Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On Bloomberg’s “ETF IQ” on Monday, REX Monetary chief government Greg King made his most forceful public case but for Solana’s position in real-world finance—particularly for stablecoins—and defined why his agency constructed a 1940 Act, staking-enabled ETF round SOL relatively than ready for a standard ’33 Act spot product.

Solana Vs. Ethereum

King didn’t hedge when requested to place the Solana-versus-Ethereum debate into plain language for mainstream buyers: “Eth is the second greatest crypto. Solana is mainly prime 5. Lots of people assume Solana is the up and comer that may overthrow the world. It’s a very controversial debate. I’ve most likely made buddies and enemies even suggesting that now.”

That framing goes to the center of in the present day’s market divide. Ethereum stays the default base layer for on-chain finance and developer tooling; Solana’s pitch is uncooked throughput and low-latency UX for funds, shopper apps, and—crucially in King’s view—stablecoin settlement at scale. It’s additionally the sensible rationale for REX’s product design: if the chain’s economics are pushed by quantity and staking, package deal each right into a regulated fund wrapper that passes yield by means of to shareholders.

Associated Studying

“Solana is mainly sooner and extra designed for prime processing pace. Frankly, after I noticed the massive debate come out about stablecoins being all constructed on Eth, I used to be like, this can be a enormous oversight. I feel Solana is the story of the longer term as far stablecoins go.”

The car implementing that thesis is SSK—the agency’s Solana-forward ETF that stakes SOL and pays a month-to-month distribution. King characterised staking for non-crypto natives as an earnings stream tied to community safety relatively than energy-intensive mining.

“It boils all the way down to, for buyers, mainly an rate of interest in your crypto,” he mentioned, noting that on Solana it “varies… someplace between the 6% to eight% annualized vary.” In SSK’s design, these rewards usually are not trapped contained in the fund: “SSK is the primary fund to ship that staking reward by means of to buyers within the US,” he mentioned, including that the present run-rate distribution is “roughly 5% a yr proper now,” with the usual caveat that payouts fluctuate.

REX Monetary CEO Greg King believes Solana is the story of stablecoin’s future over Ethereum. He speaks with @EricBalchunas on “ETF IQ” https://t.co/aVEoiSkzfo pic.twitter.com/iQx9g4oYJg

— Bloomberg TV (@BloombergTV) August 25, 2025

Solana ETF Highlight

A second pillar of King’s argument is structural. He drew a shiny line between ’33 Act spot ETPs—lengthy acquainted to crypto buyers by way of grantor-trust buildings—and the ’40 Act investment-company wrapper REX selected. The latter, he mentioned, is “the higher wrapper… extra investor safeguards, extra versatile.”

Associated Studying

In apply, which means an actively managed portfolio that may maintain SOL immediately and by way of listed devices whereas delegating to institutional validators and optimizing for staking seize and liquidity. It additionally means increased all-in prices than a plain-vanilla fairness ETF and concentrated publicity to a single crypto-asset’s volatility—trade-offs the agency acknowledges even because it leans into the yield-plus-beta pitch.

The interview additionally touched on the approaching product wave throughout US exchanges. Bloomberg’s Eric Balchunas flagged the queue of ’33 Act spot purposes for tokens with established futures markets, whereas co-host Katie Greifeld pressed on timing for a “pure spot Solana ETF.” King was cautious on precise dates however not on path: “I do assume we see a little bit of an explosion,” he mentioned—then instantly drew boundaries round high quality management.

“Crypto will get fairly sketchy beneath the highest 10, actually beneath the highest 20. I feel there’s some vital choosing and selecting that has to occur by issuers there.” Even amongst majors, he expects “a number of funds per coin,” with Solana a “nice candidate” given its mixture of scale, perceived “underdog” standing within the race with Ethereum, and relatively bigger staking reward.

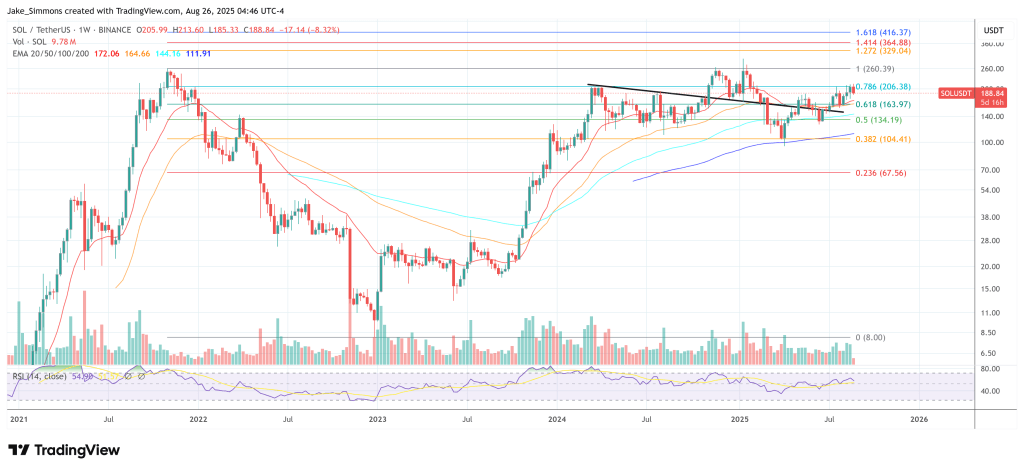

At press time, SOL traded at $188.

Featured picture created with DALL.E, chart from TradingView.com