For Johnson & Johnson (NYSE: JNJ), investments in its pipeline and exiting decrease precedence companies stay central to its technique within the new fiscal 12 months. The healthcare behemoth is within the midst of a serious transformation, streamlining operations and additional increasing its diversified portfolio. The corporate is getting ready to report outcomes for the primary three months of fiscal 2025.

Johnson & Johnson has hiked its dividend commonly over the previous a number of years and presently provides a yield of three.2%, which is nicely above the S&P 500 common. After a combined efficiency final 12 months, the inventory entered 2025 on a constructive word. Nonetheless, the momentum waned in latest weeks and JNJ is presently buying and selling on the ranges seen 12 months in the past.

Q1 Report on Faucet

The primary-quarter report is scheduled for launch on April 15, at 6:20 am ET. On common, analysts following the enterprise predict earnings of $2.6 per share and revenues of $21.6 billion for the March quarter. Within the comparable quarter of 2024, the corporate earned $2.71 per share on revenues of $21.38 billion. Johnson & Johnson holds the excellence of persistently beating quarterly earnings estimates for over a decade. In the latest quarter, income additionally topped expectations, marking the third beat in a row.

Final 12 months, the corporate put aside round $50 billion for analysis and growth and M&A, together with the $14.6-billion deal to amass Intracellular Therapies. Just lately, it introduced manufacturing, R&D, and know-how investments of greater than $55 billion within the US over the subsequent 4 years. In keeping with the administration, earlier offers together with the acquisition of Shockwave, V-Wave, and Ambrx enabled it to additional shift the portfolio to handle unmet wants in high-growth and high-innovation markets.

“Turning to 2025. And, as beforehand guided again on the finish of 2023, we anticipate to ship operational gross sales development of three% overcoming headwinds related to US biosimilar entries for STELARA and the influence of the Half D redesign and continued macroeconomic pressures in China. Maybe, much more spectacular, we’re planning for adjusted operational earnings per share development of practically 9%. I can’t consider another firm that may have the ability to ship development by the primary 12 months of shedding exclusivity of a multibillion-dollar product,” the corporate’s CEO Joaquin Duato stated within the This autumn earnings name.

The drugmaker expects acquisitions and divestitures to favorably influence operational development by about 50 foundation factors in FY25. The administration maintains a constructive outlook, regardless of anticipating headwinds from the gross sales slowdown in China and biosimilar competitors for considered one of its lead merchandise – for blockbuster drug Stelara, biosimilars have been accredited and are anticipated to be launched within the US and Europe quickly.

Combined This autumn

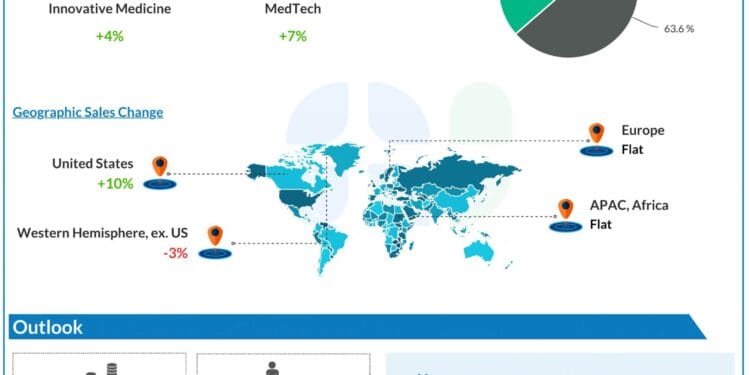

Within the December quarter, web earnings decreased 17% year-over-year to $3.4 billion or $1.41 per share. On an adjusted foundation, earnings per share decreased 11% to $2.04. In the meantime, This autumn gross sales elevated 5.3% from final 12 months to $22.5 billion, with Innovation Medication gross sales and MedTech gross sales rising 4% and seven% respectively. Operational gross sales development was 6.7% within the fourth quarter. The administration stated it expects fiscal 2025 reported gross sales to be within the vary of $89.2 billion to $90.0 billion and adjusted earnings per share between $10.50 and $10.70.

Johnson & Johnson’s common inventory worth for the final 52 weeks is $154.88. The shares closed the final buying and selling session on the lowest degree in about two months, reversing a few of their earlier positive factors.