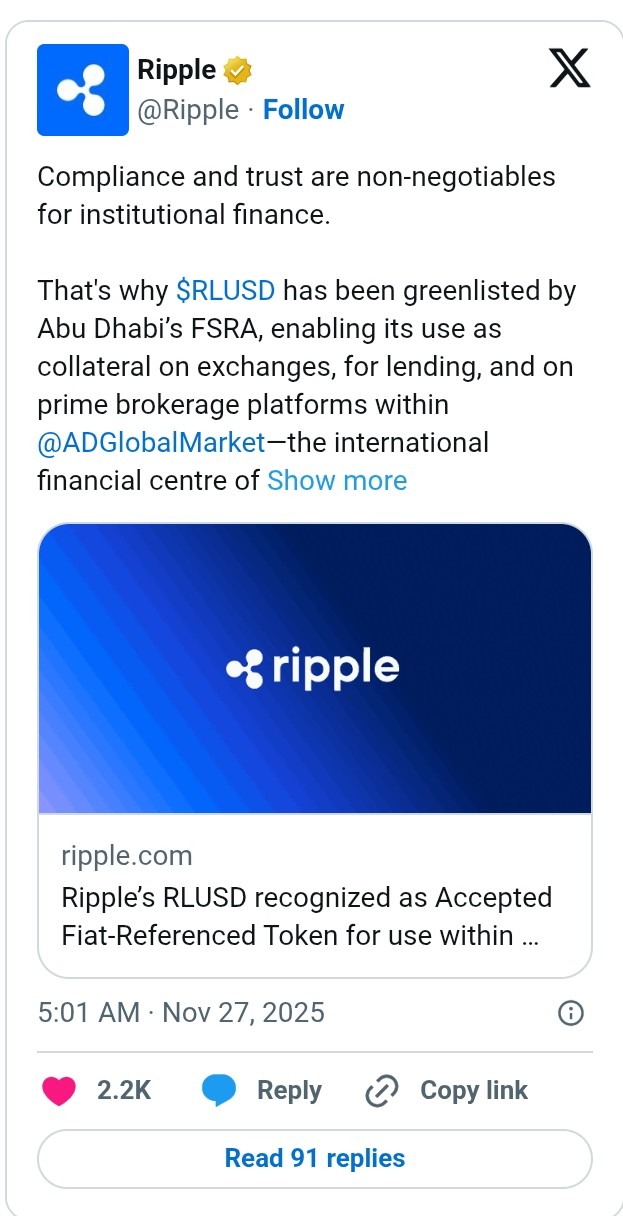

- RLUSD has achieved regulatory approval as an Accepted Fiat-Referenced Token in Abu Dhabi.

- The stablecoin can legally be used within the capital of the United Arab Emirates.

Ripple has attained one other regulatory approval for its USD-backed stablecoin. Abu Dhabi’s Monetary Companies Regulatory Authority (FSRA) acknowledged RLUSD as an “Accepted Fiat-Referenced Token”. This implies the Ripple stablecoin can legally be used within the capital of the United Arab Emirates, the worldwide Monetary heart of Abu Dhabi, and the ADGM.

In a weblog put up, Ripple introduced that the license requires licensed people to make use of the asset for regulated actions. Not simply that. Its use should be in step with the regulatory obligations arrange for using Fiat-Referenced Tokens.

Ripple’s senior vp of stablecoins, Jack McDonald, famous that the adoption charge of RLUSD is rising quickly amongst establishments. In case, this might put together the bottom for the subsequent wave of compliance whereas securing international digital adoption.

Ripple’s Managing Director for Center East and Africa, Reece Merrick, additionally highlighted that the newest regulatory approval confirms the RLUSD’s existence as a compliant stablecoin that not solely meets the best requirements of belief, but additionally transparency and utility.

“This recognition is one more step ahead for Ripple’s operations within the area, the place we’re experiencing surging curiosity in our merchandise. We look ahead to persevering with to work with our companions and regulators to assist the protected and speedy adoption of digital asset know-how throughout the Center East.”

After congratulating the blockchain firm, the Chief Market Growth Officer at ADGM, Arvind Ramamurthy, additionally clarified that the regulatory framework of the area is completely designed to assist innovation and progress. In response to him, Abu Dhabi has sought to solidify its place because the “subsequent era of monetary companies and digital finance”.

Earlier Regulatory Strikes Involving RLUSD

Earlier than this strategic transfer, the RLUSD earlier obtained approval from the Dubai Monetary Companies Authority (DFSA) to function as a crypto token and be used inside the Dubai Worldwide Monetary Centre (DIFC). In that landmark improvement, Ripple was reported to now have the inexperienced mild to combine its stablecoin into the DFSA-licensed flagship funds resolution.

Market information has additionally confirmed that stablecoin adoption has been on the rise within the UAE. In 2024, stablecoin transactions within the area elevated by 55% yr on yr. As detailed in our earlier information transient, Ripple has additionally secured a UAE custody deal to tokenize property titles on the XRP Ledger.

Ripple has equally sought to capitalize on the worldwide demand to increase the attain of RLUSD with its latest transfer occurring in Bahrain. It has additionally partnered with ABSA Financial institution to offer digital asset custody companies to South African clients, as featured in our earlier information story. In Kenya, Mercy Corps Ventures was earlier reported to be “pilot testing RLUSD in a local weather danger insurance coverage mission.”