ASIC (Software-Particular Built-in Circuit) mining is extremely environment friendly for cryptocurrency mining however comes with a number of limitations.

One main disadvantage is the lack of versatility. ASICs are designed to carry out computations for a selected algorithm, comparable to SHA-256 for mining Bitcoin. This implies they can’t be repurposed for different duties or mining totally different algorithms with out vital {hardware} modifications. Not like GPUs, which can be utilized for varied functions like gaming or AI processing, ASIC miners have a single use case.

One other limitation is the excessive preliminary price. ASIC miners are considerably costlier in comparison with GPUs or CPUs. The upfront funding is commonly substantial, and extra prices comparable to cooling, infrastructure, and upkeep additional add to the expense. This generally is a barrier for small scale miners seeking to enter the business.

One other limitation of ASIC mining is the fast tempo at which know-how advances on this business. As newer, extra environment friendly ASIC miners are launched, older fashions shortly turn out to be outdated and fewer worthwhile. Which means that ASIC mining rigs have a restricted lifespan and should must be changed incessantly to stay aggressive out there.

Why Miners are Exploring Alternate options to ASICs

One of many major considerations is centralisation. ASIC mining is dominated by large-scale mining farms and some producers that produce the {hardware}. This centralisation goes towards the decentralised nature of cryptocurrencies and makes the community susceptible to manage by a number of entities. To take care of decentralisation, many miners are shifting to options like GPUs and FPGAs, that are extra extensively accessible.

ASIC mining can be identified for its excessive vitality consumption and environmental affect. These machines require vital quantities of electrical energy, resulting in excessive operational prices. With growing world considerations over vitality use and local weather change, in addition to regulatory scrutiny on vitality intensive mining, some miners are turning to extra vitality environment friendly options, comparable to GPU mining, which permits for better flexibility in vitality utilization.

One other benefit of options like GPUs and FPGAs is their better flexibility. Not like ASICs, that are designed for a single algorithm, GPUs and FPGAs could be tailored for various mining algorithms and even non-mining duties comparable to AI, gaming, and scientific computing. This adaptability permits miners to modify between cryptocurrencies primarily based on profitability with out the necessity to substitute their {hardware}.

How GPU Mining Works and Its Benefits

GPU (Graphics Processing Unit) mining entails utilizing graphics playing cards to unravel advanced mathematical issues required for verifying transactions on a blockchain community.

The mining course of begins with the GPU executing hash calculations. The GPU runs a mining algorithm to discover a legitimate hash. Miners then group transactions into blocks and validate them by fixing cryptographic puzzles. The primary miner to discover a legitimate answer is rewarded with cryptocurrency. This cycle repeats as miners try to unravel new blocks.

GPUs are properly fitted to mining as a result of they’ve 1000’s of cores optimised for parallel processing, making them a lot quicker at mining than CPUs. This parallel computing skill permits GPUs to course of giant quantities of information effectively, giving them a bonus in fixing cryptographic puzzles.

One of many largest benefits of GPU mining is versatility. Not like ASIC miners, that are designed for particular algorithms, GPUs can mine totally different cryptocurrencies. If one coin turns into unprofitable, miners can swap to a different with out having to switch their {hardware}.

One other key profit is price efficient entry. GPUs are typically extra inexpensive than ASIC miners and can be utilized for a number of functions, comparable to gaming, AI processing, and video rendering. This makes them funding even when mining turns into much less worthwhile over time.

Moreover, GPUs have higher longevity and resale worth. Not like ASIC miners, which shortly turn out to be out of date as new fashions are launched, GPUs can be utilized for different duties past mining. Even when mining profitability declines, GPUs could be resold or repurposed, making them a extra sustainable funding.

Finest Cryptocurrencies for GPU Mining in 2025

One of many prime cryptocurrencies for GPU mining in 2025 is Ethereum Basic (ETC). Ethereum Basic continues to make use of the Etchash algorithm, making it appropriate with GPU mining. As a continuation of the unique Ethereum blockchain, it affords GPU miners a possibility to contribute to a platform supporting decentralized functions and good contracts. With Ethereum’s shift to Proof of Stake, Ethereum Basic has attracted miners in search of options.

Ravencoin (RVN) is a blockchain platform targeted on the creation and switch of property. It employs an KAWPOW algorithm, which is optimised for GPU mining and resists ASIC dominance. This ensures that GPU miners can compete pretty, sustaining the community’s decentralisation and safety. Ravencoin’s robust group assist and common community upgrades make it a gorgeous selection for miners.

Monero (XMR)is famend for its robust emphasis on privateness and decentralisation. Monero is designed to be ASIC-resistant, making it a super selection for GPU miners. This resistance to specialised mining {hardware} helps preserve a decentralised community by permitting people with shopper grade {hardware} to take part successfully. Monero’s concentrate on privateness and anonymity has made it a preferred selection for people seeking to preserve their transactions confidential, making it a doubtlessly profitable possibility for GPU miners.

Efficiency and Profitability of GPUs vs ASICS

ASIC miners are goal constructed machines designed to carry out a single mining algorithm with most effectivity. Due to this, they ship considerably greater hash charges in comparison with GPUs whereas consuming much less energy. For instance, an ASIC designed for Bitcoin mining can generate terahashes per second (TH/s), whereas a GPU sometimes operates within the megahash per second (MH/s) vary for cash like Ethereum Basic or Ravencoin. This immense processing energy makes ASICs the most suitable choice for mining cryptocurrencies that permit their use.

GPUs, then again, are extra versatile and versatile. Whereas they can not match the uncooked energy of ASICs for particular algorithms, they’ll mine a number of cryptocurrencies by switching between totally different mining algorithms. This flexibility permits miners to adapt to market modifications and mine probably the most worthwhile coin at any given time. Moreover, GPUs could be repurposed for different duties, comparable to gaming, AI processing, or video rendering, which provides to their long run usability.

ASIC miners typically supply greater profitability for mining cryptocurrencies like Bitcoin because of their superior effectivity and decrease price per hash. Nonetheless, their profitability relies upon closely on electrical energy prices and mining issue. Since ASICs eat a big quantity of energy, miners with entry to low-cost electrical energy profit probably the most. Moreover, ASIC miners have a restricted lifespan, as newer, extra environment friendly fashions are incessantly launched, making older variations out of date quicker.

GPUs, whereas much less environment friendly in uncooked energy, present better adaptability and resale worth. If mining turns into unprofitable, GPUs can nonetheless be used for different functions or bought to avid gamers, builders, or AI researchers. Furthermore, some cryptocurrencies are designed to be ASIC resistant, that means that GPU miners have a extra stage taking part in discipline and might stay aggressive in mining these cash. The decrease upfront funding required for GPU mining additionally makes it a extra accessible possibility for hobbyists and small scale miners.

FPGA Mining: The Stability Between Effectivity and Customisation

FPGA (Discipline-Programmable Gate Array) mining is gaining consideration as a middle-ground answer between GPU and ASIC mining. It affords a novel steadiness of effectivity and suppleness, making it a gorgeous possibility for miners seeking to optimize their operations with out the inflexible limitations of ASICs or the decrease effectivity of GPUs.

FPGAs are extra energy environment friendly than GPUs and might obtain hash charges corresponding to ASICs whereas consuming considerably much less electrical energy. Not like GPUs, that are designed for a variety of computational duties, FPGAs could be programmed to execute particular mining algorithms with optimised efficiency. This effectivity makes FPGA mining a viable selection for miners seeking to cut back vitality prices whereas sustaining aggressive mining energy.

Whereas not as specialised as ASICs, FPGAs outperform GPUs when it comes to uncooked mining effectivity for a lot of algorithms. For instance, an FPGA could be configured to mine low energy, much less aggressive cash effectively, making them excellent for area of interest cryptocurrencies that aren’t but dominated by ASIC miners.

One of many largest benefits of FPGA mining is its programmability. Not like ASICs, that are designed for a single algorithm and turn out to be out of date if the algorithm modifications, FPGAs could be reprogrammed to assist totally different mining algorithms. This permits miners to adapt to market fluctuations, switching between totally different cash primarily based on profitability.

FPGAs additionally allow customized firmware growth, permitting superior customers to fine-tune efficiency parameters and optimise energy consumption. This stage of customisation offers a big benefit over each GPUs and ASICs, notably for miners who’ve the technical experience to change {hardware} configurations.

Challenges and Obstacles to FPGA Adoption in Mining

FPGAs exist in a center floor between GPUs and ASICs, however this positioning generally is a drawback. On one hand, GPUs supply better flexibility and ease of use, making them the popular selection for multi-algorithm mining. Then again, ASIC miners ship greater effectivity and are the go to selection for main proof-of-work cryptocurrencies like Bitcoin. This squeezes FPGA adoption into area of interest markets, limiting its attraction to a small section of superior miners.

Whereas FPGAs are extra energy environment friendly than GPUs, they nonetheless fall in need of ASIC miners when it comes to uncooked efficiency per watt. ASICs are designed for most effectivity on a single algorithm, whereas FPGAs, regardless of being customisable, might not all the time match ASICs when it comes to hash price and vitality consumption. Which means that for extremely aggressive cash, ASICs typically stay the dominant selection, leaving FPGAs with a narrower vary of worthwhile mining choices.

FPGA mining {hardware} is commonly costlier than GPUs. The demand for FPGAs in different industries, comparable to AI, telecommunications, and information centres, additional limits availability and drives up prices. Not like ASIC miners, that are mass produced for particular algorithms, FPGA {hardware} shouldn’t be particularly manufactured for cryptocurrency mining, making sourcing troublesome and expensive.

Benefits of FPGA Mining for Area of interest Algorithms

Many area of interest cryptocurrencies implement ASIC resistant algorithms to take care of a good and decentralised mining ecosystem. Since ASIC producers prioritize growing miners for main cryptocurrencies like Bitcoin, smaller cash stay unoptimised for ASIC mining. FPGAs present a super different, as they’ll effectively mine these ASIC resistant algorithms whereas avoiding the obsoleteness related to ASIC miners.

FPGAs could be programmed to run customized mining algorithms with greater effectivity than GPUs. Whereas GPUs are designed for common computational duties, FPGAs permit miners to optimize {hardware} stage execution for particular algorithms. This leads to greater hash charges and decrease energy consumptioncompared to GPUs, making them less expensive for area of interest cryptocurrencies that lack ASIC competitors.

Challenges and Obstacles to FPGA Adoption in Mining

One of many major challenges is the excessive preliminary price. FPGAs are typically costlier than GPUs or ASICs, each when it comes to {hardware} and growth bills. Specialised FPGA boards optimised for mining could be expensive, particularly for small scale miners who might not have the capital to spend money on excessive finish {hardware}.

The complexity of programming and configuring FPGAs is one other problem that mining corporations face when contemplating adoption. FPGA programming requires specialised expertise and experience, and there’s a scarcity of pros with these capabilities within the mining business. This makes it troublesome for mining corporations to successfully implement FPGAs of their operations.

One other barrier to FPGA adoption in mining is the shortage of standardisation and compatibility of FPGA know-how with current mining methods and tools. Many mining corporations have already got established methods and processes in place, and integrating FPGAs into these methods could be difficult and time consuming. This could deter mining corporations from exploring the potential advantages of utilizing FPGAs.

Rising Mining {Hardware}: The Future Past ASICs

Warmth administration is a significant problem in crypto mining, particularly for big scale operations. Immersion cooling, the place mining rigs are submerged in non-conductive cooling fluids, is gaining popularity because it considerably reduces warmth construct up, extends {hardware} lifespan, and lowers vitality prices. AI pushed cooling methods are additionally being developed to optimise temperature management in mining farms.

With rising considerations over the environmental affect of crypto mining, many operations are shifting in direction of renewable vitality sources like photo voltaic, wind, hydro, and geothermal energy. Mining corporations are additionally experimenting with vitality environment friendly setups, comparable to utilizing extra warmth from mining rigs for industrial or residential heating. Improvements in battery storage and grid balancing options are serving to miners cut back dependence on conventional energy grids.

Quantum computing continues to be in its early phases, however it presents each alternatives and threats to crypto mining. If quantum computer systems attain a degree the place they’ll break conventional cryptographic algorithms, it might disrupt Proof-of-Work (PoW) mining. Nonetheless, quantum resistant cryptographic algorithms are being developed to counteract this danger. Some corporations are additionally exploring using quantum computing to optimise mining algorithms and enhance effectivity.

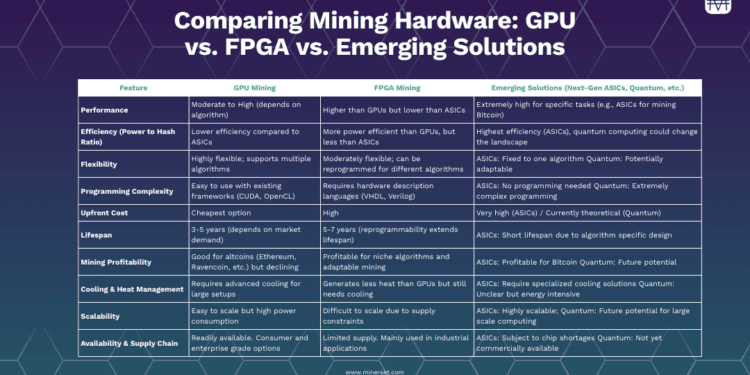

Evaluating Mining {Hardware}: GPU vs. FPGA vs. Rising Options

Ought to You Diversify Your Mining Setup?

One of many major benefits of diversifying your setup is that it permits you to mine a number of cryptocurrencies concurrently, growing your probabilities of discovering worthwhile blocks. Diversifying your mining setup might help unfold the danger of investing in a single coin which will expertise a sudden drop in worth. By mining a number of cryptocurrencies, you’ll be able to hedge your bets and doubtlessly profit from the expansion of various cash over time.

Nonetheless, diversifying your mining setup additionally comes with its personal set of challenges. Managing a number of mining operations could be advanced and time consuming, particularly for newcomers. It requires extra assets comparable to a number of mining rigs, extra energy consumption, and doubtlessly greater working prices.

ASIC (Software-Particular Built-in Circuit) mining is extremely environment friendly for cryptocurrency mining however comes with a number of limitations.

One main disadvantage is the lack of versatility. ASICs are designed to carry out computations for a selected algorithm, comparable to SHA-256 for mining Bitcoin. This implies they can’t be repurposed for different duties or mining totally different algorithms with out vital {hardware} modifications. Not like GPUs, which can be utilized for varied functions like gaming or AI processing, ASIC miners have a single use case.

One other limitation is the excessive preliminary price. ASIC miners are considerably costlier in comparison with GPUs or CPUs. The upfront funding is commonly substantial, and extra prices comparable to cooling, infrastructure, and upkeep additional add to the expense. This generally is a barrier for small scale miners seeking to enter the business.

One other limitation of ASIC mining is the fast tempo at which know-how advances on this business. As newer, extra environment friendly ASIC miners are launched, older fashions shortly turn out to be outdated and fewer worthwhile. Which means that ASIC mining rigs have a restricted lifespan and should must be changed incessantly to stay aggressive out there.

Why Miners are Exploring Alternate options to ASICs

One of many major considerations is centralisation. ASIC mining is dominated by large-scale mining farms and some producers that produce the {hardware}. This centralisation goes towards the decentralised nature of cryptocurrencies and makes the community susceptible to manage by a number of entities. To take care of decentralisation, many miners are shifting to options like GPUs and FPGAs, that are extra extensively accessible.

ASIC mining can be identified for its excessive vitality consumption and environmental affect. These machines require vital quantities of electrical energy, resulting in excessive operational prices. With growing world considerations over vitality use and local weather change, in addition to regulatory scrutiny on vitality intensive mining, some miners are turning to extra vitality environment friendly options, comparable to GPU mining, which permits for better flexibility in vitality utilization.

One other benefit of options like GPUs and FPGAs is their better flexibility. Not like ASICs, that are designed for a single algorithm, GPUs and FPGAs could be tailored for various mining algorithms and even non-mining duties comparable to AI, gaming, and scientific computing. This adaptability permits miners to modify between cryptocurrencies primarily based on profitability with out the necessity to substitute their {hardware}.

How GPU Mining Works and Its Benefits

GPU (Graphics Processing Unit) mining entails utilizing graphics playing cards to unravel advanced mathematical issues required for verifying transactions on a blockchain community.

The mining course of begins with the GPU executing hash calculations. The GPU runs a mining algorithm to discover a legitimate hash. Miners then group transactions into blocks and validate them by fixing cryptographic puzzles. The primary miner to discover a legitimate answer is rewarded with cryptocurrency. This cycle repeats as miners try to unravel new blocks.

GPUs are properly fitted to mining as a result of they’ve 1000’s of cores optimised for parallel processing, making them a lot quicker at mining than CPUs. This parallel computing skill permits GPUs to course of giant quantities of information effectively, giving them a bonus in fixing cryptographic puzzles.

One of many largest benefits of GPU mining is versatility. Not like ASIC miners, that are designed for particular algorithms, GPUs can mine totally different cryptocurrencies. If one coin turns into unprofitable, miners can swap to a different with out having to switch their {hardware}.

One other key profit is price efficient entry. GPUs are typically extra inexpensive than ASIC miners and can be utilized for a number of functions, comparable to gaming, AI processing, and video rendering. This makes them funding even when mining turns into much less worthwhile over time.

Moreover, GPUs have higher longevity and resale worth. Not like ASIC miners, which shortly turn out to be out of date as new fashions are launched, GPUs can be utilized for different duties past mining. Even when mining profitability declines, GPUs could be resold or repurposed, making them a extra sustainable funding.

Finest Cryptocurrencies for GPU Mining in 2025

One of many prime cryptocurrencies for GPU mining in 2025 is Ethereum Basic (ETC). Ethereum Basic continues to make use of the Etchash algorithm, making it appropriate with GPU mining. As a continuation of the unique Ethereum blockchain, it affords GPU miners a possibility to contribute to a platform supporting decentralized functions and good contracts. With Ethereum’s shift to Proof of Stake, Ethereum Basic has attracted miners in search of options.

Ravencoin (RVN) is a blockchain platform targeted on the creation and switch of property. It employs an KAWPOW algorithm, which is optimised for GPU mining and resists ASIC dominance. This ensures that GPU miners can compete pretty, sustaining the community’s decentralisation and safety. Ravencoin’s robust group assist and common community upgrades make it a gorgeous selection for miners.

Monero (XMR)is famend for its robust emphasis on privateness and decentralisation. Monero is designed to be ASIC-resistant, making it a super selection for GPU miners. This resistance to specialised mining {hardware} helps preserve a decentralised community by permitting people with shopper grade {hardware} to take part successfully. Monero’s concentrate on privateness and anonymity has made it a preferred selection for people seeking to preserve their transactions confidential, making it a doubtlessly profitable possibility for GPU miners.

Efficiency and Profitability of GPUs vs ASICS

ASIC miners are goal constructed machines designed to carry out a single mining algorithm with most effectivity. Due to this, they ship considerably greater hash charges in comparison with GPUs whereas consuming much less energy. For instance, an ASIC designed for Bitcoin mining can generate terahashes per second (TH/s), whereas a GPU sometimes operates within the megahash per second (MH/s) vary for cash like Ethereum Basic or Ravencoin. This immense processing energy makes ASICs the most suitable choice for mining cryptocurrencies that permit their use.

GPUs, then again, are extra versatile and versatile. Whereas they can not match the uncooked energy of ASICs for particular algorithms, they’ll mine a number of cryptocurrencies by switching between totally different mining algorithms. This flexibility permits miners to adapt to market modifications and mine probably the most worthwhile coin at any given time. Moreover, GPUs could be repurposed for different duties, comparable to gaming, AI processing, or video rendering, which provides to their long run usability.

ASIC miners typically supply greater profitability for mining cryptocurrencies like Bitcoin because of their superior effectivity and decrease price per hash. Nonetheless, their profitability relies upon closely on electrical energy prices and mining issue. Since ASICs eat a big quantity of energy, miners with entry to low-cost electrical energy profit probably the most. Moreover, ASIC miners have a restricted lifespan, as newer, extra environment friendly fashions are incessantly launched, making older variations out of date quicker.

GPUs, whereas much less environment friendly in uncooked energy, present better adaptability and resale worth. If mining turns into unprofitable, GPUs can nonetheless be used for different functions or bought to avid gamers, builders, or AI researchers. Furthermore, some cryptocurrencies are designed to be ASIC resistant, that means that GPU miners have a extra stage taking part in discipline and might stay aggressive in mining these cash. The decrease upfront funding required for GPU mining additionally makes it a extra accessible possibility for hobbyists and small scale miners.

FPGA Mining: The Stability Between Effectivity and Customisation

FPGA (Discipline-Programmable Gate Array) mining is gaining consideration as a middle-ground answer between GPU and ASIC mining. It affords a novel steadiness of effectivity and suppleness, making it a gorgeous possibility for miners seeking to optimize their operations with out the inflexible limitations of ASICs or the decrease effectivity of GPUs.

FPGAs are extra energy environment friendly than GPUs and might obtain hash charges corresponding to ASICs whereas consuming considerably much less electrical energy. Not like GPUs, that are designed for a variety of computational duties, FPGAs could be programmed to execute particular mining algorithms with optimised efficiency. This effectivity makes FPGA mining a viable selection for miners seeking to cut back vitality prices whereas sustaining aggressive mining energy.

Whereas not as specialised as ASICs, FPGAs outperform GPUs when it comes to uncooked mining effectivity for a lot of algorithms. For instance, an FPGA could be configured to mine low energy, much less aggressive cash effectively, making them excellent for area of interest cryptocurrencies that aren’t but dominated by ASIC miners.

One of many largest benefits of FPGA mining is its programmability. Not like ASICs, that are designed for a single algorithm and turn out to be out of date if the algorithm modifications, FPGAs could be reprogrammed to assist totally different mining algorithms. This permits miners to adapt to market fluctuations, switching between totally different cash primarily based on profitability.

FPGAs additionally allow customized firmware growth, permitting superior customers to fine-tune efficiency parameters and optimise energy consumption. This stage of customisation offers a big benefit over each GPUs and ASICs, notably for miners who’ve the technical experience to change {hardware} configurations.

Challenges and Obstacles to FPGA Adoption in Mining

FPGAs exist in a center floor between GPUs and ASICs, however this positioning generally is a drawback. On one hand, GPUs supply better flexibility and ease of use, making them the popular selection for multi-algorithm mining. Then again, ASIC miners ship greater effectivity and are the go to selection for main proof-of-work cryptocurrencies like Bitcoin. This squeezes FPGA adoption into area of interest markets, limiting its attraction to a small section of superior miners.

Whereas FPGAs are extra energy environment friendly than GPUs, they nonetheless fall in need of ASIC miners when it comes to uncooked efficiency per watt. ASICs are designed for most effectivity on a single algorithm, whereas FPGAs, regardless of being customisable, might not all the time match ASICs when it comes to hash price and vitality consumption. Which means that for extremely aggressive cash, ASICs typically stay the dominant selection, leaving FPGAs with a narrower vary of worthwhile mining choices.

FPGA mining {hardware} is commonly costlier than GPUs. The demand for FPGAs in different industries, comparable to AI, telecommunications, and information centres, additional limits availability and drives up prices. Not like ASIC miners, that are mass produced for particular algorithms, FPGA {hardware} shouldn’t be particularly manufactured for cryptocurrency mining, making sourcing troublesome and expensive.

Benefits of FPGA Mining for Area of interest Algorithms

Many area of interest cryptocurrencies implement ASIC resistant algorithms to take care of a good and decentralised mining ecosystem. Since ASIC producers prioritize growing miners for main cryptocurrencies like Bitcoin, smaller cash stay unoptimised for ASIC mining. FPGAs present a super different, as they’ll effectively mine these ASIC resistant algorithms whereas avoiding the obsoleteness related to ASIC miners.

FPGAs could be programmed to run customized mining algorithms with greater effectivity than GPUs. Whereas GPUs are designed for common computational duties, FPGAs permit miners to optimize {hardware} stage execution for particular algorithms. This leads to greater hash charges and decrease energy consumptioncompared to GPUs, making them less expensive for area of interest cryptocurrencies that lack ASIC competitors.

Challenges and Obstacles to FPGA Adoption in Mining

One of many major challenges is the excessive preliminary price. FPGAs are typically costlier than GPUs or ASICs, each when it comes to {hardware} and growth bills. Specialised FPGA boards optimised for mining could be expensive, particularly for small scale miners who might not have the capital to spend money on excessive finish {hardware}.

The complexity of programming and configuring FPGAs is one other problem that mining corporations face when contemplating adoption. FPGA programming requires specialised expertise and experience, and there’s a scarcity of pros with these capabilities within the mining business. This makes it troublesome for mining corporations to successfully implement FPGAs of their operations.

One other barrier to FPGA adoption in mining is the shortage of standardisation and compatibility of FPGA know-how with current mining methods and tools. Many mining corporations have already got established methods and processes in place, and integrating FPGAs into these methods could be difficult and time consuming. This could deter mining corporations from exploring the potential advantages of utilizing FPGAs.

Rising Mining {Hardware}: The Future Past ASICs

Warmth administration is a significant problem in crypto mining, particularly for big scale operations. Immersion cooling, the place mining rigs are submerged in non-conductive cooling fluids, is gaining popularity because it considerably reduces warmth construct up, extends {hardware} lifespan, and lowers vitality prices. AI pushed cooling methods are additionally being developed to optimise temperature management in mining farms.

With rising considerations over the environmental affect of crypto mining, many operations are shifting in direction of renewable vitality sources like photo voltaic, wind, hydro, and geothermal energy. Mining corporations are additionally experimenting with vitality environment friendly setups, comparable to utilizing extra warmth from mining rigs for industrial or residential heating. Improvements in battery storage and grid balancing options are serving to miners cut back dependence on conventional energy grids.

Quantum computing continues to be in its early phases, however it presents each alternatives and threats to crypto mining. If quantum computer systems attain a degree the place they’ll break conventional cryptographic algorithms, it might disrupt Proof-of-Work (PoW) mining. Nonetheless, quantum resistant cryptographic algorithms are being developed to counteract this danger. Some corporations are additionally exploring using quantum computing to optimise mining algorithms and enhance effectivity.

Evaluating Mining {Hardware}: GPU vs. FPGA vs. Rising Options

Ought to You Diversify Your Mining Setup?

One of many major benefits of diversifying your setup is that it permits you to mine a number of cryptocurrencies concurrently, growing your probabilities of discovering worthwhile blocks. Diversifying your mining setup might help unfold the danger of investing in a single coin which will expertise a sudden drop in worth. By mining a number of cryptocurrencies, you’ll be able to hedge your bets and doubtlessly profit from the expansion of various cash over time.

Nonetheless, diversifying your mining setup additionally comes with its personal set of challenges. Managing a number of mining operations could be advanced and time consuming, particularly for newcomers. It requires extra assets comparable to a number of mining rigs, extra energy consumption, and doubtlessly greater working prices.