The TON Basis has formally rolled out TON Pay, a brand new funds software program improvement equipment designed to show Telegram right into a full-scale blockchain commerce platform.

- TON Pay brings native TON and USDT funds immediately into Telegram Mini Apps.

- The SDK is pockets-agnostic and positions TON as Telegram’s settlement layer.

- Toncoin trades close to $1.35 with weak short-term momentum, nonetheless far beneath its 2024 peak.

Introduced on February 9, 2026, the launch brings native crypto funds immediately into Telegram Mini Apps, eradicating the necessity for exterior checkout instruments or redirects.

TON Pay allows retailers and builders to simply accept crypto funds seamlessly inside Telegram, with preliminary assist for Toncoin (TON) and Tether (USDT). The SDK is wallet-agnostic, permitting customers to pay with any appropriate TON pockets moderately than being locked right into a single supplier, a transfer aimed toward lowering friction and enhancing person selection.

BREAKING 🔥Introducing TON Pay 💎

A funds SDK that lets retailers and builders settle for crypto funds throughout TON apps.

Beginning with Telegram Mini Apps. pic.twitter.com/OsZMwMFLsP— TON 💎 (@ton_blockchain) February 9, 2026

Developer Focus and Telegram Ecosystem Technique

From a improvement standpoint, TON Pay simplifies probably the most advanced components of crypto integration. The SDK consolidates pockets infrastructure, settlement, and checkout flows right into a single integration, considerably decreasing technical overhead for builders.

For customers, the expertise is designed to really feel native moderately than experimental. By minimizing gasoline-related friction and lowering the variety of approval steps, TON Pay targets on a regular basis client transactions moderately than area of interest crypto use circumstances. Strategically, this positions the TON blockchain because the settlement layer for Telegram’s ecosystem, which now reaches near 1.1 billion customers worldwide.

Nikola Plecas, Vice President of Funds on the TON Basis, mentioned the purpose is to make funds “seamless and native,” enabling builders to activate crypto funds with minimal setup whereas protecting the person expertise intuitive.

Roadmap: Subscriptions and Gasless Transactions

The TON Basis has signaled that TON Pay is barely the start line. Future updates are anticipated to introduce subscription-based funds and gasless transactions, options that would additional cut back onboarding boundaries for retailers and customers alike.

These additions would permit Telegram Mini Apps to assist recurring funds and frictionless microtransactions, reinforcing Telegram’s push towards turning into a self-contained digital commerce platform moderately than only a messaging app.

Toncoin Worth Motion and Technical Snapshot

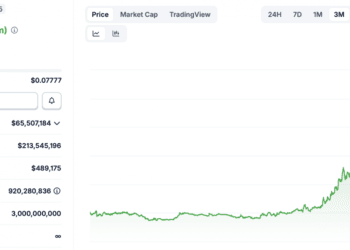

Toncoin is at the moment buying and selling round $1.35, consolidating after a risky begin to February. Brief-term technical indicators mirror a cautious market construction. The RSI is hovering within the mid-40s, pointing to weak momentum with out reaching oversold circumstances. In the meantime, the MACD stays close to the zero line with shallow destructive histogram bars, suggesting restricted directional conviction within the close to time period.

From a longer-term perspective, TON stays in a deep correction part. The token peaked at an all-time excessive of $8.24 in June 2024 and has since declined by roughly 64.2% over the previous 12 months. Even so, Toncoin continues to be buying and selling properly above its all-time low of $0.39, recorded in September 2021.

As TON Pay begins rolling out throughout Telegram Mini Apps, market members can be watching carefully to see whether or not elevated cost exercise interprets into sustained on-chain utilization and renewed momentum for Toncoin’s value.

The data supplied on this article is for academic functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. Coindoo.com doesn’t endorse or suggest any particular funding technique or cryptocurrency. At all times conduct your personal analysis and seek the advice of with a licensed monetary advisor earlier than making any funding choices.