Be a part of Our Telegram channel to remain updated on breaking information protection

Tom Lee’s BitMine Immersion Applied sciences purchased $82 million Ethereum (ETH), sending its shares hovering 11%.

In keeping with on-chain information from Arkham Intelligence cited by Lookonchain, the world’s largest ETH treasury firm purchased one other 28,625 tokens.

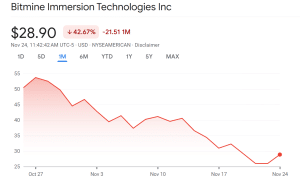

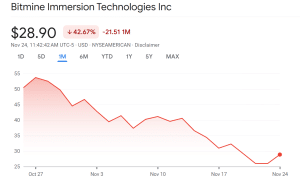

The bounce again comes after a tough month for BitMine throughout which its shares plummeted greater than 42% amid doubts over whether or not its ETH treasury enterprise mannequin is sustainable.

BitMine share worth (Supply: Google Finance)

The shares are nonetheless down 6% up to now week however have soared 190% up to now six months and 270% to this point this 12 months. ETH is up 1% up to now 24 hours to commerce at $2,854.71 as of 11:27 a.m. EST.

Nonetheless, DropsTab estimates that the 27.5% plunge within the ETH worth up to now month has left BitMine sitting on an unrealized lack of $4.39 billion on its ETH holdings.

Regardless of that, BitMine reported on Nov. 21 a internet earnings for its 2025 fiscal 12 months of $328.1 million, with earnings per share coming in at $13.39.

The corporate additionally declared its first annual dividend of $0.01 per share, and disclosed plans to launch a “Made-in America Validator Community,” which is a devoted staking providing that may see the corporate put its large ETH holdings to work.

🧵

BitMine posted fiscal 4Q and full-year outcomes (ending Aug 31, 2025).FY outcomes:

– GAAP EPS of $13.39 per share

– Internet earnings of $328 million

– Declare annual dividend of $0.01 per shareOperational highlights:

– $BMNR staking answer to be named MAVAN

– “Made in America…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 21, 2025

Bitwise Says That Most Treasury Corporations Gained’t Maintain Premiums

Bitwise chief funding officer Matt Hougan mentioned in an X thread that in future most crypto treasury corporations ”will commerce at a reduction, and only some distinctive corporations will commerce at a premium.”

In the meantime, spot crypto ETFs are more likely to change into ”DAT killers,” Nate Geraci, president of NovaDiusWealth, mentioned in a put up on X, referring to Digital Asset Treasury corporations equivalent to BitMine.

”DATs thrived through regulatory arbitrage,” he mentioned. ”That sport is just about over now.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection