“A few of the hurdles have been tackling the problem of the necessity to transfer at tempo whereas we have now a legacy enterprise,” says Tamas Szabo, the Group CEO of Pepperstone. These hurdles sat on the coronary heart of the retail dealer’s enlargement from conventional CFD into bodily crypto. This was as soon as a distinct segment transition, however has since began to edge into the mainstream.

Tamas Szabo, CEO at Pepperstone

As of at present, IG Group has entered the spot crypto enterprise, whereas Capital.com and XTB are making ready to observe, and CMC Markets has signalled broader ambition that extends into decentralised finance. Pepperstone, in the meantime, has simply launched its bodily crypto enterprise for Australian purchasers. “So, we have now constructed a big standalone crypto crew,” Szabo goes on to elucidate how the dealer moved to beat these constraints.

The Web’s Cash is Now Attracting Skilled Merchants

In accordance with CryptoQuant, a blockchain analytics and on-chain information platform, buying and selling quantity on the spot cryptocurrency market reached US$18.6 trillion final 12 months, a 9% improve year-on-year. Crypto should be risky, however it’s now not marginal. For a lot of the previous decade, one agency sat squarely on the centre of this exercise. At its peak in 2023, Binance, the world’s largest digital-asset alternate, dealt with near 60% of all spot crypto trades, the place precise possession of belongings modifications fingers instantly fairly than by way of derivatives – or on the “spot”.

Just lately, nevertheless, its grip has loosened.

CoinDesk information present that by December 2025, Binance’s share of world spot buying and selling quantity had fallen to round 25%, its lowest stage since early 2021. The lacking quantity didn’t migrate in a single neat course. Some flowed to rival exchanges, some to decentralised platforms, and brokers are actually positioning themselves to seize a share of it.

2025 crypto alternate exercise in overview.

Spot quantity reached $18.6T (+9% YoY) whereas perpetuals surged to $61.7T (+29%), with Binance dominating spot, BTC perps, liquidity, and reserves.

Development is derivative-led, and market energy continues to pay attention on the prime. pic.twitter.com/Om8udJJ9Qv

— CryptoQuant.com (@cryptoquant_com) January 12, 2026

“A Lengthy-Time period Conviction” for Brokers

One of many earliest mainstream brokers to take crypto significantly was eToro, now one of many world’s largest multi-asset platforms. “From the outset, eToro approached spot crypto with a long-term conviction that crypto is right here to remain, including bitcoin to the platform as early as 2013 when demand was restricted, and market sentiment was extremely skeptical,” says Adi Lasker Gattegno, the fintech’s Director of Liquidity Administration and Crypto Operations.

Perspective issues. In 2013, Coinbase, at present the world’s second-largest crypto alternate, was a fledgling startup and reported promoting simply US$1 million value of bitcoin in a single month, at costs hovering above $22 per coin. That very same 12 months, the American novelist Charles Stross used bitcoin in his science-fiction Hugo Award-shortlisted novel Neptune’s Brood as a fictional interstellar forex, exactly as a result of it was obscure sufficient to sound believable in a far-future setting. Crypto was, fairly actually, science fiction.

Crypto’s rise owes a lot to regulation. In 2018, the European Securities and Markets Authority (ESMA) clamped down on CFDs, capping leverage and proscribing retail advertising and marketing. Some nationwide watchdogs went additional, steadily narrowing CFD enterprise. In January 2026, Israel-based dealer Plus500 grew to become the most recent within the development, halting onboarding for Spanish CFD purchasers after the native regulator adopted one of many EU’s hardest interpretations of the foundations.

In the meantime, clearer crypto frameworks such because the EU’s MiCA and America’s GENIUS Act lent digital belongings a legitimacy CFDs more and more lack.

Adi Lasker Gattegno, Director of Liquidity Administration and Crypto Operations of eToro

In accordance with the 2025 International State of Crypto report by the crypto alternate Gemini Belief, primarily based on a survey of greater than 7,200 customers throughout the US, UK, France, Italy, Singapore and Australia, almost one in 4 respondents stated they owned crypto.

Provide, inevitably, has adopted demand. “Our providing has grown right into a holistic providing that caters to each crypto-native customers and conventional retail buyers inside a regulated, multi-asset atmosphere. We now help 150 crypto belongings, alongside companies similar to staking, crypto-focused Good Portfolios, and CopyTrader,” Gattegno says.

Towards the top of 2025, Pepperstone’s Szabo, talking on the digital asset convention AusCryptoCon in Sydney, introduced that the CFD dealer could be making the leap to identify crypto in 2026, and at present it launched the devoted crypto alternate. “Inside and exterior analysis has proven that CFD merchants are heavy crypto buyers,” he explains a part of the reasoning to FinanceMagnates.com.

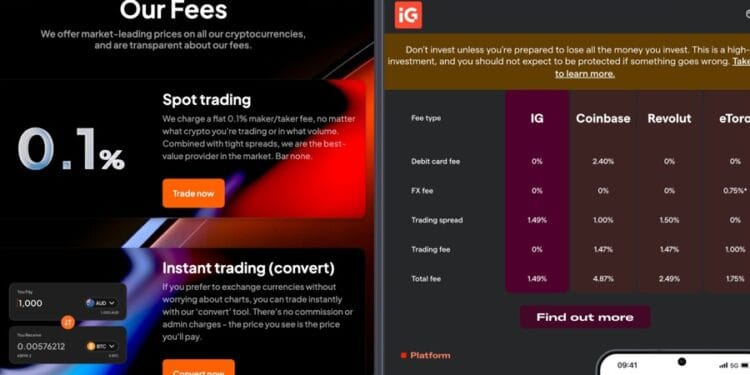

Having simply launched its product, the dealer plans a measured entry. The preliminary focus shall be on adoption and shopper expertise, constructed round a flat 0.1% price, tight spreads and deep liquidity. “Over time, as we develop the product providing and the market grows, spot crypto is predicted to enrich our conventional merchandise and turn into a significant a part of our total enterprise,” Szabo provides.

Plug-and-Play Vs In-Home Tech

When contemplating crypto enlargement, brokers should first handle one query: whether or not to construct the infrastructure in-house or go together with white-label options. Each have their benefits and downsides.

White-label tech infrastructure has all the time been a part of the brokerage trade, and the identical is true for crypto exchanges as effectively. These days, a rising ecosystem of expertise suppliers gives plug-and-play infrastructure designed to sit down comfortably alongside present CFD choices.

Shift Markets is one such supplier. Since 2019, it has developed a white-label crypto answer aimed primarily at FX and CFD brokers trying to enter digital belongings with out reinventing the wheel. “Our focus is much less on introducing a brand new product in isolation, and extra on enabling crypto to operate as a pure extension of a dealer’s present multi-asset providing,” says Ian McAfee, the agency’s co-founder and CEO.

Out of the field, Shift’s platform gives aggregated liquidity, real-time order matching, pockets infrastructure, crypto and stablecoin funding and a full again workplace.

Ian McAfee, co-founder and CEO of Shift Markets

One other is B2BROKER, a world fintech whose core clientele contains banks, crypto corporations and, above all, CFD brokers. “We developed a full stack of merchandise to help crypto companies,” says Arthur Azizov, the corporate’s founder and CEO. This contains its personal brokerage platform, B2TRADER; spot and perpetual futures liquidity, that are coming shortly; the B2CORE back-office and CRM system; and B2BINPAY, its crypto funds and wallet-management platform.

Not everybody, nevertheless, opts for a third-party route.“Our spot crypto infrastructure is completely in-house,” says Tamas Szabo, “leveraging 15 years of expertise in CFD buying and selling. It gives full oversight of execution high quality, deep liquidity and pricing and system safety.”

It’s value mentioning that originally, IG additionally sought third-party infrastructure, partnering with digital buying and selling platform Uphold. Later, although, the dealer acquired Australian crypto alternate Impartial Reserve, aiming to roll out crypto merchandise for the Center East and APAC area.

Deployment With out Reinvention

Deployment will be a lot smoother than what the complexity may recommend. In accordance with each third-party tech suppliers, most brokers favour software-as-a-service (SaaS) fashions, which provide the quickest path to market. A minority go for hybrid cloud deployments utilizing their very own groups, whereas absolutely on-premise environments are uncommon.

“Some brokers favor having extra management, and a few in sure jurisdictions encounter regulatory necessities for controlling extra of the atmosphere,” McAfee notes.

The onboarding timelines will be brisk, owing a lot to automation. Azizov says that preliminary setup can take as little as three hours, adopted by round 9 days of configuration, branding and safety work. From contract signing to go-live, your entire course of will be accomplished in below ten days.

In observe, integration with present brokerage techniques is just not disruptive, with API-led approaches designed to suit round established expertise stacks fairly than change them outright.

The limiting issue is never the expertise itself, however a dealer’s personal technical readiness and urge for food for change.

For Pepperstone, spot crypto is built-in into the dealer’s wider platform ecosystem, whereas remaining operationally and regulatorily distinct by separate net and cell platforms. Deposits, withdrawals, and reconciliations are processed by the identical safe techniques.

Deep Liquidity is Needed, However Can Be a Problem

“The important thing focus areas have been guaranteeing deep liquidity, sustaining platform stability below peak buying and selling, and supporting safe deposit and withdrawal processes,” says Szabo, reflecting on the challenges Pepperstone has confronted in transferring from CFDs to identify crypto. Certainly, crypto liquidity is just not a simple equation to resolve, as it’s scattered throughout chains, exchanges and OTC desks, complicating the duty of worth formation. For Peppestone, it was addressed by leaning on the size of its derivatives enterprise. “We course of over US$6 billion in crypto CFD quantity every month, so we’re in a position to help strong liquidity and dependable execution for our purchasers,” he explains.

For these counting on plug-and-play options, expertise suppliers handle liquidity by aggregating costs from main venues and delivering them to brokers’ platforms, both as exterior worth feeds or embedded immediately inside a dealer’s personal crypto alternate.

Past these aggregation layers, there are additionally matching engines constructed particularly for crypto markets. One such supplier is Finery Markets, a crypto-focused digital communication community (ECN) which has additionally partnered with B2BROKER. In accordance with its founder and CEO, Konstantin Shulga, the agency gives two important integration paths: entry to aggregated institutional liquidity by way of its personal ECN, or a Crypto-as-a-Service turnkey answer.

Entry to the Finery’s institutional liquidity community is supplied by a single integration level, combining execution with core back-office features similar to real-time reporting, place administration and danger controls inside one technical framework.

“The selection is dependent upon the dealer’s goals,” he says. The ECN mannequin fits corporations looking for finest execution and internalisation, whereas the turnkey possibility is designed for these wanting a speedy, zero-development launch.

Konstantin Shulga, CEO and co-founder of Finery Markets

“Execution and custodial dangers stay strictly decoupled,” Shulga stresses. Brokers are free to work with any certified custodian, with native integrations out there for suppliers similar to BitGo and Fireblocks. To resolve latency points – in crypto markets, milliseconds matter, significantly throughout bouts of volatility – Amazon Internet Providers appears to be the popular possibility, as each B2BROKER and Finery Markets leverage the US big’s community. “For optimum efficiency,” Azizov notes, “we normally advocate monetary hubs like London to attenuate latency between the platform and our liquidity suppliers.”

Compliance, although, is dealt with at arm’s size. Finery doesn’t maintain shopper belongings, and buying and selling is non-custodial. As a result of trades are bilateral, the authorized contract sits immediately between counterparties, permitting brokers to plug in their very own KYC, transaction-monitoring instruments and controls consistent with native regulation.

“Brokers Ought to By no means Outsource Their Model, Shopper Relationship or Business Determination-Making”

Spot crypto includes actual belongings, actual wallets and actual settlement. When techniques are constructed in-house, duty is evident; when features are outsourced, readability over who owns what turns into essential.

On Shift’s platform, brokers retain operational management over treasury administration, liquidity optimisation and day-to-day monitoring. In-house groups are required for reconciliation and efficiency checks. The platform itself manages orders and tracks belongings on a digital ledger, whereas connecting brokers to specialist suppliers for custody, liquidity, funds, KYC and AML.

B2BROKER gives a extra closed-loop ecosystem by which each technical and operational elements are tightly built-in. Core buying and selling logic, pre-integrated KYC, funds and back-office techniques are bundled collectively, supported by devoted account managers

Arthur Azizov, founder and CEO of B2BROKER

Azizov, although, is categorical that sure issues ought to by no means be outsourced. “Brokers ought to by no means outsource their model, shopper relationship or industrial decision-making,” Azizov notes. “That possession should all the time stick with the dealer.”

“You Are No Longer Managing Contracts, You Are Managing Actual Belongings.”

For all of the progress in tooling, transferring from CFDs to identify crypto stays a conceptual leap. “Transitioning to identify buying and selling means a basic change in enterprise logic and the brokerage’s working mannequin,” says Azizov. Treasury administration is the clearest instance: CFD buying and selling abstracts every little thing right into a base forex and spot crypto doesn’t. Purchasers can maintain, switch and withdraw actual belongings – bitcoin, ether, stablecoins – forcing brokers to handle multi-asset balances, on-chain flows and real-time liquidity. “You might be now not managing contracts,” B2BROKER CEO stresses. “You might be managing actual belongings.”

McAfee agrees. Providing spot buying and selling requires integration with custodians and the upkeep of balances throughout all supported cryptos. “This provides extra complexity,” he goes on, “because the dealer must rebalance their treasury to align with person holdings, in addition to preserve balances at liquidity suppliers – or guarantee they’ll course of end-of-day settlements in a number of currencies.”

There’s additionally an inclination to conflate spot buying and selling with perpetual futures, which really feel extra acquainted to CFD brokers as a result of they depend on related leverage, margins and funding charges. With spot buying and selling, although, Azivov notes, purchasers can solely commerce what they really maintain, which modifications behaviour, publicity and danger administration.

Regulation provides one other layer of complexity, as crypto licensing regimes typically differ sharply from these governing CFDs. “Discovering the right regulatory perimeter – and understanding what merchandise will be provided in every market – is likely one of the most difficult elements of such a transition,” McAfee stresses.

Subtle brokers, he provides, are likely to ask onerous questions early: which belongings are supported, how balances are managed, how reconciliations work, and the way danger controls function. Solely then do they flip to the regulatory maze.

“A standard mistake we see is a dealer not all the time absolutely assessing the standard or viability of a vendor that they selected to combine to the platform,” McAfee notes. One other is counting on single factors of failure, similar to one liquidity supplier, one fee rail, even one key particular person. Contingency planning, Azizov says, is usually an afterthought.

Many brokers additionally prioritise velocity to market over the unglamorous work of constructing audit trails, permission buildings and monitoring techniques. These particulars, nevertheless, are exactly what regulators scrutinise as soon as a enterprise scales.

A Convergence Afoot?

As extra brokers add spot crypto, it factors to a deeper shift that goes past expertise stacks or liquidity plumbing: Does being a pure-play retail CFD dealer nonetheless maintain?

On the similar time, crypto exchanges have been edging into conventional dealer territory, typically by acquisition fairly than invention. Crypto.com, Coinbase and Kraken are amongst those who, lately, have purchased established EU corporations holding MiFID licences – ready-made passports into regulated markets.

The true query, then, is just not merely whether or not being a pure-play CFD dealer stays a sustainable mannequin, however whether or not crypto and conventional derivatives are actually approaching a degree of convergence – technologically, commercially and, more and more, within the eyes of purchasers themselves.

“Whereas the boundaries between brokers and exchanges are evolving,” says Szabo, shopper priorities stay centered on price, execution high quality, belief and importantly nice UX and ease of use. Our Australian-made, low-cost, high-liquidity mannequin gives readability and reliability, which we consider will proceed to distinguish Pepperstone available in the market.”

“A few of the hurdles have been tackling the problem of the necessity to transfer at tempo whereas we have now a legacy enterprise,” says Tamas Szabo, the Group CEO of Pepperstone. These hurdles sat on the coronary heart of the retail dealer’s enlargement from conventional CFD into bodily crypto. This was as soon as a distinct segment transition, however has since began to edge into the mainstream.

Tamas Szabo, CEO at Pepperstone

As of at present, IG Group has entered the spot crypto enterprise, whereas Capital.com and XTB are making ready to observe, and CMC Markets has signalled broader ambition that extends into decentralised finance. Pepperstone, in the meantime, has simply launched its bodily crypto enterprise for Australian purchasers. “So, we have now constructed a big standalone crypto crew,” Szabo goes on to elucidate how the dealer moved to beat these constraints.

The Web’s Cash is Now Attracting Skilled Merchants

In accordance with CryptoQuant, a blockchain analytics and on-chain information platform, buying and selling quantity on the spot cryptocurrency market reached US$18.6 trillion final 12 months, a 9% improve year-on-year. Crypto should be risky, however it’s now not marginal. For a lot of the previous decade, one agency sat squarely on the centre of this exercise. At its peak in 2023, Binance, the world’s largest digital-asset alternate, dealt with near 60% of all spot crypto trades, the place precise possession of belongings modifications fingers instantly fairly than by way of derivatives – or on the “spot”.

Just lately, nevertheless, its grip has loosened.

CoinDesk information present that by December 2025, Binance’s share of world spot buying and selling quantity had fallen to round 25%, its lowest stage since early 2021. The lacking quantity didn’t migrate in a single neat course. Some flowed to rival exchanges, some to decentralised platforms, and brokers are actually positioning themselves to seize a share of it.

2025 crypto alternate exercise in overview.

Spot quantity reached $18.6T (+9% YoY) whereas perpetuals surged to $61.7T (+29%), with Binance dominating spot, BTC perps, liquidity, and reserves.

Development is derivative-led, and market energy continues to pay attention on the prime. pic.twitter.com/Om8udJJ9Qv

— CryptoQuant.com (@cryptoquant_com) January 12, 2026

“A Lengthy-Time period Conviction” for Brokers

One of many earliest mainstream brokers to take crypto significantly was eToro, now one of many world’s largest multi-asset platforms. “From the outset, eToro approached spot crypto with a long-term conviction that crypto is right here to remain, including bitcoin to the platform as early as 2013 when demand was restricted, and market sentiment was extremely skeptical,” says Adi Lasker Gattegno, the fintech’s Director of Liquidity Administration and Crypto Operations.

Perspective issues. In 2013, Coinbase, at present the world’s second-largest crypto alternate, was a fledgling startup and reported promoting simply US$1 million value of bitcoin in a single month, at costs hovering above $22 per coin. That very same 12 months, the American novelist Charles Stross used bitcoin in his science-fiction Hugo Award-shortlisted novel Neptune’s Brood as a fictional interstellar forex, exactly as a result of it was obscure sufficient to sound believable in a far-future setting. Crypto was, fairly actually, science fiction.

Crypto’s rise owes a lot to regulation. In 2018, the European Securities and Markets Authority (ESMA) clamped down on CFDs, capping leverage and proscribing retail advertising and marketing. Some nationwide watchdogs went additional, steadily narrowing CFD enterprise. In January 2026, Israel-based dealer Plus500 grew to become the most recent within the development, halting onboarding for Spanish CFD purchasers after the native regulator adopted one of many EU’s hardest interpretations of the foundations.

In the meantime, clearer crypto frameworks such because the EU’s MiCA and America’s GENIUS Act lent digital belongings a legitimacy CFDs more and more lack.

Adi Lasker Gattegno, Director of Liquidity Administration and Crypto Operations of eToro

In accordance with the 2025 International State of Crypto report by the crypto alternate Gemini Belief, primarily based on a survey of greater than 7,200 customers throughout the US, UK, France, Italy, Singapore and Australia, almost one in 4 respondents stated they owned crypto.

Provide, inevitably, has adopted demand. “Our providing has grown right into a holistic providing that caters to each crypto-native customers and conventional retail buyers inside a regulated, multi-asset atmosphere. We now help 150 crypto belongings, alongside companies similar to staking, crypto-focused Good Portfolios, and CopyTrader,” Gattegno says.

Towards the top of 2025, Pepperstone’s Szabo, talking on the digital asset convention AusCryptoCon in Sydney, introduced that the CFD dealer could be making the leap to identify crypto in 2026, and at present it launched the devoted crypto alternate. “Inside and exterior analysis has proven that CFD merchants are heavy crypto buyers,” he explains a part of the reasoning to FinanceMagnates.com.

Having simply launched its product, the dealer plans a measured entry. The preliminary focus shall be on adoption and shopper expertise, constructed round a flat 0.1% price, tight spreads and deep liquidity. “Over time, as we develop the product providing and the market grows, spot crypto is predicted to enrich our conventional merchandise and turn into a significant a part of our total enterprise,” Szabo provides.

Plug-and-Play Vs In-Home Tech

When contemplating crypto enlargement, brokers should first handle one query: whether or not to construct the infrastructure in-house or go together with white-label options. Each have their benefits and downsides.

White-label tech infrastructure has all the time been a part of the brokerage trade, and the identical is true for crypto exchanges as effectively. These days, a rising ecosystem of expertise suppliers gives plug-and-play infrastructure designed to sit down comfortably alongside present CFD choices.

Shift Markets is one such supplier. Since 2019, it has developed a white-label crypto answer aimed primarily at FX and CFD brokers trying to enter digital belongings with out reinventing the wheel. “Our focus is much less on introducing a brand new product in isolation, and extra on enabling crypto to operate as a pure extension of a dealer’s present multi-asset providing,” says Ian McAfee, the agency’s co-founder and CEO.

Out of the field, Shift’s platform gives aggregated liquidity, real-time order matching, pockets infrastructure, crypto and stablecoin funding and a full again workplace.

Ian McAfee, co-founder and CEO of Shift Markets

One other is B2BROKER, a world fintech whose core clientele contains banks, crypto corporations and, above all, CFD brokers. “We developed a full stack of merchandise to help crypto companies,” says Arthur Azizov, the corporate’s founder and CEO. This contains its personal brokerage platform, B2TRADER; spot and perpetual futures liquidity, that are coming shortly; the B2CORE back-office and CRM system; and B2BINPAY, its crypto funds and wallet-management platform.

Not everybody, nevertheless, opts for a third-party route.“Our spot crypto infrastructure is completely in-house,” says Tamas Szabo, “leveraging 15 years of expertise in CFD buying and selling. It gives full oversight of execution high quality, deep liquidity and pricing and system safety.”

It’s value mentioning that originally, IG additionally sought third-party infrastructure, partnering with digital buying and selling platform Uphold. Later, although, the dealer acquired Australian crypto alternate Impartial Reserve, aiming to roll out crypto merchandise for the Center East and APAC area.

Deployment With out Reinvention

Deployment will be a lot smoother than what the complexity may recommend. In accordance with each third-party tech suppliers, most brokers favour software-as-a-service (SaaS) fashions, which provide the quickest path to market. A minority go for hybrid cloud deployments utilizing their very own groups, whereas absolutely on-premise environments are uncommon.

“Some brokers favor having extra management, and a few in sure jurisdictions encounter regulatory necessities for controlling extra of the atmosphere,” McAfee notes.

The onboarding timelines will be brisk, owing a lot to automation. Azizov says that preliminary setup can take as little as three hours, adopted by round 9 days of configuration, branding and safety work. From contract signing to go-live, your entire course of will be accomplished in below ten days.

In observe, integration with present brokerage techniques is just not disruptive, with API-led approaches designed to suit round established expertise stacks fairly than change them outright.

The limiting issue is never the expertise itself, however a dealer’s personal technical readiness and urge for food for change.

For Pepperstone, spot crypto is built-in into the dealer’s wider platform ecosystem, whereas remaining operationally and regulatorily distinct by separate net and cell platforms. Deposits, withdrawals, and reconciliations are processed by the identical safe techniques.

Deep Liquidity is Needed, However Can Be a Problem

“The important thing focus areas have been guaranteeing deep liquidity, sustaining platform stability below peak buying and selling, and supporting safe deposit and withdrawal processes,” says Szabo, reflecting on the challenges Pepperstone has confronted in transferring from CFDs to identify crypto. Certainly, crypto liquidity is just not a simple equation to resolve, as it’s scattered throughout chains, exchanges and OTC desks, complicating the duty of worth formation. For Peppestone, it was addressed by leaning on the size of its derivatives enterprise. “We course of over US$6 billion in crypto CFD quantity every month, so we’re in a position to help strong liquidity and dependable execution for our purchasers,” he explains.

For these counting on plug-and-play options, expertise suppliers handle liquidity by aggregating costs from main venues and delivering them to brokers’ platforms, both as exterior worth feeds or embedded immediately inside a dealer’s personal crypto alternate.

Past these aggregation layers, there are additionally matching engines constructed particularly for crypto markets. One such supplier is Finery Markets, a crypto-focused digital communication community (ECN) which has additionally partnered with B2BROKER. In accordance with its founder and CEO, Konstantin Shulga, the agency gives two important integration paths: entry to aggregated institutional liquidity by way of its personal ECN, or a Crypto-as-a-Service turnkey answer.

Entry to the Finery’s institutional liquidity community is supplied by a single integration level, combining execution with core back-office features similar to real-time reporting, place administration and danger controls inside one technical framework.

“The selection is dependent upon the dealer’s goals,” he says. The ECN mannequin fits corporations looking for finest execution and internalisation, whereas the turnkey possibility is designed for these wanting a speedy, zero-development launch.

Konstantin Shulga, CEO and co-founder of Finery Markets

“Execution and custodial dangers stay strictly decoupled,” Shulga stresses. Brokers are free to work with any certified custodian, with native integrations out there for suppliers similar to BitGo and Fireblocks. To resolve latency points – in crypto markets, milliseconds matter, significantly throughout bouts of volatility – Amazon Internet Providers appears to be the popular possibility, as each B2BROKER and Finery Markets leverage the US big’s community. “For optimum efficiency,” Azizov notes, “we normally advocate monetary hubs like London to attenuate latency between the platform and our liquidity suppliers.”

Compliance, although, is dealt with at arm’s size. Finery doesn’t maintain shopper belongings, and buying and selling is non-custodial. As a result of trades are bilateral, the authorized contract sits immediately between counterparties, permitting brokers to plug in their very own KYC, transaction-monitoring instruments and controls consistent with native regulation.

“Brokers Ought to By no means Outsource Their Model, Shopper Relationship or Business Determination-Making”

Spot crypto includes actual belongings, actual wallets and actual settlement. When techniques are constructed in-house, duty is evident; when features are outsourced, readability over who owns what turns into essential.

On Shift’s platform, brokers retain operational management over treasury administration, liquidity optimisation and day-to-day monitoring. In-house groups are required for reconciliation and efficiency checks. The platform itself manages orders and tracks belongings on a digital ledger, whereas connecting brokers to specialist suppliers for custody, liquidity, funds, KYC and AML.

B2BROKER gives a extra closed-loop ecosystem by which each technical and operational elements are tightly built-in. Core buying and selling logic, pre-integrated KYC, funds and back-office techniques are bundled collectively, supported by devoted account managers

Arthur Azizov, founder and CEO of B2BROKER

Azizov, although, is categorical that sure issues ought to by no means be outsourced. “Brokers ought to by no means outsource their model, shopper relationship or industrial decision-making,” Azizov notes. “That possession should all the time stick with the dealer.”

“You Are No Longer Managing Contracts, You Are Managing Actual Belongings.”

For all of the progress in tooling, transferring from CFDs to identify crypto stays a conceptual leap. “Transitioning to identify buying and selling means a basic change in enterprise logic and the brokerage’s working mannequin,” says Azizov. Treasury administration is the clearest instance: CFD buying and selling abstracts every little thing right into a base forex and spot crypto doesn’t. Purchasers can maintain, switch and withdraw actual belongings – bitcoin, ether, stablecoins – forcing brokers to handle multi-asset balances, on-chain flows and real-time liquidity. “You might be now not managing contracts,” B2BROKER CEO stresses. “You might be managing actual belongings.”

McAfee agrees. Providing spot buying and selling requires integration with custodians and the upkeep of balances throughout all supported cryptos. “This provides extra complexity,” he goes on, “because the dealer must rebalance their treasury to align with person holdings, in addition to preserve balances at liquidity suppliers – or guarantee they’ll course of end-of-day settlements in a number of currencies.”

There’s additionally an inclination to conflate spot buying and selling with perpetual futures, which really feel extra acquainted to CFD brokers as a result of they depend on related leverage, margins and funding charges. With spot buying and selling, although, Azivov notes, purchasers can solely commerce what they really maintain, which modifications behaviour, publicity and danger administration.

Regulation provides one other layer of complexity, as crypto licensing regimes typically differ sharply from these governing CFDs. “Discovering the right regulatory perimeter – and understanding what merchandise will be provided in every market – is likely one of the most difficult elements of such a transition,” McAfee stresses.

Subtle brokers, he provides, are likely to ask onerous questions early: which belongings are supported, how balances are managed, how reconciliations work, and the way danger controls function. Solely then do they flip to the regulatory maze.

“A standard mistake we see is a dealer not all the time absolutely assessing the standard or viability of a vendor that they selected to combine to the platform,” McAfee notes. One other is counting on single factors of failure, similar to one liquidity supplier, one fee rail, even one key particular person. Contingency planning, Azizov says, is usually an afterthought.

Many brokers additionally prioritise velocity to market over the unglamorous work of constructing audit trails, permission buildings and monitoring techniques. These particulars, nevertheless, are exactly what regulators scrutinise as soon as a enterprise scales.

A Convergence Afoot?

As extra brokers add spot crypto, it factors to a deeper shift that goes past expertise stacks or liquidity plumbing: Does being a pure-play retail CFD dealer nonetheless maintain?

On the similar time, crypto exchanges have been edging into conventional dealer territory, typically by acquisition fairly than invention. Crypto.com, Coinbase and Kraken are amongst those who, lately, have purchased established EU corporations holding MiFID licences – ready-made passports into regulated markets.

The true query, then, is just not merely whether or not being a pure-play CFD dealer stays a sustainable mannequin, however whether or not crypto and conventional derivatives are actually approaching a degree of convergence – technologically, commercially and, more and more, within the eyes of purchasers themselves.

“Whereas the boundaries between brokers and exchanges are evolving,” says Szabo, shopper priorities stay centered on price, execution high quality, belief and importantly nice UX and ease of use. Our Australian-made, low-cost, high-liquidity mannequin gives readability and reliability, which we consider will proceed to distinguish Pepperstone available in the market.”