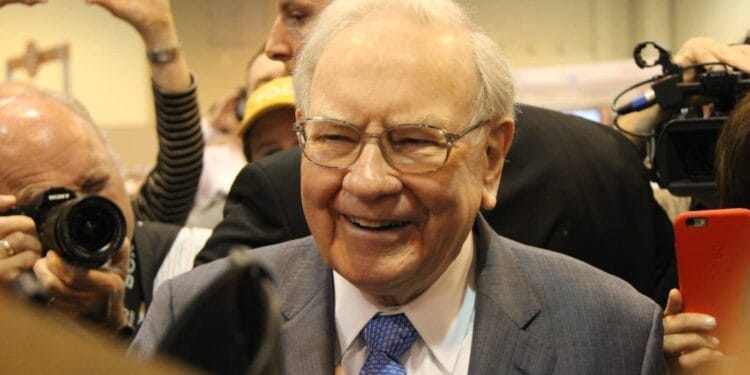

Picture supply: The Motley Idiot

Warren Buffett — who introduced he’s stepping down from Berkshire Hathaway on the finish of 2025 — has left an indelible mark on the investing world.

Because the mid-Nineteen Sixties, Berkshire’s shares have delivered a surprising common annual return of 20.1%. To place that into context, the S&P 500 has produced a mean return of 11.4% during the last 50 years. So it’s no marvel skilled and retail buyers alike eagerly observe the most recent on what Buffett’s been shopping for and promoting.

The ‘Oracle of Omaha’ hasn’t all the time bought it proper, as his $433m buy of Dexter Shoe Firm in 1993 confirmed. However as his wider file reveals, the uncommon misfires have been comfortably dwarfed by his many years of choosing winners.

With this in thoughts, right here’s a high Buffett share I’m contemplating including to my very own portfolio: The Coca-Cola Firm (NYSE:KO).

A Buffett magnificence

The Coke producer is maybe Buffett’s most well-known holding. Since shopping for his first shares within the late Nineteen Eighties, he’s steadily constructed his stake and Berkshire immediately owns 400m shares. That’s equal to round 8% of the delicate drinks large’s excellent shares.

Solely Apple, American Specific and Financial institution of America command bigger locations in Berkshire’s portfolio.

Buffett’s not bought a single share in Coca-Cola down the years. He loves the terrific model energy of its drinks — the likes of Coca-Cola, Fanta, and Sprite all stay in excessive demand in any respect factors of the financial cycle, making it some of the strong companies on the planet.

Because the desk reveals, Coca-Cola is by far the world’s strongest non-alcoholic drinks model, and the one such product with Model Finance’s ‘AAA+’ model power score. That’s because of the corporate’s distinctive markets and lengthy observe file of market-leading innovation.

Which means that if volumes undergo throughout downturns, Coca-Cola can hike costs to offset this and continue to grow earnings. It could actually additionally cut back the affect of rising prices on the underside line. Whereas case volumes rose simply 2% in January-March, focused worth hikes meant natural gross sales improved by a a lot more healthy 6% over the quarter.

This in flip meant earnings per share improved 5% yr on yr.

Dividend king

In addition to its formidable model energy, Coca-Cola’s robustness can be helped by its multi-sector publicity. It manufactures vitality drinks, espresso, juices, water and alcohol alongside its world-famous delicate drinks.

The agency’s endurance can be because of its vast geographic footprint, which protects group earnings from weak point in a single or two territories. In the present day, round 2.2bn of the corporate’s drinks are strong throughout 200 international locations in developed and rising markets.

This multinational strategy does go away it weak to opposed forex actions. However to this point this hasn’t derailed the corporate’s sturdy historical past of income development.

By the way, Metropolis analysts assume Coca-Cola’s annual earnings will rise one other 20% in 2025. This additionally leads them to tip one other elevate within the yearly dividend, the sixty fourth in a row.

In the present day, Coca-Cola shares commerce on a premium price-to-earnings (P/E) ratio of 24.2 occasions. It’s the form of industry-high valuation that might immediate it to fall sharply in worth if investor confidence begins to waver. But regardless of this danger, I believe the delicate drinks star is greater than worthy of this princely valuation.

It’s why I’m contemplating including it to my very own portfolio.

Picture supply: The Motley Idiot

Warren Buffett — who introduced he’s stepping down from Berkshire Hathaway on the finish of 2025 — has left an indelible mark on the investing world.

Because the mid-Nineteen Sixties, Berkshire’s shares have delivered a surprising common annual return of 20.1%. To place that into context, the S&P 500 has produced a mean return of 11.4% during the last 50 years. So it’s no marvel skilled and retail buyers alike eagerly observe the most recent on what Buffett’s been shopping for and promoting.

The ‘Oracle of Omaha’ hasn’t all the time bought it proper, as his $433m buy of Dexter Shoe Firm in 1993 confirmed. However as his wider file reveals, the uncommon misfires have been comfortably dwarfed by his many years of choosing winners.

With this in thoughts, right here’s a high Buffett share I’m contemplating including to my very own portfolio: The Coca-Cola Firm (NYSE:KO).

A Buffett magnificence

The Coke producer is maybe Buffett’s most well-known holding. Since shopping for his first shares within the late Nineteen Eighties, he’s steadily constructed his stake and Berkshire immediately owns 400m shares. That’s equal to round 8% of the delicate drinks large’s excellent shares.

Solely Apple, American Specific and Financial institution of America command bigger locations in Berkshire’s portfolio.

Buffett’s not bought a single share in Coca-Cola down the years. He loves the terrific model energy of its drinks — the likes of Coca-Cola, Fanta, and Sprite all stay in excessive demand in any respect factors of the financial cycle, making it some of the strong companies on the planet.

Because the desk reveals, Coca-Cola is by far the world’s strongest non-alcoholic drinks model, and the one such product with Model Finance’s ‘AAA+’ model power score. That’s because of the corporate’s distinctive markets and lengthy observe file of market-leading innovation.

Which means that if volumes undergo throughout downturns, Coca-Cola can hike costs to offset this and continue to grow earnings. It could actually additionally cut back the affect of rising prices on the underside line. Whereas case volumes rose simply 2% in January-March, focused worth hikes meant natural gross sales improved by a a lot more healthy 6% over the quarter.

This in flip meant earnings per share improved 5% yr on yr.

Dividend king

In addition to its formidable model energy, Coca-Cola’s robustness can be helped by its multi-sector publicity. It manufactures vitality drinks, espresso, juices, water and alcohol alongside its world-famous delicate drinks.

The agency’s endurance can be because of its vast geographic footprint, which protects group earnings from weak point in a single or two territories. In the present day, round 2.2bn of the corporate’s drinks are strong throughout 200 international locations in developed and rising markets.

This multinational strategy does go away it weak to opposed forex actions. However to this point this hasn’t derailed the corporate’s sturdy historical past of income development.

By the way, Metropolis analysts assume Coca-Cola’s annual earnings will rise one other 20% in 2025. This additionally leads them to tip one other elevate within the yearly dividend, the sixty fourth in a row.

In the present day, Coca-Cola shares commerce on a premium price-to-earnings (P/E) ratio of 24.2 occasions. It’s the form of industry-high valuation that might immediate it to fall sharply in worth if investor confidence begins to waver. But regardless of this danger, I believe the delicate drinks star is greater than worthy of this princely valuation.

It’s why I’m contemplating including it to my very own portfolio.