As Bitcoin approaches more and more euphoric territory, the million-dollar query resurfaces of how can we precisely time the cycle’s peak? Most traders both exit too early or trip the market again down after failing to acknowledge when situations have shifted. However a deceptively easy device, the 200-week transferring common, might provide vital insights into Bitcoin value developments.

Bitcoin Value Baseline

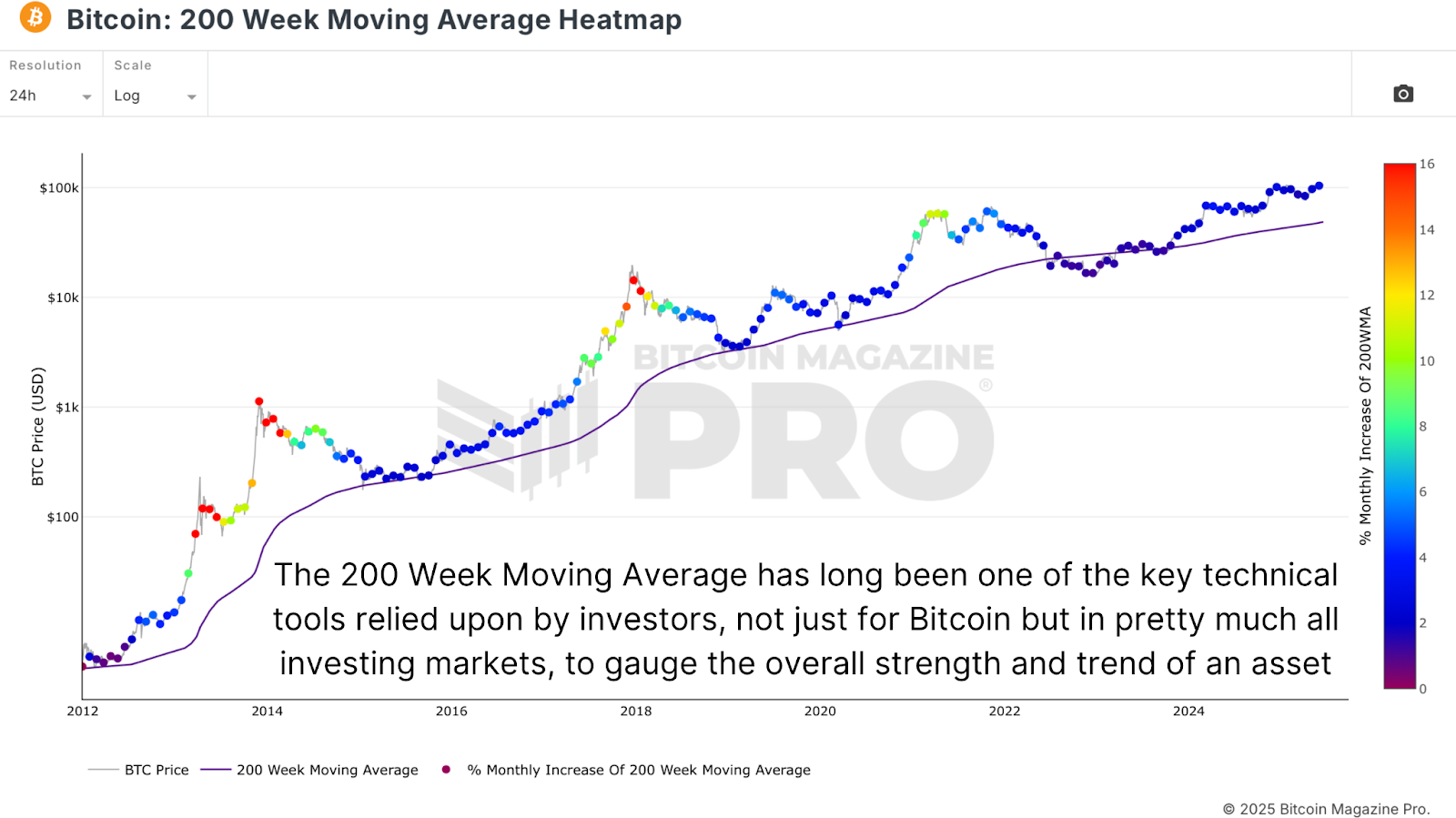

The 200 Week Transferring Common Heatmap has lengthy served as probably the most revered technical reference factors in Bitcoin evaluation. It smooths out noise by calculating the common closing value throughout the final 200 weekly candles, successfully monitoring Bitcoin’s long-term pattern. Traditionally, this transferring common has acted as highly effective help throughout bear markets, catching the underside in the course of the 2015, 2018, and 2022 drawdowns.

Extra not too long ago, Bitcoin dipped briefly beneath the 200WMA in the course of the depths of the 2022 bear market, however as value reclaimed this stage, it marked the transition again into bullish territory. Immediately, with Bitcoin effectively above this transferring common as soon as once more, many traders are watching how quickly the 200WMA is rising as an early warning sign for cycle peaks.

Whereas the 200WMA itself offers long-term context, analyzing its development price provides additional nuance. By measuring the month-to-month proportion enhance of the 200WMA itself, we are able to construct a easy warmth map overlay. Traditionally, when the 200WMA was rising at 14-16% annualized (the orange and purple zones), Bitcoin was usually close to its cycle peaks. Nonetheless, as Bitcoin’s market cap has grown and volatility has compressed, these extremes have moderated.

Within the present cycle, development charges have to this point topped out at round 5-6% (the blue and turquoise zones), with no main push into the yellow or inexperienced high-risk zones noticed in earlier bull runs. This means that whereas Bitcoin has rallied considerably, it has but to succeed in the type of parabolic section traditionally related to blow-off tops.

The Hidden Sample

Past warmth maps, a remarkably constant sample has emerged when the 200WMA surpasses its prior all-time excessive stage. Throughout a number of cycles, when this crossover happens, Bitcoin has both peaked or come extraordinarily near peaking in value. This consistency is stunning if it is a mere coincidence. Whereas no mannequin is ideal, the repetitive nature of this sign strongly suggests it deserves shut consideration as this cycle matures.

Given Bitcoin’s earlier all-time excessive of roughly $69,000, we are able to try and forecast when the 200WMA may subsequent cross this threshold based mostly on its present slope. Assuming a continuation of the common development price seen not too long ago, projections counsel this crossover may happen round Could or June 2026.

This could signify a major lengthening of the cycle in comparison with the 2017 and 2021 tops. If this 2026 situation performs out, it could mark Bitcoin’s first main break from the historic four-year halving cycle construction.

Diminishing Peaks

To refine the worth forecast additional, we are able to combine the Mayer A number of, which measures how far Bitcoin trades above its 200WMA. Traditionally, peaks have ranged as excessive as 15x throughout 2013’s mania, declining to 6x throughout 2021’s double-top. This downward pattern suggests diminishing returns as Bitcoin matures.

Plotting a trendline throughout the present cycle’s Mayer A number of highs implies a possible peak a number of of round 3.2 for this cycle. Making use of that a number of to a projected 200WMA stage of ~$70,000 by mid-2026 yields a theoretical value peak of roughly $220,000.

Whereas a $220,000 Bitcoin might sound aggressive to some, it’s much more cheap than most of the ultra-optimistic requires $500k and even $1M throughout this cycle. The capital inflows required to succeed in such excessive valuations would probably exceed what’s possible throughout the subsequent 12-24 months until we see unprecedented developments similar to nation-state adoption or speedy world reserve accumulation.

That stated, the mid-$200k vary would nonetheless signify an exceptional consequence for this cycle, one which accommodates each Bitcoin’s maturing market construction and its continued natural development trajectory.

Conclusion

The 200-week transferring common stays one in every of Bitcoin’s most traditionally dependable long-term indicators, providing not simply help throughout bear markets however probably signaling cycle peaks because it crosses earlier highs. Whereas the long run is inherently unsure, utilizing these trend-based metrics permits us to strategy Bitcoin value projections with a data-driven, probabilistic framework slightly than emotionally charged predictions.

If the present trajectory continues, we could also be taking a look at a Bitcoin peak round $220,000 someday in mid-2026, a situation that balances bullish optimism with real looking market development dynamics.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.