Bitcoin continues to commerce just under the $84,000 mark, reflecting a broader slowdown in upward momentum. Regardless of makes an attempt to reclaim larger ranges, the cryptocurrency has remained below the $90,000 mark for over two weeks.

This present range-bound exercise comes almost two months after Bitcoin touched its all-time excessive in January, indicating a interval of uncertainty as merchants assess macroeconomic situations and upcoming Federal Reserve coverage selections.

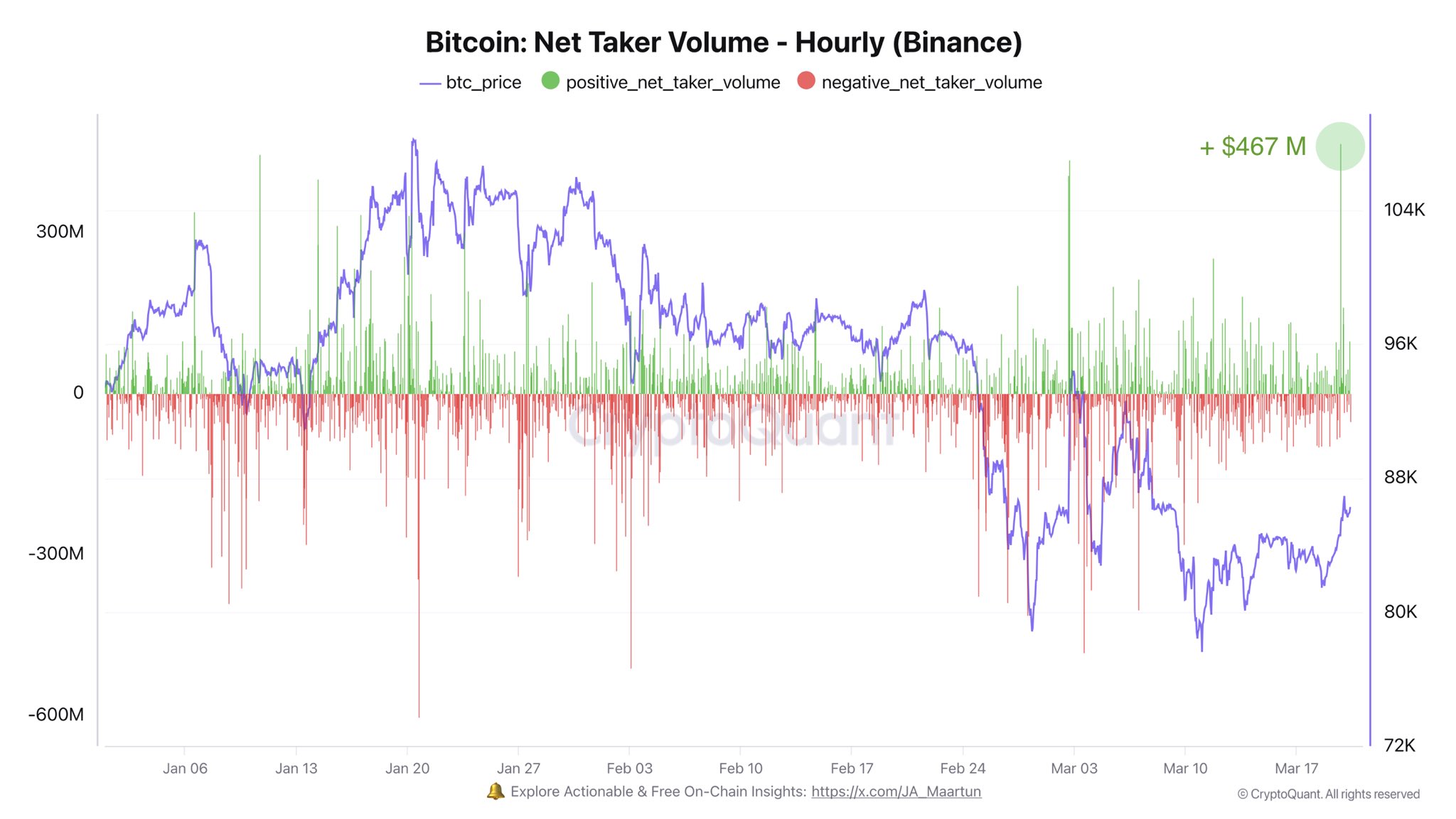

Within the midst of the stagnation from BTC’s value, on-chain knowledge is providing contrasting indicators on the place the market is likely to be headed subsequent. Analysts have pointed to fluctuations in shopping for and promoting strain on main exchanges, notably Binance, as key indicators of short-term market sentiment.

Surge in Binance Internet Taker Quantity

CryptoQuant analyst Darkfost just lately highlighted a notable spike in web taker quantity on Binance, the world’s largest centralized crypto trade. In line with Darkfost, web taker quantity surged by $467 million in a single hour—marking the very best degree recorded in 2025 to date.

This metric, which measures the distinction between aggressive market buys and sells, is usually used to gauge the fast sentiment of energetic merchants. A optimistic worth signifies stronger shopping for exercise and has traditionally signaled short-term bullishness.

Darkfost emphasised that this uptick in taker quantity occurred simply previous to the current FOMC assembly, suggesting that some merchants could also be positioning for favorable coverage outcomes.

Whereas the information solely displays an hourly timeframe and should not indicate long-term directional change, the motion may sign a broader shift in sentiment amongst energetic members, particularly given Binance’s influential place in world crypto markets.

Shopping for strain from Binance merchants is likely to be again.

— Binance is the CeX with the very best buying and selling quantity, making it notably related for knowledge evaluation. —

The web taker quantity is a robust metric for gauging dealer sentiment, because it measures the amount of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Exercise Returns as Change Ratios Spike

In the meantime, one other CryptoQuant analyst, EgyHash, offered a extra cautious interpretation of current exercise. In line with his evaluation, the Bitcoin Change Whale Ratio—outlined because the share of complete trade inflows coming from the highest 10 largest addresses—has surged to its highest level in over a yr.

This ratio is carefully monitored as a result of spikes typically precede elevated promoting strain, particularly when giant holders transfer funds to exchanges. Whereas not a definitive indicator of fast liquidation, the rise in whale-driven deposits means that some main gamers could also be making ready for reallocation or profit-taking.

Mixed with stagnant value motion, this metric implies that Bitcoin’s present value degree could also be approaching a choice level, the place the market path will probably be decided by the steadiness between new demand and potential provide from giant holders.

Featured picture created with DALL-E, Chart from TradingView

Shopping for strain from Binance merchants is likely to be again.

Shopping for strain from Binance merchants is likely to be again.