Be a part of Our Telegram channel to remain updated on breaking information protection

Japan-based Metaplanet has acquired 103 BTC value $11.7 million, bringing it near surpassing Riot Platforms because the world’s sixth-largest company Bitcoin holder.

The corporate’s CEO, Simon Gerovich, mentioned in an Aug. 25 X put up that the most recent BTC buy was executed at a median purchase worth of $113,491 per BTC. Following the latest acquisition, Metaplanet’s holdings within the largest crypto by market cap now stand at 18,991 BTC.

Metaplanet Appears to be like To Climb Bitcoin Treasury Rankings

Gerovich added that Metaplanet’s holdings have been acquired for a complete price of round $1.95 billion, with the general common worth for the acquisitions standing at roughly $102,712 per BTC. To this point, the corporate has additionally achieved a year-to-date (YTD) BTC yield of 479.5%, Gerovich mentioned.

That’s as the corporate appears to double down on its BTC technique. Earlier this month, the agency unveiled its Bitcoin-backed yield curve and its “Metaplanet Prefs” program to tackle Japan’s bond market in addition to additional weaponize its BTC treasury.

Gerovich additionally shared in one other X put up at present that Metaplanet has been added to the FTSE Japan Index within the September evaluate. Based on the CEO, that is “one other necessary milestone on our journey as Japan’s main Bitcoin treasury firm.”

✅ Metaplanet has been added to the FTSE Japan Index within the September evaluate. One other necessary milestone on our journey as Japan’s main Bitcoin treasury firm. https://t.co/rZfWWgQyoe pic.twitter.com/k3rnIz3CDd

— Simon Gerovich (@gerovich) August 25, 2025

At the moment ranked as the most important company BTC holder in Asia and the seventh-biggest holder globally, Metaplanet is now lower than 300 BTC away from overtaking Riot Platforms within the BTC treasury rankings.

Based on information from BitBO, Riot Platforms holds 19,287 BTC on its steadiness sheet valued at $2.18 billion at present costs.

The present chief, Technique, led by Michael Saylor, takes the primary spot with a snug margin. With 629,376 BTC in its reserves value greater than $71 billion, Technique holds slightly below 3% of BTC’s whole provide.

The second-biggest Bitcoin treasury agency is Marathon Digital, with its holdings of fifty,639 BTC.

Saylor has additionally hinted that Technique will add to its lead. In an X put up yesterday, he posted a screenshot of the SaylorTracker chart with the caption, “Bitcoin is on sale.”

Bitcoin is on Sale pic.twitter.com/azJIYk2xDe

— Michael Saylor (@saylor) August 24, 2025

Posts with that chart have been adopted by bulletins of Bitcoin purchases previously.

If historical past repeats itself and Technique pronounces a brand new BTC purchase, it might be the third Bitcoin acquisition by the corporate in August.

Technique’s most up-to-date buy was on Aug. 18, when it purchased 430 BTC for $51.4 million.

Technique is now sitting on an unrealized acquire of greater than $24.7 million as effectively, which equates to round 53.52%, in response to information from SaylorTracker.

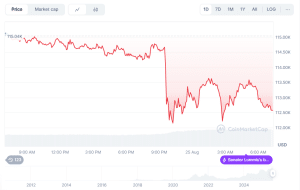

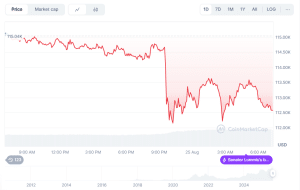

Bitcoin Value Stalls Even Amid The Continued Company Shopping for Spree

Even supposing firms like Technique and Metaplanet proceed to buy extra BTC, the crypto king’s worth has dropped over the previous month.

Within the final 30 days, BTC has slid over 4%. That is primarily as a result of greater than 2% drop over the past week, information from CoinMarketCap exhibits.

BTC worth chart (Supply: CoinMarketCap)

The drop in BTC’s worth at the same time as establishments hold shopping for is probably going on account of Bitcoin’s oldest whales taking revenue.

Bitcoiner Willy Woo mentioned in an Aug. 24 X put up that the “BTC provide is concentrated round OG whales who peaked their holdings in 2011.”

This differential in price foundation, the availability they maintain and their fee of promoting has profound impacts on how a lot new capital that should are available to carry worth.

You’ll be able to take a look at this as BTC going by means of rising pains till these 10,000x acquire buyers are absorbed.

— Willy Woo (@woonomic) August 24, 2025

“They purchased their BTC at $10 or decrease,” Woo mentioned, including that it now takes greater than $110K of “new capital” to soak up every BTC that these whales promote.

One such whale has additionally been blamed for BTC’s flash crash within the final 24 hours. This massive investor began transferring BTC to the decentralized crypto perpetuals platform Hyperliquid on Aug. 16, and despatched 24,000 BTC value $2.7 billion throughout six transfers, Blockchain.com information exhibits.

Of that quantity, 18,142 BTC valued at $2 billion has already been offered. Many crypto group members on X consider this exercise triggered a cascade of promote orders throughout the market.

Because of that, BTC’s worth dipped to as little as $111,060.54 yesterday. It has since recovered to commerce at $112,497.43 as of 1:28 a.m. EST.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection