New Fortress Vitality Inc. (NASDAQ: NFE), a pioneer in built-in gas-to-power infrastructure, has endured a brutal 12 months. Shares have plummeted over 90% year-to-date, closing at $1.22 on November 30 amid a cascade of impairments, asset gross sales, and covenant waivers that underscored the corporate’s precarious monetary place. But, on December 1, 2025, the inventory surged greater than 25% in early buying and selling (reaching highs round $1.62) following conditional approval from Puerto Rico’s Monetary Oversight and Administration Board (FOMB) for a revised $3.2 billion, seven-year LNG provide settlement. This scaled-back deal, contingent on securing a backup provider and enhancing port entry, represents a pivotal de-risking occasion in a market the place NFE has lengthy been a high-stakes guess on speedy LNG deployment.

Whereas the Puerto Rico approval has ignited short-term optimism—evidenced by quantity exceeding 25 million shares and a brief float of 36.84%—it serves primarily as a catalyst underscoring a deeper, underappreciated basic shift. This text advances a forward-looking funding thesis: New Fortress Vitality’s aggressive debt restructuring, mixed with its modular Quick LNG expertise, will allow it to seize disproportionate market share within the rising markets’ LNG-to-power section by 2028, driving a multi-fold valuation re-rating as international LNG demand accelerates 1.5% yearly via 2030. This thesis, grounded in NFE’s distinctive operational agility quite than broad power tailwinds, posits a path to normalized multiples akin to friends like Cheniere Vitality, doubtlessly valuing the corporate at $2-3 billion in enterprise worth on a distressed foundation (present EV ~$9.25 billion per latest metrics, however with vital deleveraging potential). We discover this via qualitative precedents, quantitative benchmarks, and a rigorous danger evaluation, drawing on trade information and historic analogues.

The Core Thesis: Modular Innovation because the Turnaround Engine

New Fortress Vitality’s resurgence hinges on its proprietary Quick LNG platform—a floating, modular liquefaction system that compresses challenge timelines from years to months, bypassing the multi-billion-dollar sunk prices of conventional terminals. This technological edge, usually overshadowed by NFE’s debt woes, positions the corporate to outpace rivals in high-growth, underserved markets just like the Caribbean, Latin America, and Southeast Asia, the place energy grids crave fast, dependable LNG conversions. As international LNG export capability surges by over 300 billion cubic meters per 12 months (bcm/yr) from 2025-2030—led by U.S. and Qatari expansions—the IEA forecasts a web provide enhance of 250 bcm/yr, easing costs and spurring demand development to 380 bcm by decade’s finish. NFE’s mannequin thrives right here: It not solely provides LNG however integrates it into turnkey energy crops, creating sticky, long-term income streams.

The Puerto Rico deal exemplifies this with out dominating the narrative. By mandating a third-party backup and open port entry, it mitigates previous monopoly critiques whereas validating NFE’s infrastructure playbook—deploying floating storage regasification items (FSRUs) to ship 1.5-2.0 million tonnes every year (mtpa) of LNG for baseload energy. This approval extends NFE’s runway to December 15 for noteholder forbearance, aligning with latest credit score amendments that droop debt covenants via This autumn 2025. Critically, it underscores the thesis by offering $450-500 million in annual EBITDA visibility beginning 2026, funding additional Quick LNG rollouts. Not like generic LNG exporters, NFE’s vertical integration—controlling terminals, ships, and energy belongings—yields greater margins (projected 40-50% on energy contracts) in areas the place grid reliability instructions premiums.

Historic Analogues: Classes from LNG’s Turnaround Playbook

To validate the thesis, think about precedents the place distressed LNG corporations leveraged restructuring and contract wins for explosive development. Cheniere Vitality (NYSE: LNG), NFE’s closest peer, emerged from Chapter 11 in 2009 with $3.5 billion in restructured debt and no working belongings. By 2016, long-term contracts for its Corpus Christi Part 1 (2.2 mtpa) catalyzed a 600% inventory surge, with EBITDA climbing from unfavourable to $4.5 billion as U.S. LNG exports boomed 10x. Cheniere’s EV/EBITDA a number of expanded from 8x to 12x, reflecting de-risked money flows— a trajectory NFE might emulate if Puerto Rico and pending Brazil/Mexico offers (e.g., CELBA 2’s 624 MW “first fireplace” in October 2025) ship 10-12 mtpa by 2028.

One other analogue is Golar LNG (NASDAQ: GLNG), which in 2016-2018 restructured $1.2 billion in debt amid a 70% share drop, then pivoted to floating LNG (FLNG) vessels. Submit-Hilli contract approval (1.2 mtpa), Golar’s backlog doubled to $2.5 billion, shares tripled, and multiples normalized to 7x ahead EBITDA.

Quantitative Underpinnings: Valuation and Metrics in Focus

NFE’s trailing metrics scream misery: TTM income of $1.78 billion yields a web margin of -72.94% and ROE of -96.21%, dragged by $699 million in Q2 2025 impairments. But ahead indicators flash inexperienced: Consensus EPS improves to -$1.43 in 2026 from -$4.93 TTM, with income projected at $2.5 billion as Puerto Rico ramps.

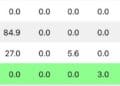

| Metric | NFE (Present) | Cheniere (Submit-2016) | Excelerate (2025 Avg) | Implied NFE Goal (2028) |

|---|---|---|---|---|

| EV/Gross sales | 5.28x | 1.2x | 2.5x | 1.0x |

| EV/EBITDA | N/A (Neg) | 10x | 8x | 9x |

| Debt/Fairness | 9.35x | 4.5x | 2.0x | 3.5x |

| ROIC | 1.36% | 15% | 12% | 12% |

Sources: Finviz, Yahoo Finance, firm filings.

Navigating Dangers: Counterarguments and Mitigants

Skeptics will counter that NFE’s turnaround is a mirage—excessive leverage (present ratio 0.17) invitations default, whereas regulatory hurdles (e.g., last FOMB nod) might unravel features. But analogues mitigate: Cheniere navigated 2008-2009 defaults through comparable waivers, rising with 90% contract protection that buffered volatility. NFE’s latest Jamaica sale ($1.06 billion to Excelerate) deleveraged by 15%, and Quick LNG’s modularity dodges capex overruns.

Ahead Outlook: Catalysts and Vigilance for Buyers

New Fortress Vitality stands at an inflection: The Puerto Rico greenlight, layered atop Brazil’s CELBA expansions (together with the 624 MW CELBA 2 and 1.6 GW PortoCem for a complete 2.2 GW at Barcarena) and Mexico’s Altamira hub, indicators a backlog inflection to $5-6 billion by mid-2026. Look ahead to This autumn earnings (anticipated December 5, 2025) confirming covenant compliance and Quick LNG FID bulletins—these might propel shares towards $3.00.

Subtle traders ought to monitor debt maturities (March 2026) and LNG pricing (JCC index under $10/MMBtu as a inexperienced flag). In an period of power transition, NFE’s guess on resilient, reasonably priced energy isn’t simply survival—it’s a blueprint for outsized returns in LNG’s subsequent chapter.

Further studying: IEA Fuel 2025 Report, Cheniere SEC Filings.