Constellation Manufacturers, Inc. (NYSE: STZ) has successfully navigated challenges like cautious shopper spending and declining demand for its wine and spirits manufacturers by capitalizing on the sustained progress within the beer section. The corporate owns among the prime manufacturers and is increasing its brewery community to fulfill the excessive demand.

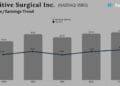

It’s estimated that the brewer’s fourth-quarter earnings edged as much as $2.27 per share from $2.26 per share within the comparable quarter of fiscal 2024, excluding one-off objects. On common, analysts following the corporate forecast web gross sales of $2.13 billion for the February quarter, which is broadly according to the gross sales it generated within the year-ago quarter. The This autumn 2025 report is scheduled for launch on Wednesday, April 9, at 5.25 pm ET.

The Inventory

After falling to a four-and-half-year low final month, the corporate’s inventory is struggling to regain power. Previously 12 months, the worth has shrunk by 32%. Buying and selling sharply under its 12-month common worth, the inventory is comparatively low cost now. In the meantime, STZ stays a favourite amongst long-term traders because of the firm’s constant monetary efficiency, resilience, and wholesome dividend payouts.

Within the November quarter, Constellation Manufacturers’ web gross sales remained broadly unchanged at $2.46 billion. Third-quarter web revenue grew 21% to $616 million, and earnings per share rose 23% to $3.39. At $3.25 per share, comparable earnings have been flat year-over-year. Each gross sales and the underside line missed Wall Road’s expectations. The continued upswing in beer gross sales, which account for greater than 80% of complete income, offset a 14% drop within the Wine and Spirits section.

Steering

A number of months in the past, the administration stated it expects natural gross sales to develop between 2% and 5% in fiscal 2025. Earnings per share, on a reported foundation, are anticipated to be between $3.90 and 4.30. The forecast for full-year comparable earnings is between $13.40 per share and 13.80 per share. A basic cutback on discretionary spending and customers’ value-seeking conduct has been a drag on gross sales and profitability, recently.

“We proceed to take a position behind the momentum of our manufacturers, drive operational efficiencies, preserve price self-discipline, and supply sturdy money era whereas nonetheless executing towards our capital allocation priorities as we now have finished for the final a number of years. We’ll proceed to carefully monitor the subdued spend and value-seeking traits we now have seen develop throughout our shopper base and the financial drivers influencing that conduct in addition to different doable macro shifts, notably any adjustments arising from potential tariff insurance policies,” stated the corporate’s CEO Garth Hankinson within the Q3 2025 earnings name.

Outlook

Whereas Constellation Manufacturers’ extremely fashionable manufacturers like Modelo and Corona give it a aggressive benefit, the corporate faces a risk from the brand new import tariffs as a result of it operates a number of breweries in Mexico. A full-fledged commerce warfare would negatively influence the enterprise, notably as US beer corporations wrestle with declining consumption and growing competitors for market share.

Constellation Manufacturers’ inventory has misplaced 16% previously three months. It has been buying and selling flat after struggling a pointy fall within the early days of the 12 months. The shares traded barely decrease on Friday afternoon.