI yearly finances.

The proposal, if authorised by the DAO, would set a brand new precedent for decentralized decision-making.

Can the proposal nonetheless push the value of UNI larger?

Uniswap Worth On A Restoration, Goals For A Rally Over Key Resistances

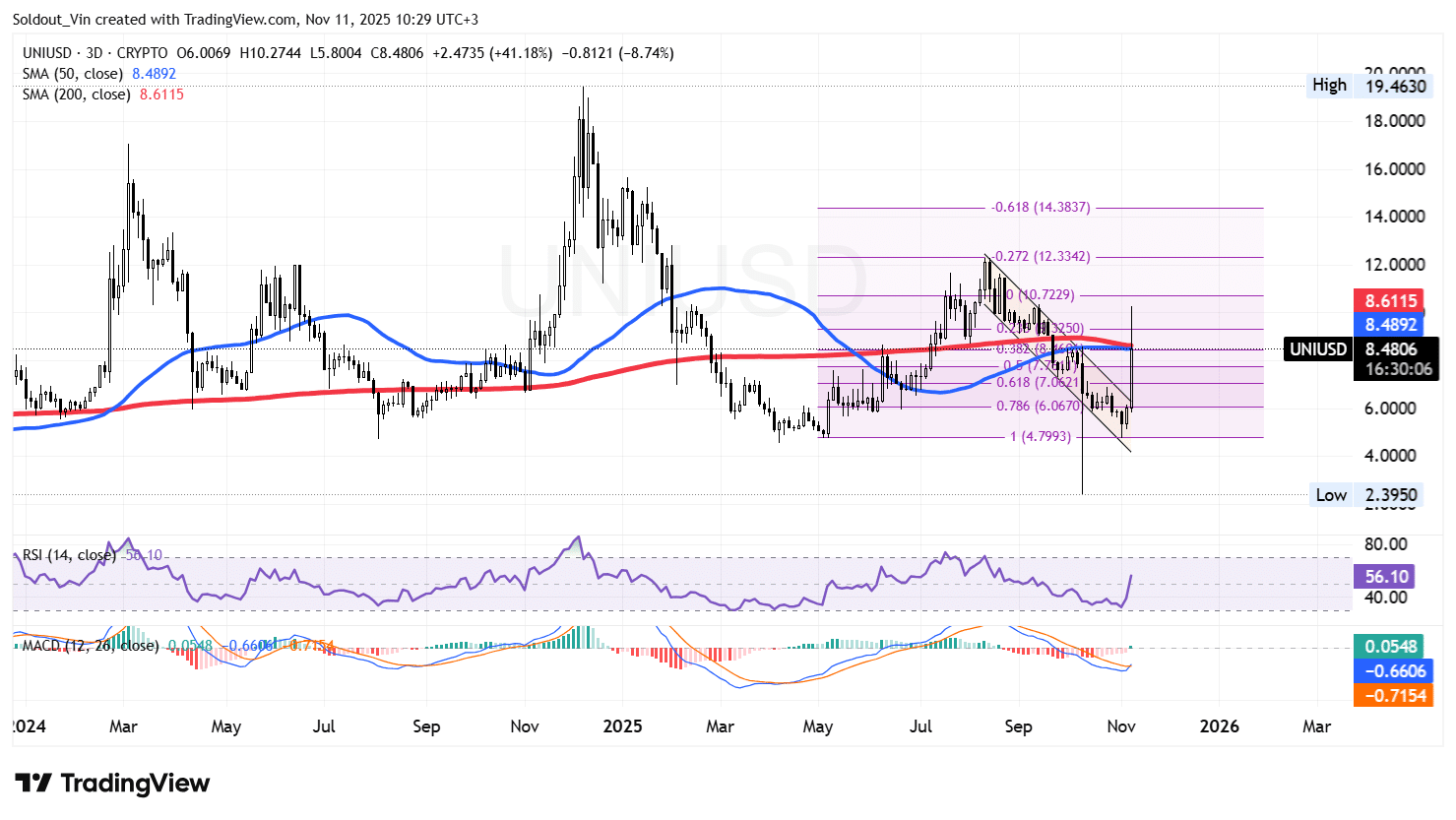

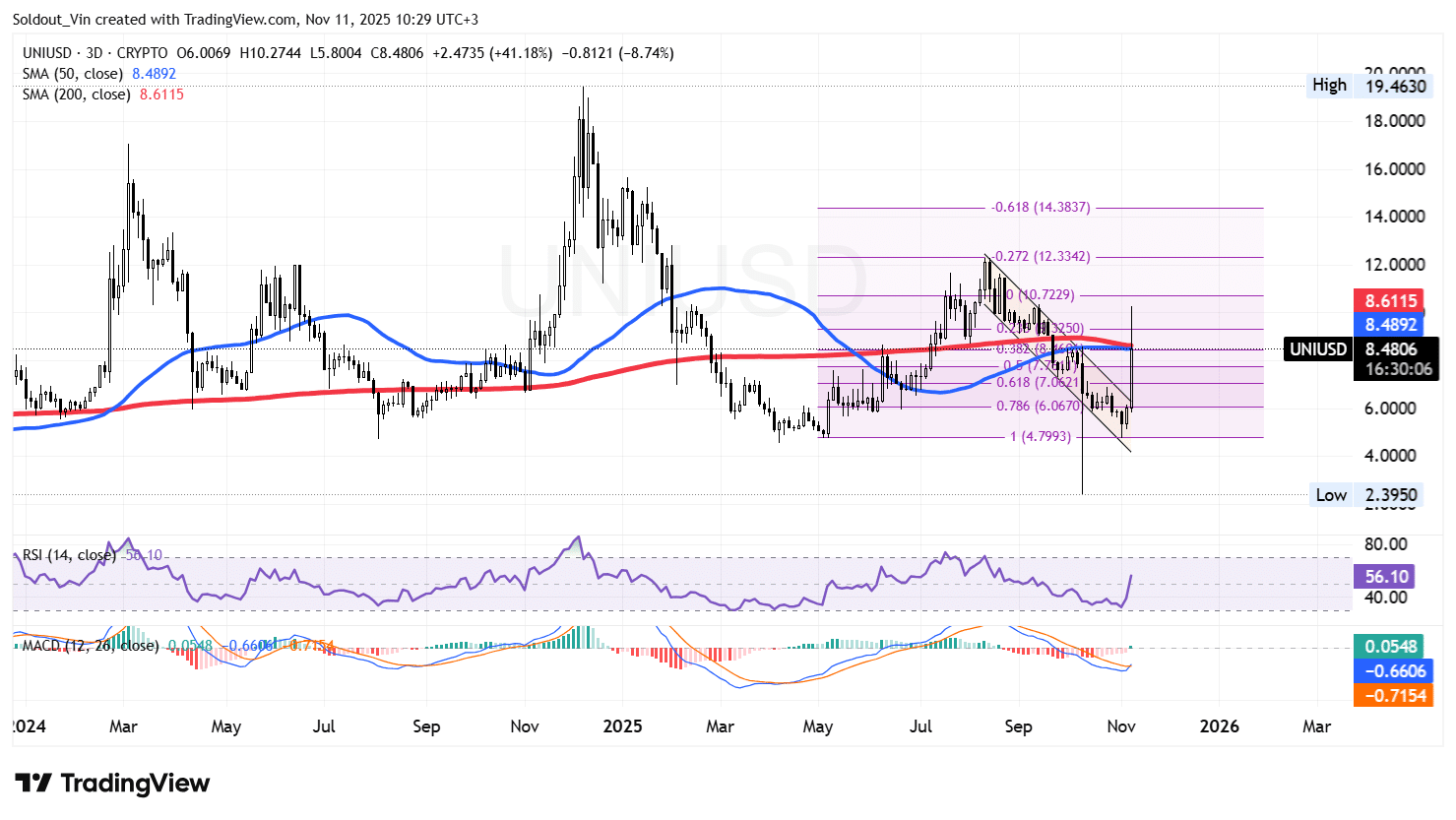

The UNI value, after bottoming in Could throughout the $4.79 assist, went by way of a sustained surge to clear main resistances.

The surge allowed the Uniswap value to hit an area excessive of $12.29, as indicated on the Fibonacci retracement ranges.

After hitting this resistance, the value of UNI went by way of a retracement, buying and selling throughout the confines of a falling channel sample, because the bears took benefit of the loss of life cross that had earlier fashioned on the $8.28 stage.

Nonetheless, after hitting the $4.79 assist once more, and because of the governance proposal, the value of the Uniswap token has since recovered above the higher boundary of the falling channel. The most recent 3-day candle is hovering above main resistance on the Fibonacci retracement stage.

On account of the propelled costs, UNI crossed above each the 50-day and 200-day Easy Shifting Averages (SMAs) on the 3-day timeframe, cementing the general bullish outlook, however has since settled barely beneath the value.

In the meantime, the 50-day SMA ($8.488) is closing in on the 200-day SMA ($8.611), which may end in a golden cross. This might additional permit the bulls to push the value even larger.

The Relative Energy Index (RSI) additionally helps the bullish rally, with the RSI recovering beneath the oversold ranges, to now cross above the 50-midline stage, at the moment at 55.82, as momentum picks up.

Furthermore, the Shifting Common Convergence Divergence (MACD) has turned optimistic, with the blue MACD line now crossing above the orange sign line, however stays underneath the zero line. This helps the rally whereas cautioning merchants of minimal bullish alerts.

UNI Worth Prediction: Bulls Eye $10 And Above

Based on the UNI/USD chart evaluation on the 3-day timeframe, all indicators, together with the RSI and the MACD traces, level to a sustained bullish rally.

If the UNI value crosses above the 0.382 Fibonacci stage at $9.41, the subsequent doable costs are above the $10 stage, with the subsequent key assist stage on the 0.236 Fib stage at $10.52 and the 0 Fib stage at $12.29.

Conversely, if the present rally is short-lived and sellers begin to take earnings, the Uniswap value may retrace again to the $0.618 Fib stage at $7.66 or the 0.786 Fib stage at $6.4 throughout the boundaries of the falling channel.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection