Wall Avenue’s Goldman Sachs has revealed an growth of its crypto holdings, reporting roughly $2.36 billion in whole crypto publicity — together with $1.1 billion in Bitcoin ETFs, based on monetary holding disclosures.

Bitcoin’s portion of the haul — the most important of any digital asset listed — highlights simply how far the venerable funding financial institution has shifted from earlier skepticism towards significant publicity on the planet’s largest cryptocurrency by market cap.

The $1.1 billion place was in IBIT, BlackRock’s iShares Bitcoin Belief ETF.

The SEC filings additionally revealed holdings of roughly $35.8 million in Constancy’s Smart Origin Bitcoin Fund, roughly $92,000 in American Bitcoin and roughly $57,000 in Bitcoin Depot and varied different bitcoin mining or cloud-based corporations. Based on the filings, Goldman Sachs additionally had a whole lot of 1000’s in IBIT calls and places.

Goldman’s path into Bitcoin started greater than half a decade in the past with tentative forays into the asset class. In 2022, the agency executed its first identified BTC-backed mortgage and a non-deliverable Bitcoin choices commerce — milestones that marked early strategic steps into digital belongings.

But for a lot of its historical past, Goldman was publicly circumspect about crypto, with executives in earlier years distancing the financial institution from Bitcoin as an investable class.

That posture shifted notably in 2024, when Securities and Trade Fee (SEC) filings revealed the financial institution’s first significant accumulation of Bitcoin ETFs, together with BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy’s Smart Origin Bitcoin Fund.

Institutional filings from that interval present Goldman tripling its Bitcoin ETF stake inside months, bringing its holdings to roughly $1.5 billion and making it one of many largest institutional holders of Bitcoin ETFs.

Filings from as we speak additionally confirmed that Goldman Sachs held Ethereum, XRP, and Solana

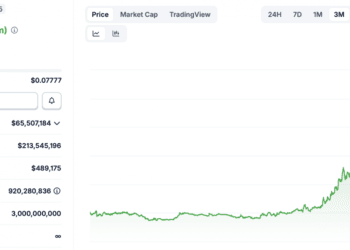

Latest bitcoin value motion

All that is occurring as Bitcoin has struggled to carry its footing above the psychologically key $70,000 degree.

Bitcoin noticed a pointy selloff final week, breaking down by means of the $70,000 and $60,000 ranges earlier than discovering help close to $60,000. After capitulating at that degree, bulls managed a powerful rebound, pushing the value again as much as round $71,700 earlier than closing the week close to $70,315.

Regardless of the bounce, general sentiment stays bearish, as bears managed a lot of the draw back transfer.

Key resistance ranges have shifted following the decline. The primary space to look at is $71,800, the place the value was rejected. Above that, the 0.382 Fibonacci retracement sits close to $74,500, with stronger resistance anticipated at $79,000 and $84,000.

On the draw back, bulls want to carry $65,650 and $63,000 to take care of a reversal try. The $60,000 degree is now crucial help, sitting simply above the 0.618 retracement at $57,800, which can characterize the true ground.

Wall Avenue’s Goldman Sachs has revealed an growth of its crypto holdings, reporting roughly $2.36 billion in whole crypto publicity — together with $1.1 billion in Bitcoin ETFs, based on monetary holding disclosures.

Bitcoin’s portion of the haul — the most important of any digital asset listed — highlights simply how far the venerable funding financial institution has shifted from earlier skepticism towards significant publicity on the planet’s largest cryptocurrency by market cap.

The $1.1 billion place was in IBIT, BlackRock’s iShares Bitcoin Belief ETF.

The SEC filings additionally revealed holdings of roughly $35.8 million in Constancy’s Smart Origin Bitcoin Fund, roughly $92,000 in American Bitcoin and roughly $57,000 in Bitcoin Depot and varied different bitcoin mining or cloud-based corporations. Based on the filings, Goldman Sachs additionally had a whole lot of 1000’s in IBIT calls and places.

Goldman’s path into Bitcoin started greater than half a decade in the past with tentative forays into the asset class. In 2022, the agency executed its first identified BTC-backed mortgage and a non-deliverable Bitcoin choices commerce — milestones that marked early strategic steps into digital belongings.

But for a lot of its historical past, Goldman was publicly circumspect about crypto, with executives in earlier years distancing the financial institution from Bitcoin as an investable class.

That posture shifted notably in 2024, when Securities and Trade Fee (SEC) filings revealed the financial institution’s first significant accumulation of Bitcoin ETFs, together with BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy’s Smart Origin Bitcoin Fund.

Institutional filings from that interval present Goldman tripling its Bitcoin ETF stake inside months, bringing its holdings to roughly $1.5 billion and making it one of many largest institutional holders of Bitcoin ETFs.

Filings from as we speak additionally confirmed that Goldman Sachs held Ethereum, XRP, and Solana

Latest bitcoin value motion

All that is occurring as Bitcoin has struggled to carry its footing above the psychologically key $70,000 degree.

Bitcoin noticed a pointy selloff final week, breaking down by means of the $70,000 and $60,000 ranges earlier than discovering help close to $60,000. After capitulating at that degree, bulls managed a powerful rebound, pushing the value again as much as round $71,700 earlier than closing the week close to $70,315.

Regardless of the bounce, general sentiment stays bearish, as bears managed a lot of the draw back transfer.

Key resistance ranges have shifted following the decline. The primary space to look at is $71,800, the place the value was rejected. Above that, the 0.382 Fibonacci retracement sits close to $74,500, with stronger resistance anticipated at $79,000 and $84,000.

On the draw back, bulls want to carry $65,650 and $63,000 to take care of a reversal try. The $60,000 degree is now crucial help, sitting simply above the 0.618 retracement at $57,800, which can characterize the true ground.