Upix, a Solana (SOL) treasury and client manufacturers firm, skilled a dramatic plunge of as much as 60% following the submitting of a registration assertion. The submitting permits buyers to promote frequent shares of the Tampa, Florida-based firm.

Upexi Information With SEC

In April, Upexi introduced plans to boost $100 million as a part of its strategic pivot to build up Solana tokens. The corporate disclosed that it had entered into agreements to buy roughly 43.9 million frequent shares, together with pre-funded warrants.

The brand new registration filed with the US Securities and Change Fee (SEC) permits these buyers to promote their inventory in the event that they select to take action.

Upexi’s CEO, Allan Marshall, addressed the scenario in an interview, explaining that the submitting is customary process and doesn’t essentially point out a direct intent to promote by buyers. “It doesn’t imply the buyers are promoting or wish to promote, however it means they will,” he said.

Upexi is adopting a treasury technique much like the one employed by Michael Saylor and his Bitcoin proxy agency Technique (beforehand MicroStrategy), and Marshall expressed confidence within the long-term success of this strategy.

Nonetheless, the Solana treasury firm’s inventory (UPXI) closed Tuesday’s buying and selling session down little over 60% towards $3.97, and down from the $24 stage, its highest worth for the 12 months reached final April.

XRP, Solana, And Ethereum Be part of Bitcoin In Rebound

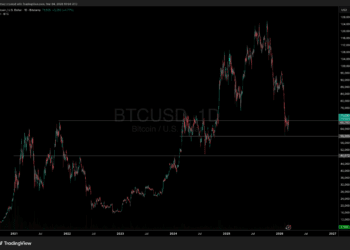

On one other entrance, the broader cryptocurrency market noticed a rebound after President Donald Trump introduced a ceasefire between Israel and Iran. Following his declaration of a whole truce on Reality Social, Bitcoin (BTC) surged 2%, climbing from $104,000 to $106,000.

Different cryptocurrencies, together with XRP, Solana, and Ethereum (ETH), additionally skilled good points, contributing to a 3% improve within the total cryptocurrency market cap, which rose from $3.19 trillion to $3.27 trillion because the ceasefire announcement.

David Siemer, CEO of crypto asset supervisor Wave Digital Property, remarked on the constructive market response, attributing it largely to the easing tensions within the Center East. Regardless of Trump’s subsequent warnings to each nations relating to violations of the ceasefire, cryptocurrencies maintained their momentum.

The backdrop of this volatility stems from escalating battle earlier within the month, triggered by a United Nations report indicating Iran’s non-compliance with nuclear safeguards. This led to Israeli airstrikes on nuclear websites in Iran, escalating tensions and prompting fears of a broader battle.

The scenario intensified additional when Trump introduced US army airstrikes on Iranian nuclear services, sending buyers right into a panic and inflicting Bitcoin to drop under $100,000 for the primary time in over a month.

When writing, Solana trades at $145, up by 1.5% within the 24-hour timeframe.

Featured picture from DALL-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Upix, a Solana (SOL) treasury and client manufacturers firm, skilled a dramatic plunge of as much as 60% following the submitting of a registration assertion. The submitting permits buyers to promote frequent shares of the Tampa, Florida-based firm.

Upexi Information With SEC

In April, Upexi introduced plans to boost $100 million as a part of its strategic pivot to build up Solana tokens. The corporate disclosed that it had entered into agreements to buy roughly 43.9 million frequent shares, together with pre-funded warrants.

The brand new registration filed with the US Securities and Change Fee (SEC) permits these buyers to promote their inventory in the event that they select to take action.

Upexi’s CEO, Allan Marshall, addressed the scenario in an interview, explaining that the submitting is customary process and doesn’t essentially point out a direct intent to promote by buyers. “It doesn’t imply the buyers are promoting or wish to promote, however it means they will,” he said.

Upexi is adopting a treasury technique much like the one employed by Michael Saylor and his Bitcoin proxy agency Technique (beforehand MicroStrategy), and Marshall expressed confidence within the long-term success of this strategy.

Nonetheless, the Solana treasury firm’s inventory (UPXI) closed Tuesday’s buying and selling session down little over 60% towards $3.97, and down from the $24 stage, its highest worth for the 12 months reached final April.

XRP, Solana, And Ethereum Be part of Bitcoin In Rebound

On one other entrance, the broader cryptocurrency market noticed a rebound after President Donald Trump introduced a ceasefire between Israel and Iran. Following his declaration of a whole truce on Reality Social, Bitcoin (BTC) surged 2%, climbing from $104,000 to $106,000.

Different cryptocurrencies, together with XRP, Solana, and Ethereum (ETH), additionally skilled good points, contributing to a 3% improve within the total cryptocurrency market cap, which rose from $3.19 trillion to $3.27 trillion because the ceasefire announcement.

David Siemer, CEO of crypto asset supervisor Wave Digital Property, remarked on the constructive market response, attributing it largely to the easing tensions within the Center East. Regardless of Trump’s subsequent warnings to each nations relating to violations of the ceasefire, cryptocurrencies maintained their momentum.

The backdrop of this volatility stems from escalating battle earlier within the month, triggered by a United Nations report indicating Iran’s non-compliance with nuclear safeguards. This led to Israeli airstrikes on nuclear websites in Iran, escalating tensions and prompting fears of a broader battle.

The scenario intensified additional when Trump introduced US army airstrikes on Iranian nuclear services, sending buyers right into a panic and inflicting Bitcoin to drop under $100,000 for the primary time in over a month.

When writing, Solana trades at $145, up by 1.5% within the 24-hour timeframe.

Featured picture from DALL-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.