Procter & Gamble Firm (NYSE: PG) is gearing up for its newest earnings report whereas navigating a difficult market atmosphere marked by intensifying competitors and evolving client habits. Over time, the buyer items behemoth has maintained its market management, supported by its extremely environment friendly provide chain, model superiority, and robust digital push. Notably, P&G’s publicity to latest import tariffs is comparatively decrease in comparison with most consumer-focused friends because of its long-term technique of sustaining a localized U.S. manufacturing footprint.

Q2 Report Due

When the corporate stories its second-quarter outcomes on January 22, earlier than the opening bell, the market might be on the lookout for whole gross sales of $22.33 billion and earnings of $1.87 per share. In Q2 2025, the corporate earned $1.88 per share on gross sales of $21.88 billion. Previously two quarters, each gross sales and earnings topped expectations, and the pattern is predicted to proceed this time.

After beginning 2026 on a weak be aware, Procter & Gamble’s shares have gained energy and have been trending upward since final week. It stays to be seen whether or not this momentum will proceed forward of subsequent week’s earnings. The corporate has confronted a tough patch for over a 12 months, following a gradual decline since its all-time excessive on the finish of 2024. It has misplaced round 5% up to now six months. Having raised its dividend consecutively for greater than six many years, P&G is likely one of the longest-standing members of the S&P 500 Dividend Aristocrats index.

Q1 End result

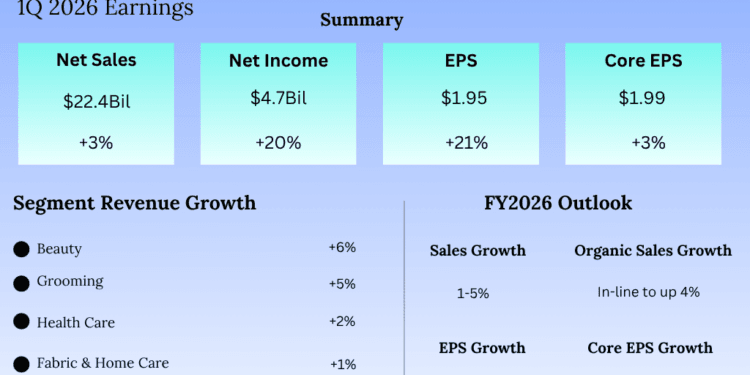

P&G reported increased gross sales and earnings for the primary quarter. Internet gross sales rose 3% yearly to $22.4 billion in Q1, with natural gross sales rising 2% amid flat volumes and a modest improve in pricing and blend. Core earnings, which exclude particular objects, moved up 3% from final 12 months to $1.99 per share within the September quarter. On a reported foundation, web earnings attributable to the corporate grew by one-fifth year-over-year to $4.75 billion or $1.95 per share. Each gross sales and revenue surpassed Wall Avenue’s expectations.

From P&G’s Q1 2026 Earnings Name:

“We are going to proceed to speed up productiveness in all areas of our operation, together with the lately introduced restructuring work, to gas investments in superiority, mitigate value and forex headwinds, and drive margin enlargement. We now have an goal for development financial savings in value of products offered, of as much as $1.5 billion earlier than tax, enabled by platform applications with international utility throughout classes with Provide Chain 3.0. We now have a line of sight to financial savings for improved advertising and marketing productiveness, extra effectivity, higher effectiveness, avoiding extra frequency, and decreasing waste whereas rising attain.“

Highway Forward

In a latest assertion, P&G management mentioned it expects full-year 2026 gross sales to rise 1–5% year-over-year, with natural gross sales development projected to be flat to up 4% versus the prior 12 months. Core earnings are forecast to be flat to up 4% in FY26. The enterprise stays within the midst of a restructuring centered on value discount, right-sizing, and streamlining the model portfolio. The corporate has additionally appointed COO Shailesh Jejurikar as its new CEO, efficient January 1, 2026, succeeding Jon Moeller.

The typical worth of Procter & Gamble’s inventory for the final 12 months is $157.75. On Wednesday, the shares principally traded increased throughout the session.

Procter & Gamble Firm (NYSE: PG) is gearing up for its newest earnings report whereas navigating a difficult market atmosphere marked by intensifying competitors and evolving client habits. Over time, the buyer items behemoth has maintained its market management, supported by its extremely environment friendly provide chain, model superiority, and robust digital push. Notably, P&G’s publicity to latest import tariffs is comparatively decrease in comparison with most consumer-focused friends because of its long-term technique of sustaining a localized U.S. manufacturing footprint.

Q2 Report Due

When the corporate stories its second-quarter outcomes on January 22, earlier than the opening bell, the market might be on the lookout for whole gross sales of $22.33 billion and earnings of $1.87 per share. In Q2 2025, the corporate earned $1.88 per share on gross sales of $21.88 billion. Previously two quarters, each gross sales and earnings topped expectations, and the pattern is predicted to proceed this time.

After beginning 2026 on a weak be aware, Procter & Gamble’s shares have gained energy and have been trending upward since final week. It stays to be seen whether or not this momentum will proceed forward of subsequent week’s earnings. The corporate has confronted a tough patch for over a 12 months, following a gradual decline since its all-time excessive on the finish of 2024. It has misplaced round 5% up to now six months. Having raised its dividend consecutively for greater than six many years, P&G is likely one of the longest-standing members of the S&P 500 Dividend Aristocrats index.

Q1 End result

P&G reported increased gross sales and earnings for the primary quarter. Internet gross sales rose 3% yearly to $22.4 billion in Q1, with natural gross sales rising 2% amid flat volumes and a modest improve in pricing and blend. Core earnings, which exclude particular objects, moved up 3% from final 12 months to $1.99 per share within the September quarter. On a reported foundation, web earnings attributable to the corporate grew by one-fifth year-over-year to $4.75 billion or $1.95 per share. Each gross sales and revenue surpassed Wall Avenue’s expectations.

From P&G’s Q1 2026 Earnings Name:

“We are going to proceed to speed up productiveness in all areas of our operation, together with the lately introduced restructuring work, to gas investments in superiority, mitigate value and forex headwinds, and drive margin enlargement. We now have an goal for development financial savings in value of products offered, of as much as $1.5 billion earlier than tax, enabled by platform applications with international utility throughout classes with Provide Chain 3.0. We now have a line of sight to financial savings for improved advertising and marketing productiveness, extra effectivity, higher effectiveness, avoiding extra frequency, and decreasing waste whereas rising attain.“

Highway Forward

In a latest assertion, P&G management mentioned it expects full-year 2026 gross sales to rise 1–5% year-over-year, with natural gross sales development projected to be flat to up 4% versus the prior 12 months. Core earnings are forecast to be flat to up 4% in FY26. The enterprise stays within the midst of a restructuring centered on value discount, right-sizing, and streamlining the model portfolio. The corporate has additionally appointed COO Shailesh Jejurikar as its new CEO, efficient January 1, 2026, succeeding Jon Moeller.

The typical worth of Procter & Gamble’s inventory for the final 12 months is $157.75. On Wednesday, the shares principally traded increased throughout the session.