Now that the bull run is useless, will Fed Chair Jerome Powell do additional price cuts? This crash proved two issues :

1. All the time DCA into bitcoin

2. Maintain and assume it’s a lifetime funding

In the meantime, Powell signaled this week that the central financial institution might be nearing the top of its three-year effort to unwind the huge stimulus unleashed in the course of the 2020 pandemic. Talking earlier than the Nationwide Affiliation of Enterprise Economics in Philadelphia, Powell mentioned the Fed might quickly conclude its balance-sheet discount.”

“We might method that time within the coming months,” Powell mentioned, noting that policymakers have adopted a “intentionally cautious method” to keep away from a repeat of the 2019 cash market freeze that compelled emergency intervention.

Right here’s the finest case: the US authorities sputters again to life inside 7–12 days. Right here’s what it is advisable know:

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Powell Do Additional Price Cuts? Fed Nears Finish of Quantitative Tightening

The Fed’s portfolio peaked at almost $9 Tn in the course of the pandemic’s peak and now stands round $6.6 Tn, in keeping with FRED. The runoff, often called quantitative tightening (QT), has decreased extra financial institution reserves and raised questions on whether or not liquidity situations may once more tighten too sharply.

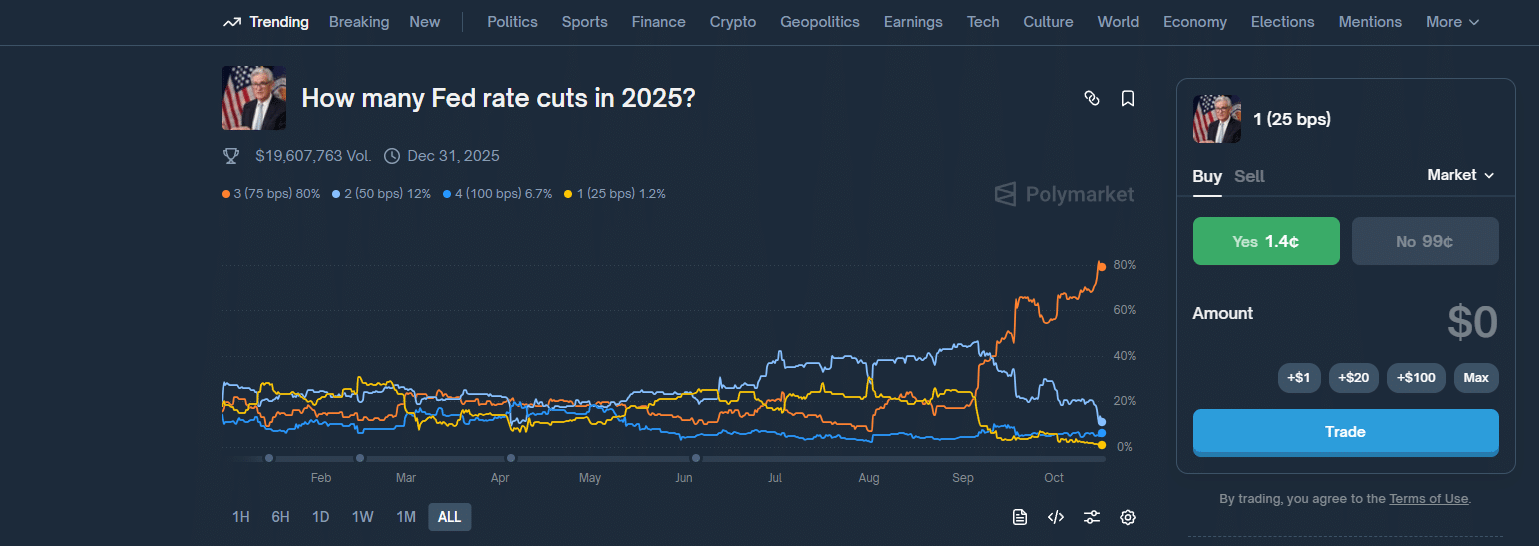

Powell stopped wanting confirming an October price reduce however didn’t deny it both, saying the “financial outlook hasn’t modified a lot” because the Fed’s final assembly. Markets took that as tacit affirmation that one other price reduce might be coming, however

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

.cwp-coin-widget-container .cwp-graph-container.optimistic svg path:nth-of-type(2) {

stroke: #008868 !vital;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic {

coloration: #008868 !vital;

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.optimistic {

border: 1px stable #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic::earlier than {

border-bottom: 4px stable #008868 !vital;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-graph-container.unfavorable svg path:nth-of-type(2) {

stroke: #A90C0C !vital;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavorable {

border: 1px stable #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable {

coloration: #A90C0C !vital;

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable::earlier than {

border-top: 4px stable #A90C0C !vital;

}

0.97%

Bitcoin

BTC

Worth

$111,674.63

0.97% /24h

Quantity in 24h

$65.17B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

responded negatively to the information, dropping 0.5%.

Right here’s the most effective case situation (we’d like some excellent news, proper?):

- As soon as the lights flip again on and the gov’t shutdown is over, the SEC resumes its grind towards altcoin ETF approvals, the narrative everybody’s ready on.

- In the meantime, gold dips, the greenback index slides, and the Fed tees up one other 25 bps reduce on October 29.

- Someplace between the shutdown headlines and the liquidity flood, the Readability Act additionally passes This fall

And as crypto merchants overthink each macro transfer, crypto does what it all the time does finest: melts up whereas nobody’s wanting. Most ache. Most irony… in the event you’re sitting on the sideline that’s.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

What In regards to the US Shutdown? Gov’t Pressures Job Market and Knowledge Circulation

The continuing federal authorities shutdown, now in its second week, has suspended the discharge of key financial information, together with the September jobs report. Nonetheless, non-public estimates from JPMorgan, Goldman Sachs, and Citigroup counsel that preliminary unemployment claims rose to round 235,000 final week, up from 224,000 beforehand.

“Excluding any shutdown noise, claims nonetheless look fairly low,” added Abiel Reinhart of JPMorgan.

To finish the shutdown, Democrats are DEMANDING $1.5 TRILLION in new partisan spending.

That is an unserious proposal made by unserious folks.

Listed below are only a few of the issues they’re utilizing to take the federal government hostage

pic.twitter.com/IIyQz16t1P

— Speaker Mike Johnson (@SpeakerJohnson) October 15, 2025

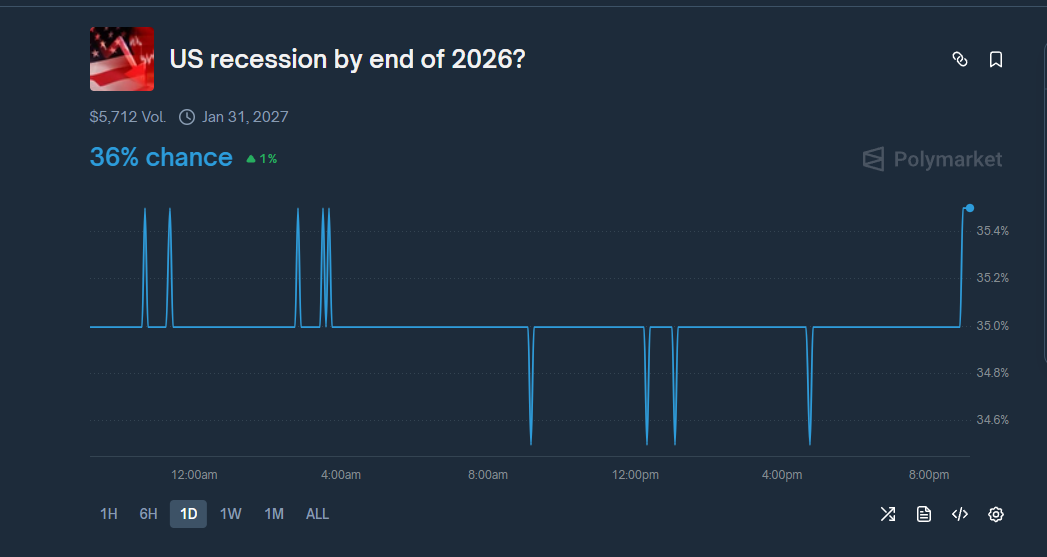

The labor market, whereas not collapsing, seems frozen in what economists name a “no hiring, no firing” equilibrium. In the meantime, Wall St. corporations stay cautious amid commerce friction, automation adoption, and coverage uncertainty heading into 2025.

US Financial Knowledge Factors to Fragile Momentum, What’s Subsequent?

Job openings are down 9% year-over-year, wages flat close to 4.1%, and inflation nonetheless grinding increased. With the Fed’s subsequent large information week coming, CPI on Oct. 15, PPI on Oct. 16, payrolls on Oct. 17 , this market appears to be like useless.

But it surely’s typically once you’re most pissed off, bored, and pissed off (similar factor as pissed off, however extra apt) that issues soften up.

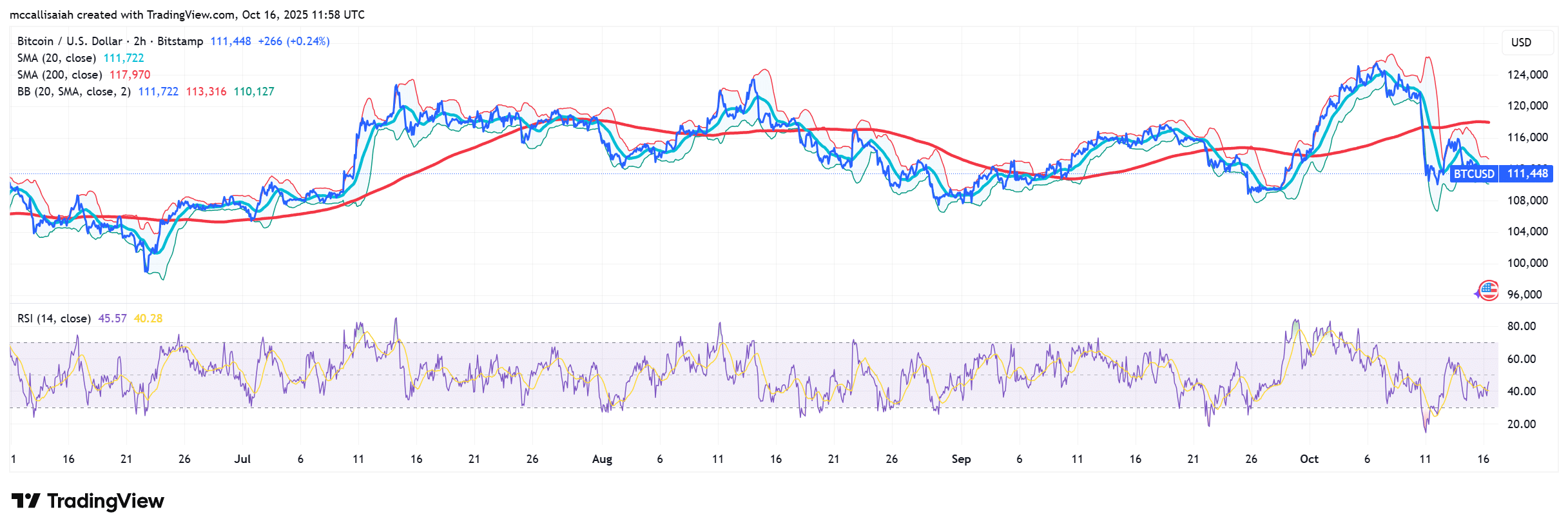

Powell’s indicators are softening: QT could also be ending, and price cuts are again on the desk. Shares have perked up, treasury yields are slipping, and Bitcoin’s hovering above $112K. We must always nonetheless see a brand new BTC ATH in This fall.

EXPLORE: BNB Meme Season? Hajimi, 币安人生, And Many 100‑1000x Runners.

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Now that the bull run is useless, will Fed Chair Jerome Powell do additional price cuts? This crash proved two issues :1. All the time DCA into bitcoin.

- TJob openings are down 9% year-over-year, wages flat close to 4.1%, and inflation nonetheless grinding increased.

The submit Now That the Bull Run is Lifeless, Will Powell Do Additional Price Cuts? Finish of Fed Tightening Close to as Job Market Softens appeared first on 99Bitcoins.