Canary Capital’s lengthy‑awaited spot XRP ETF (ticker XRPC) debuted with a bang – drawing roughly $58 million in first‑day buying and selling quantity.

The ETF’s first‐day quantity topped each different fund launch this 12 months, based on Bloomberg ETF analyst Eric Balchunas.

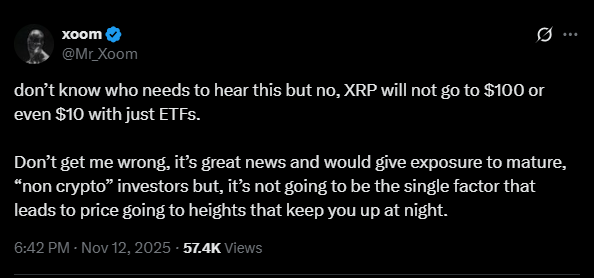

But the file‐breaking debut did not elevate XRP’s value; the coin slipped about 2.3% to $2.31 on the day. Crypto analyst Xoom (Mr_Xoom) seized on the information to warn that ETFs alone can’t propel XRP to $10 or $100. As he tweeted, “No, XRP won’t go to $100 and even $10 with simply ETFs.”

As reported by ZyCrypto, Canary’s XRP ETF outperformed over 900 ETF launches in 2025, closing its first day with $58 million in quantity.

Roughly $26 million of that traded within the opening hour. The debut marginally beat Bitwise’s new Solana ETF (57M) because the 12 months’s largest opening day.

Analysts famous the fund truly noticed about $250 million in internet inflows on day one, due to an in‑form creation mannequin.

Regardless of this institutional demand, XRP’s market value was primarily flat. Canary’s ETF launch coincided with a broad crypto market pullback, leaving XRP round $2.31 at day’s finish.

Analyst Xoom Snuffs $10/$100 Hypothesis

Nonetheless, many retail merchants had fantasized that an XRP ETF would ignite a huge rally to $10 or $100. Xoom – a effectively‑recognized crypto strategist – cautioned that this expectation is “unrealistic.”

In posts on social media, he referred to as the ETF “nice information” for opening XRP to “mature, non‑crypto” traders, however he careworn it isn’t “the one issue” that can ship the worth to these lofty ranges.

“ETFs alone” gained’t magically multiply XRP’s market cap, Xoom argued. This aligns with different analysts’ views that ETFs validate an asset however don’t assure outsized good points.

Business analysts say ETFs give crypto a regulated entry level, however they don’t immediately remodel fundamentals. The primary Bitcoin and Ethereum ETFs noticed regular flows however solely modest value strikes initially.

Xoom emphasised that whereas the preliminary ETF inflows could present some upward stress, lasting value appreciation is determined by utility and utilization.

As one Binance analysis piece famous, “finaling appreciation will rely on actual‐world utility, liquidity enhancements, and adoption of XRP in cross‐border cost infrastructure.”

Lengthy‑Time period Development Tied to Adoption

Wanting forward, Xoom urged persistence. He pointed to XRP’s ongoing integration in international funds and to adoption by banks and fintech companies because the true development drivers.

The ETF could increase buying and selling quantity and visibility within the brief time period, but it surely “is unlikely to change core fundamentals in a single day.”

The truth is, even after the Canary ETF launch, analysts famous that ETF arrivals are seen as broadly bullish, but XRP’s value eased amid broader market weak spot.

For now, consultants say traders ought to view an XRP ETF as a milestone of maturity, not a value supercharger. As Xoom and others stress, real-world adoption and community use will matter much more over time.

An XRP ETF could carry new contributors, however “persistence” and fundamentals will in the end form XRP’s path ahead.