Gold continues to dominate international markets, climbing to round $4,966 on the time of writing and reinforcing its standing as the popular hedge amid persistent macro uncertainty.

- Gold jumped to about $4,966 whereas Bitcoin is hovering just under $70,000.

- Cathie Wooden says gold and Bitcoin have low correlation, with gold rallies usually coming first.

- Gold ETF inflows stay sturdy, signaling sustained investor demand.

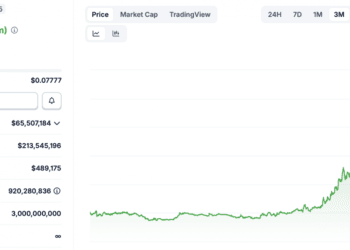

Bitcoin, against this, is buying and selling just under $70,000 after a interval of sharp swings, leaving traders debating whether or not crypto is falling behind or just consolidating.

Whereas each property are sometimes grouped collectively as alternate options to fiat currencies, their worth habits in recent times tells a extra nuanced story.

Cathie Wooden: Gold and Bitcoin Don’t Transfer Collectively

In keeping with Cathie Wooden, Bitcoin and gold have proven surprisingly little overlap of their worth actions. Since 2019, the correlation between the 2 has hovered round simply 0.14, suggesting they have a tendency to reply to completely different market forces regardless of comparable narratives round shortage and safety towards inflation.

BITCOIN ISN’T TRACKING GOLD … AND THAT’S THE SIGNAL

Cathie Wooden says:

– Bitcoin and gold have had a 0.14 correlation since 2019

– Gold has surged whereas Bitcoin is ~50% off its peak

– Traditionally, main gold strikes have preceded massive Bitcoin rallies pic.twitter.com/ybi5PZih87— Ark Make investments Tracker (@ArkkDaily) February 7, 2026

Wooden additionally factors to a recurring historic sample – main gold rallies have usually occurred earlier than massive Bitcoin advances, relatively than alongside them. In previous cycles, gold energy has acted as an early sign, with Bitcoin following later as soon as danger urge for food returned.

ETF Inflows Spotlight Sturdy Gold Demand

Investor habits seems to help that thesis. Holdings within the largest bodily backed gold ETF, SPDR Gold Belief ($GLD), have risen to roughly 34.9 million troy ounces, the best stage since Could 2022. Since June 2024, holdings have elevated by round 8 million ounces, representing progress of roughly 30% in just some months.

Throughout the broader market, gold and precious-metal ETFs attracted greater than $4.3 billion in inflows in January alone, marking the eighth consecutive month of web shopping for. Gold miner ETFs additionally noticed sturdy curiosity, pulling in about $3.6 billion – the most important influx since no less than 2009.

Bitcoin Consolidates as Gold Absorbs Defensive Capital

The distinction between the 2 property is changing into more and more seen. Gold is benefiting from defensive positioning tied to inflation dangers, geopolitical tensions, and uncertainty round international financial coverage. Bitcoin, in the meantime, has struggled to reclaim momentum close to its highs, at the same time as long-term narratives round shortage and adoption stay intact.

For some analysts, this divergence just isn’t a warning signal however a well-known setup. If historic relationships repeat, sustained energy in gold might as soon as once more precede a renewed Bitcoin rally, relatively than sign a long-lasting shift away from digital property.

As gold continues to draw capital at a report tempo, Bitcoin’s consolidation under $70,000 might show much less an indication of weak spot and extra a pause earlier than the following part of the cycle.

The knowledge offered on this article is for instructional functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. Coindoo.com doesn’t endorse or suggest any particular funding technique or cryptocurrency. All the time conduct your personal analysis and seek the advice of with a licensed monetary advisor earlier than making any funding choices.