Solana (SOL) has been navigating excessive volatility because the broader market shifted from bearish to bullish inside hours yesterday. After experiencing a pointy 25% decline from its all-time excessive (ATH) in lower than two weeks, SOL examined an important demand degree and is now attempting to get better misplaced floor.

Associated Studying

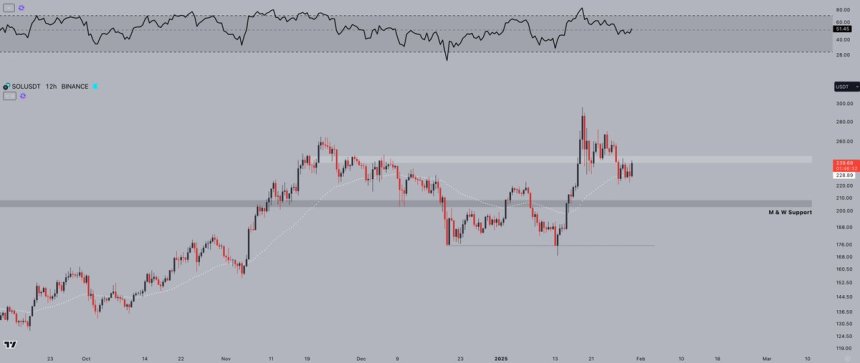

Traders stay divided on whether or not Solana has bottomed or if one other pullback is on the horizon. Nonetheless, early indicators recommend patrons are stepping in, defending key technical ranges. High analyst Jelle shared a technical evaluation on X, noting that Solana has efficiently retested the 25-day EMA and RSI midlevel, each of which have traditionally acted as sturdy assist throughout bullish tendencies. Following this retest, SOL bounced straight into key resistance, signaling a possible reversal if bulls preserve momentum.

For Solana to verify its restoration, it should break above resistance and maintain its transfer greater. If profitable, SOL may resume its bullish pattern, doubtlessly reclaiming current highs. Nonetheless, failure to interrupt key ranges may result in additional consolidation and even one other leg down. The approaching days can be essential in figuring out Solana’s subsequent main transfer.

Solana Surges 8% As Market Reacts To Fed Assembly

Solana has bounced again strongly, surging 8% from native lows on Wednesday as your entire market reacted positively to the Federal Reserve assembly. Traders and analysts at the moment are shifting their focus to a bullish outlook, anticipating a robust efficiency for crypto all year long. With sentiment bettering, SOL is as soon as once more positioning itself as a market chief, aiming to reclaim key value ranges and push towards new highs.

High analyst Jelle shared a technical evaluation on X, highlighting Solana’s current retest of the 25-day EMA and RSI midlevel, each of which have traditionally acted as essential assist zones. After confirming these ranges, SOL bounced straight into key resistance, signaling a possible breakout if momentum continues.

Jelle emphasised that for Solana to “look nice once more,” it should reclaim the $240 degree. Nonetheless, he additionally cautioned that “resistance is resistance” till a transparent breakout happens.

Associated Studying

Because the broader market tries to push greater, Solana is main the best way with sturdy technical formations and renewed bullish momentum. If bulls efficiently push previous resistance, SOL may retest its all-time highs and enter value discovery as soon as once more. The approaching days can be pivotal in figuring out whether or not Solana confirms its subsequent main uptrend.

Solana Value Holds Robust at $240

Solana (SOL) is at the moment buying and selling at $240 after efficiently testing the $220 degree as assist. The value seems able to bounce, however key resistance ranges have to be reclaimed to verify a short-term pattern reversal. For bulls to take care of momentum, SOL should break above $240 and $260, two essential resistance zones which have capped upward motion in current days. If Solana clears these ranges with energy, a surge above all-time highs (ATH) can be imminent, setting the stage for value discovery.

On the bearish aspect, shedding the $220 mark would sign weak point, doubtlessly resulting in additional draw back and deeper consolidation. The broader market stays unstable, and SOL should maintain above key assist ranges to maintain its bullish trajectory.

Associated Studying

For now, Solana stays well-positioned to push greater, however buyers can be watching intently to see if it will possibly reclaim resistance and make sure a breakout. The subsequent few days can be essential in figuring out whether or not SOL resumes its uptrend or faces one other check of demand ranges.

Featured picture from Dall-E, chart from TradingView