- CFTC named a 35-member Innovation Advisory Committee, together with CEOs from Ripple, Coinbase, Uniswap, Solana Labs, and Chainlink Labs.

- The committee additionally contains leaders from CME, Nasdaq, ICE, DTCC, DraftKings, FanDuel, and Polymarket, per the CFTC roster.

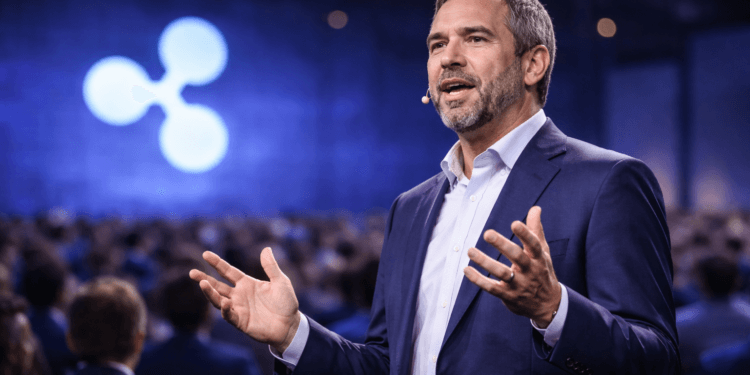

Ripple CEO Brad Garlinghouse has praised the U.S. Commodity Futures Buying and selling Fee’s newly introduced Innovation Advisory Committee, calling it an “Olympics crypto roster.” The remark adopted the CFTC’s launch of a 35-member lineup that brings collectively senior leaders from crypto markets, conventional exchanges, market infrastructure corporations, enterprise capital, academia, and prediction and sports-betting platforms.

The Innovation Advisory Committee is meant to advise the company as it really works to maintain tempo with technological change in monetary markets, with consideration on areas resembling synthetic intelligence and blockchain. The Fee additionally named Michael Passalacqua because the committee’s designated federal officer.

So far as committees go…that is the Olympics crypto roster https://t.co/qYYNx8vviH

— Brad Garlinghouse (@bgarlinghouse) February 12, 2026

The official roster contains executives from main crypto and digital-asset corporations and protocols. The membership record contains Coinbase CEO Brian Armstrong and Uniswap Labs CEO Hayden Adams, in addition to Solana Labs CEO Anatoly Yakovenko and Chainlink Labs co-founder Sergey Nazarov.

Moreover, the panel contains executives related to crypto buying and selling, custody, and funding corporations, alongside representatives listed as professors.

Regardless of the current appointment, Ripple CEO Brad Garlinghouse has drawn criticism from Cardano founder Charles Hoskinson. CNF reported that Hoskinson accused the Ripple CEO of siding with regulators whereas debating the proposed U.S. CLARITY Act.

CFTC Goes Professional-Crypto

Alongside crypto leaders, the committee contains senior executives from established monetary market establishments and infrastructure suppliers. The roster options CME Group CEO Terry Duffy, Nasdaq CEO Adena Friedman, Intercontinental Trade CEO Jeff Sprecher, and DTCC CEO Frank LaSalla, putting market plumbing and change oversight experience in the identical advisory discussion board as digital-asset operators.

The lineup additionally contains members from prediction markets and sports activities betting, including one other set of corporations that intersect with derivatives merchandise and event-based contracts. Names on the CFTC record embrace Polymarket CEO Shayne Coplan, DraftKings CEO Jason Robins, and FanDuel President Christian Genetski.

The committee’s work is a manner to make sure regulatory choices replicate present market circumstances and to help the modernization of guidelines as improvements evolve. The Innovation Advisory Committee is a venue for structured enter from a number of segments of {the marketplace} because the CFTC prepares for a bigger position in supervising elements of the digital-asset and derivatives panorama.

Late final 12 months, CNF outlined a CFTC tokenized-collateral initiative launched in September below Appearing Chair Caroline D. Pham. This system launched a derivatives pilot permitting Bitcoin, Ethereum, and USDC as collateral, with added monitoring, reporting, and consumer-protection guardrails.

In the meantime, we reported that Ripple has partnered with Aviva Traders to tokenize conventional funding funds on the XRP Ledger. The collaboration will help issuance and administration of tokenized fund merchandise, with preliminary launches anticipated this 12 months below a longer-term plan.