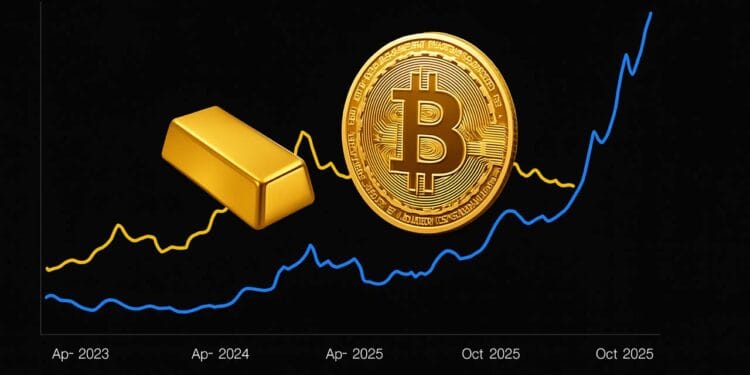

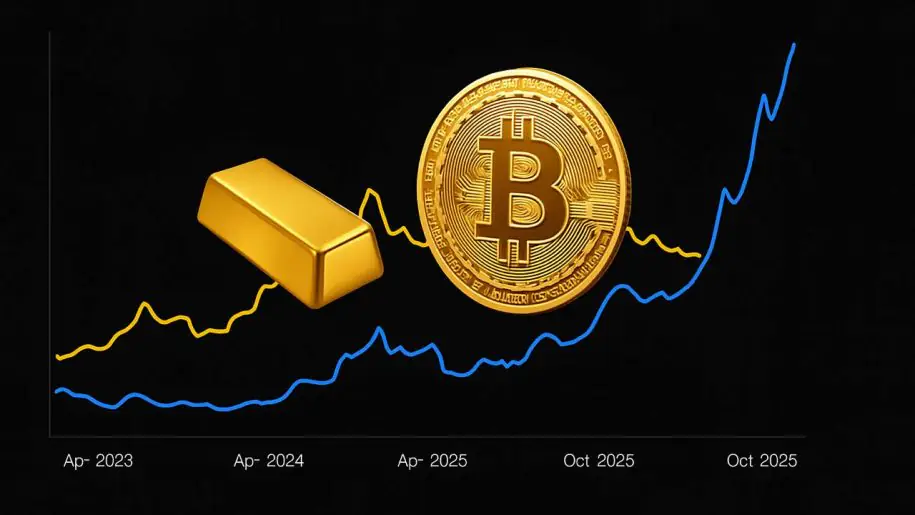

Gold and cryptocurrencies could typically rise collectively, however the similarities finish there, in response to Michael Cuggino, president and portfolio supervisor at Everlasting Portfolio Funds.

Talking in a latest interview with CNBC, Cuggino stated that regardless of earlier beliefs that Bitcoin may turn out to be a contemporary different to gold, the 2 property behave very in a different way and react to distinct macroeconomic forces.

Cuggino defined that cryptocurrencies have developed to reflect technology-sector dynamics moderately than the conduct of conventional safe-haven property. “At one level, I assumed Bitcoin and different digital property would possibly change gold,” he stated. “However now we see that they reply extra to liquidity cycles and speculative sentiment than to the identical long-term macro drivers that transfer gold.”

Based on him, Bitcoin’s comparatively brief buying and selling historical past — roughly 15 years — exhibits a constant correlation with tech indices such because the Nasdaq 100 (Triple Qs), notably in periods of unfastened financial coverage. When central banks inject liquidity and rates of interest fall, high-growth sectors and digital property are inclined to rise collectively. Conversely, when monetary situations tighten, each often expertise sharp drawdowns.

Gold’s Power Tied to World Uncertainty

Cuggino contrasted that sample with gold’s enduring stability as a long-cycle hedge. The metallic, he famous, tends to rally throughout occasions of financial stress, geopolitical danger, or financial tightening that threatens actual returns on conventional property.

“Gold’s present energy isn’t speculative,” he defined. “It’s grounded in fundamentals — from central financial institution shopping for to expectations of decrease actual rates of interest and continued geopolitical uncertainty. These are the identical forces which have pushed its worth for many years.”

Current months have seen renewed curiosity in gold as traders brace for the likelihood that the Federal Reserve may gradual and even reverse its rate-hiking cycle. With inflation nonetheless sticky and progress cooling in a number of main economies, many market contributors now anticipate a downward shift in coverage, a backdrop that has traditionally favored gold.

Bitcoin’s Position Nonetheless Evolving

Whereas Bitcoin has at occasions been dubbed “digital gold,” Cuggino believes it hasn’t but matured into that position. As a substitute, its conduct suggests it stays a danger asset, delicate to liquidity and investor sentiment. “It’s too early to attract long-term comparisons,” he stated. “Bitcoin has worth as a brand new type of know-how and digital retailer of worth, but it surely doesn’t have the identical historical past or macro logic that defines gold.”

Nonetheless, he acknowledged that each property can coexist inside trendy portfolios — gold as a retailer of worth throughout coverage uncertainty and Bitcoin as an innovation-driven asset that will profit from know-how adoption and capital rotation into digital finance.

“The important thing for traders,” Cuggino concluded, “is recognizing that whereas gold and crypto can each rise, they’re rising for fully totally different causes. Gold displays worry and safety; Bitcoin displays progress and hypothesis.”

The knowledge offered on this article is for academic functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. Coindoo.com doesn’t endorse or suggest any particular funding technique or cryptocurrency. All the time conduct your individual analysis and seek the advice of with a licensed monetary advisor earlier than making any funding selections.