Johnson & Johnson (NYSE: JNJ) is capitalizing on its transition from a broad-based healthcare conglomerate right into a market chief in progressive medication and medical expertise. The corporate continues to increase its portfolio by way of methods corresponding to diversification throughout high-growth healthcare segments and reinvestment within the enterprise, with a deal with superior therapeutics and state-of-the-art medical gadgets.

Estimates

Johnson & Johnson is predicted to ship constructive outcomes for the fourth quarter, persevering with the momentum seen for the reason that starting of the yr. On common, analysts following the corporate forecast adjusted earnings of $2.49 per share for the quarter, increased than $2.04 per share reported within the year-ago quarter. This fall revenues are anticipated to be $24.16 billion, representing a 7.3% year-over-year improve. The report is scheduled for launch on Wednesday, January 21, at 6:20 am ET.

JNJ is without doubt one of the best-performing Wall Avenue shares, rising greater than 45% final yr. A month in the past, the shares set a brand new document, earlier than paring part of these features within the following weeks. Over time, Johnson & Johnson has maintained its dedication to returning capital to shareholders by way of a long-standing dividend progress streak. The corporate’s disciplined strategy to money move allocation and innovation-focused investments has enabled it to persistently increase the payout for a lot of a long time.

Outcomes Beat

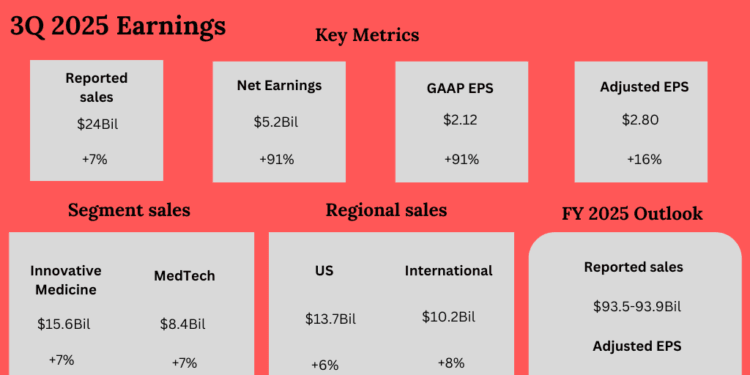

In Q3 2025, adjusted earnings rose 16% from final yr to $2.80 per share, exceeding estimates. Over the previous a number of years, quarterly earnings have regularly crushed estimates. Unadjusted internet earnings surged 91% year-over-year to $5.2 billion or $2.12 per share. At $24 billion, third-quarter reported gross sales have been up 6.8%, whereas operational gross sales grew 5.4%. The highest-line exceeded expectations. Gross sales rose 7% in each Modern Medication and MedTech, the primary working segments. Geographically, US gross sales rose 6% and Worldwide gross sales elevated 8%.

“We proceed to take a position at industry-leading ranges in our pipeline and portfolio whereas making disciplined choices to exit companies that we consider will probably be higher capable of thrive exterior of Johnson & Johnson. For our Orthopaedics enterprise, the deliberate separation creates new alternatives. Working as DePuy Synthes and led by Namal Nawana, it might be the most important, most complete orthopaedics firm, with main market share positions throughout main classes and addressing a greater than $50 billion and rising market alternative,” JNJ CEO Joaquin Duato mentioned within the Q3 FY25 earnings name.

Outlook

Buoyed by the constructive Q3 final result, the administration raised its full-year gross sales steerage to $93.5-93.9 billion. The forecast is sort of in keeping with analysts’ expectations. Full-year earnings steerage was reaffirmed within the vary of $10.80 per share to $10.90 per share, excluding particular objects. Ongoing portfolio diversification has given the corporate a aggressive benefit in an evolving {industry} marked by technological breakthroughs and shifting regulatory dynamics. Additionally, the rising demand for customized and value-based care bodes effectively for the enterprise.

The inventory has been buying and selling principally sideways since crossing the $200 mark two months in the past. That’s effectively above its 12-month common value of $171.64. On Monday, JNJ traded increased all through the session.