Key Takeaways

- World Liberty Monetary (WLFI), the crypto venture affiliated with President Donald Trump, accomplished a $1.06 million token buyback and burned $1.43 million value of WLFI.

- The funds for the buyback have been generated from charges and liquidity earnings on the venture’s decentralized finance (DeFi) actions, following a community-approved governance proposal.

- The burn goals to cut back the token’s circulating provide and enhance shortage, countering the 33% worth drop the token skilled during the last month.

World Liberty Monetary (WLFI), the DeFi venture related to the Trump household, executed a major token burn, completely eradicating 7.89 million WLFI tokens, valued at roughly $1.43 million, from circulation.

This motion adopted a $1.06 million buyback marketing campaign performed throughout the BNB Good Chain and Ethereum networks, funded solely by charges and liquidity earnings generated from the venture’s personal DeFi ecosystem.

WLFI’s Tokenomics Technique Beneficial properties Approval

The choice to implement a recurring buyback and burn mechanism was ratified by an awesome majority of WLFI holders by a governance vote, with 99% approving the proposal.

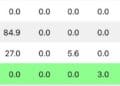

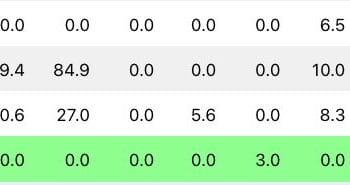

WLFI Treasury Liquidity Charges for Buyback & Burn Proposal Outcomes

This technique is a cornerstone of contemporary tokenomics, designed to imitate inventory buybacks in conventional finance. Its core objective is to cut back the whole provide of a token, thereby creating shortage that, in concept, exerts upward strain on its worth if demand stays fixed or will increase.

Below the plan, 100% of the charges generated from WLFI-managed liquidity swimming pools—excluding neighborhood and third-party swimming pools—are systematically used to repurchase the WLFI token on the open market. These bought tokens are then despatched to a burn tackle, an inaccessible pockets that successfully destroys them.

This clear, programmatic mechanism is meant to cut back the circulating provide, alleviate persistent promoting strain, and bolster confidence amongst long-term holders, whose proportional possession will increase with each profitable burn.

The workforce nonetheless holds 3.06 million WLFI, value about $638,000, on the Solana community, with additional motion pending.

The Monetary Leverage of Trump Household’s WLFI Holdings

The backdrop to this tokenomics technique is the immense, albeit unrealized, wealth held by Trump-linked entities. An entity tied to President Donald Trump and his household controls roughly $5 billion value of WLFI following a scheduled unlock of 24.6 billion tokens earlier this month.

The venture’s web site lists DT Marks DEFI LLC and relations like Donald Jr., Barron, and Eric as preliminary holders of twenty-two.5 billion WLFI, which constitutes roughly 22.5% of the whole token provide.

You will need to be aware that the tokens held by the Trump household are topic to lock-up circumstances and can’t be bought, which means the $5 billion valuation is on paper solely.

Remaining Ideas

The profitable execution of the WLFI buyback and burn demonstrates the workforce’s dedication to its community-approved tokenomics plan. Whereas the mechanism goals to stabilize the token’s worth by shortage, the long-term success of the WLFI venture will in the end rely on increasing the utility of its DeFi ecosystem and navigating the extraordinary political scrutiny surrounding the Trump household’s large crypto holdings.

Often Requested Questions

What’s a “buyback and burn”?

A buyback and burn is a tokenomics technique the place a venture makes use of income to purchase its tokens on the open market after which completely removes them from circulation to extend shortage and assist the token’s worth.

How did WLFI fund the buyback?

The buyback was funded by a portion of the charges and liquidity earnings generated from the WLFI venture’s decentralized finance (DeFi) actions.

Is the Trump household promoting their WLFI tokens?

No. The Trump household’s allocation of WLFI tokens is presently locked below a vesting schedule and can’t be bought, which means their reported $5 billion valuation is an unrealized, on-paper determine.