- Ripple launches Ripple Treasury by way of GTreasury, unifying money and crypto with reconciliation, forecasting, and liquidity instruments.

- Platform targets 24/7 settlements, decrease FX prices, and no pre-funding; Ripple says XRP stays central.

Ripple has launched Ripple Treasury, a unified enterprise platform that mixes conventional money administration with digital asset rails. The transfer provides a brand new product line to Ripple’s broader push into custody, stablecoins, and institutional providers.

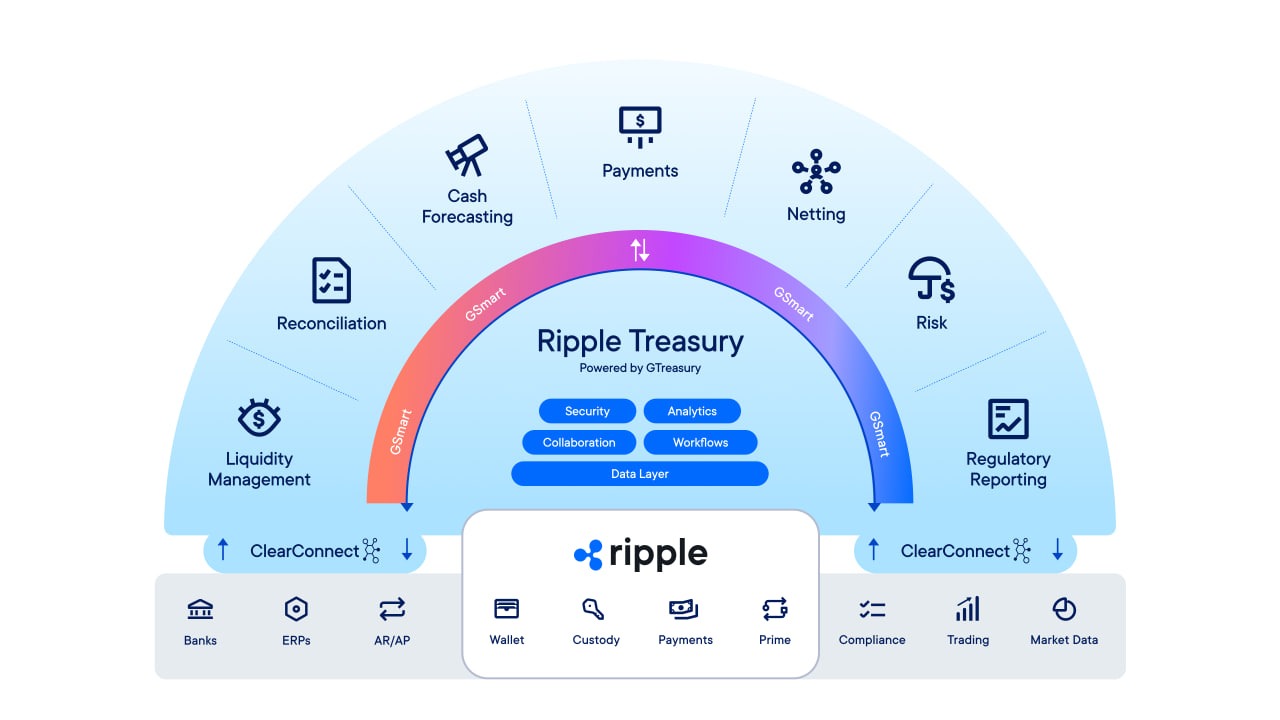

Ripple Treasury is powered by GTreasury, a treasury administration agency owned by Ripple. The platform is designed to assist finance groups that deal with liquidity administration, reconciliation, forecasting, and fee throughout numerous techniques. It goals to present a single view throughout fiat positions and digital property, whereas supporting always-on settlement and treasury workflows.

Introducing @Ripple Treasury 🚀

→ Unified visibility throughout conventional money and digital property

→ 24/7 yield optimization placing each greenback to work

→ Instantaneous cross-border settlements lowering FX prices

→ Get rid of pre-funding necessities and unlock trapped working capital… https://t.co/C6uJ5ijh2J— Reece Merrick (@reece_merrick) January 27, 2026

In posts on X, Ripple govt Reece Merrick launched Ripple Treasury and listed core features. These embody unified visibility throughout conventional money and digital property, 24/7 yield optimization, and instantaneous cross-border settlements to cut back international alternate prices.

Ripple Connects Treasury Processes with Digital Asset Infrastructure

As GTreasury lays out, the platform hyperlinks long-term enterprise treasury property with digital asset infrastructure. It comes outfitted with AI-powered forecasting and analytics, liquidity administration, real-time reconciliation, and danger controls.

“With Ripple’s backing, we reinvest 100% of earnings into platform innovation with zero debt constraining our roadmap,” GTreasury wrote on X. The corporate has additionally doubled engineering capability prior to now 90 days and bought Solvexia to strengthen reconciliation options. It has additionally added AI instruments throughout money forecasting, danger administration, and analytics.

The brand new product is positioned for enterprises in search of quicker settlement and easier treasury operations, with out splitting workflows throughout a number of distributors. In accordance with GTreasury, the product can cut back FX prices and get rid of pre-funding, whereas supporting tokenized property and programmable funds as company use expands.

The corporate plans a reside session tomorrow to show Ripple Treasury capabilities. GTreasury mentioned the occasion will cowl manufacturing use instances in operation at the moment and the way digital asset infrastructure can combine with current treasury techniques.

As we earlier reported, Ripple accomplished a $1 billion acquisition of GTreasury in late 2025. The acquisition resulted in Ripple growing its presence in company finance companies, offering treasury software program and enterprise processes to its stack.

In response to rising considerations, Ripple executives have additionally identified that XRP remains to be central to the technique of the corporate. Merrick wrote that “XRP will proceed to be on the coronary heart” of Ripple’s imaginative and prescient. An extra replace is scheduled for mid-February, with an X Areas session on Feb. 11 led by Ripple President Monica Lengthy and moderated by Jacquelyn Melinek, CEO of Token Relations, centered on Ripple’s evolution and XRP’s position.

Within the meantime, the XRP worth has pretty recovered after breaching the resistance at $1.90. At press time, XRP was buying and selling at $1.92, a 1.06% improve.