Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value climbed 3% within the final 24 hours to commerce at $3,857.27 as of 1 a.m. EST on an 8% drop in buying and selling quantity to $35.91 billion.

The ETH value rise comes as sentiment within the crypto market recovers a tad, with the Crypto Concern & Greed Index ticking as much as a ”concern” studying of 33 from 29 a day earlier.

Day by day buying and selling quantity stays robust, and key technical indicators are starting to tilt constructive.

The market feels dangerous proper now.

Bitcoin is dumping, liquidity is skinny, and there are actually no consumers.

However underneath the floor, one thing necessary is occurring on Ethereum.

On chain exercise throughout seventy six main Ethereum primarily based tokens simply hit a brand new all time excessive with… pic.twitter.com/rr056Ob6MI

— BitBull (@AkaBull_) October 31, 2025

Trade watchers notice that Ethereum is outperforming some friends as consumers step in round crucial help ranges, with ETH exhibiting indicators it may maintain its rebound

Coin Worth Resilience: ETH Worth Holds Above Key Ranges

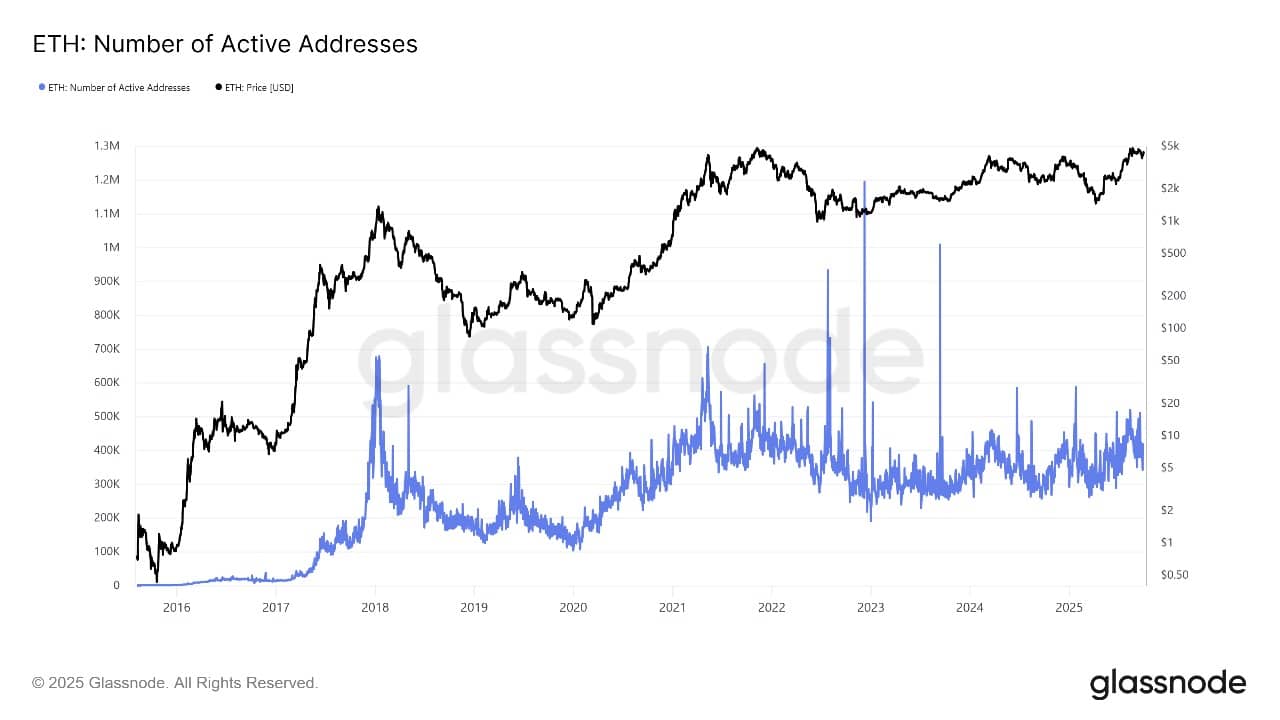

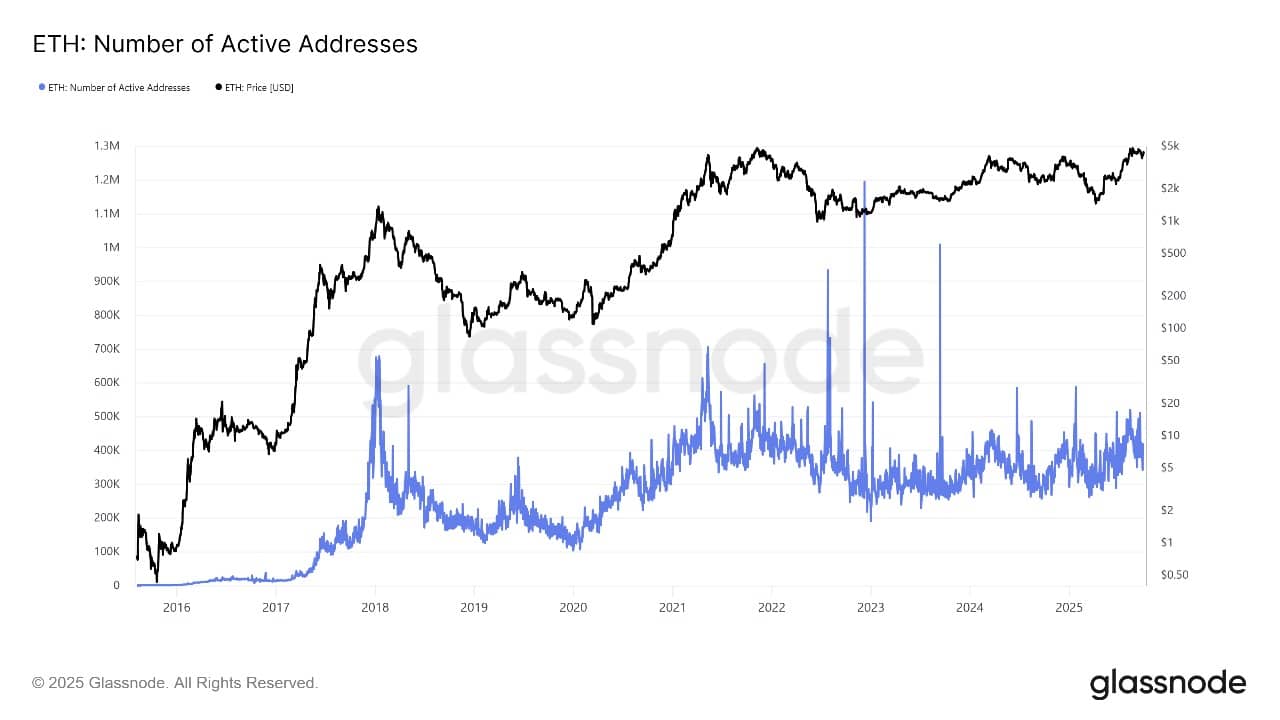

On-chain exercise displays the constructive vibe. Transaction counts and exercise throughout Ethereum dApps are booming, bringing renewed confidence to long-term holders and signaling wholesome community utilization. Extra wallets are energetic.

The ETH value grew to become a focus for merchants in November, as on-chain exercise on the Ethereum community hit all-time highs. Latest knowledge from analytics corporations like Santiment and CryptoOnChain exhibits Ethereum’s blockchain hosts the deepest stage of developer and consumer engagement ever recorded.

ETH Energetic Addresses Supply: Glassnode

In current weeks, institutional inflows have began choosing up once more. Giant funds are rotating capital into Ethereum, making use of decrease costs and constructive developments from new DeFi and NFT initiatives constructing on the community. Ethereum staking participation additionally stays excessive, which limits provide on exchanges and helps increased costs when new demand arrives.

With Blockchain upgrades nonetheless on observe and main corporations exploring Ethereum for tokenised finance, the outlook stays upbeat for the ETH value. Bulls are watching intently to see if the present uptrend can outlast ongoing regulatory debates in key markets. To this point, the pattern suggests buyers stay optimistic.

ETH Worth Technical Evaluation: Uptrend Awaits Breakout

Technical evaluation of the ETH value exhibits that the coin is attempting to interrupt above its 50-day easy transferring common (SMA) of $4,180.90 however stays above key help on the 200-day SMA of $3,341.15, as proven within the chart.

The relative power index (RSI) sits at 43.13, signaling that ETH is neither overbought nor oversold, which suggests there’s room for extra upside motion earlier than any robust correction is probably going.

ETH has been largely range-bound between $3,700 and $4,180, with the 38.2% Fibonacci retracement at $3,852 appearing as an necessary pivot. If ETH can maintain above this stage, the subsequent resistance sits close to $4,108 after which $4,180.

ETHUSD Evaluation Supply: Tradingview

A profitable break may see ETH push in direction of the psychological $4,500 stage and maybe even problem the yearly excessive round $4,952 if momentum gathers tempo.

On the draw back, if sellers take management, ETH may slide again to $3,341 (200-day SMA) or fall additional to the 61.8% Fibonacci retracement at $2,743, which might check investor endurance and certain usher in new dip consumers. The common directional index (ADX) worth at 19.10 indicators that the pattern remains to be forming however not but robust, so market path may shift rapidly.

Based mostly on market fashions and forecasts, ETH value may even see an 11–19% improve via the remainder of November, with typical goal ranges transferring in direction of $4,250 and presumably extending to $4,595 if bullish indicators persist.

Predictive fashions recommend that whereas sentiment began the month cautious, enhancing fundamentals and technicals make additional good points more and more possible.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection