Adobe Inc. (NASDAQ: ADBE) this week reported sturdy outcomes for the third quarter of fiscal 2025, with revenues and revenue rising year-over-year and beating estimates. The corporate, having emerged as a frontrunner in AI inventive functions, as soon as once more raised its full-year income and earnings per share steerage. Adobe’s management said that the corporate’s AI technique is starting to ship monetization as anticipated.

Inventory Fluctuates

The San Jose, California-headquartered design software program maker’s inventory rallied quickly after the earnings announcement, reflecting the preliminary investor optimism, however pared a lot of the good points within the following session. ADBE had s fairly unimpressive begin to 2025 and has steadily declined since then, underperforming the S&P 500 index. The worth has dropped about 40% up to now twelve months. From an funding perspective, the valuation seems enticing, given the corporate’s efficient technique to cope with disruption from the rise of generative AI and up to date improvements throughout the product portfolio.

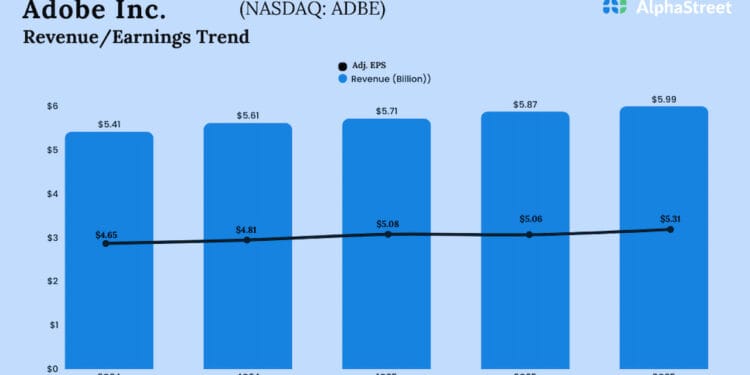

The tech agency’s third-quarter earnings, excluding one-off gadgets, elevated to $5.31 per share from $4.65 per share within the year-ago interval, beating estimates. Reported web earnings was $1.77 billion or $4.18 per share within the August quarter, in comparison with $1.68 billion or $3.76 per share in Q3 2024. The corporate posted revenues of $5.99 billion for Q3, in comparison with $5.41 billion within the corresponding quarter final 12 months. Revenues got here in above Wall Avenue’s expectations.

Outlook

The administration now expects full-year FY25 revenues to be within the vary of $23.65 billion to $23.70 billion, with an estimated 11.3% year-over-year progress in Digital Media annualized recurring income. On an adjusted foundation, full-year adjusted web earnings per share is predicted to be between $20.80 and $20.85. The forecast is larger than the steerage the corporate issued just a few months in the past. It’s on the lookout for unadjusted earnings of $16.53-6.58 per share for FY25. For the fourth quarter, Adobe targets revenues within the vary of $6.075 billion to $6.125 billion, and adjusted earnings per share within the $5.35-$5.40 vary.

“Our technique to harness AI is targeted on infusing it throughout our category-leading functions to supply extra worth and ship revolutionary, new AI-first merchandise. We’ve finished an important job executing this technique by accelerating innovation with a give attention to providing higher worth to inventive and advertising professionals and enterprise professionals, and shoppers. Creativity has all the time been core to the corporate’s mission,” Adobe’s CEO Santanu Narayen mentioned throughout his post-earnings interplay with analysts.

Technique

Adobe has come underneath stress from AI disruption and rising opponents currently, which prompted it to provoke a mixture of strategic pivots, product innovation, and pricing recalibration to cope with the scenario. Others, reminiscent of OpenAI and Google, are providing low-cost options for processing inventive workflows. Whereas Adobe has embedded generative AI throughout its ecosystem—Photoshop, Illustrator, Premiere Professional—by way of its Firefly mannequin, there are considerations that the corporate has but to successfully monetize the AI options.

On Friday, Adobe’s inventory opened larger however quickly misplaced momentum and principally traded decrease throughout the session. It has declined round 20% up to now six months.