Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has surged greater than 4% within the final 24 hours to commerce at $4,594 as of 5 a.m. EST on a 15.8% drop within the every day buying and selling quantity to $50.85 billion.

This comes as a Normal Chartered report stated ETH and Ethereum treasury companies stay undervalued even after a 76% surge prior to now yr.

World head of digital property analysis, Geoffrey Kendrick, maintained his worth goal of $7,500 by the top of the yr, serving to increase market sentiment.

STANDARD CHARTERED: $ETH is at an ideal entry level, ought to hit $7,500 by finish of 2025

This is what they stated:

– ETH pullback = nice entry level

– $7,500 yr finish goal for 2025

– Treasury firms + ETFs have already scooped up ~5% of all ETH since June

– Ethereum ETFs are… pic.twitter.com/95LofTKmni— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) August 26, 2025

The report stated Ethereum is the primary platform for sensible contracts and DeFi, and Kendrick stated utility and safety will hold driving demand, particularly as extra ETH treasury startups snap up the largest altcoin.

🚨 ETHEREUM’S DIP IS A SIGNAL, NOT A SETBACK

Normal Chartered sees Ethereum and ETH treasury companies as undervalued, regardless of current inflows and a contemporary all-time excessive of $4,955. Geoffrey Kendrick tasks ETH to achieve $7,500 by year-end, calling the present dip a uncommon entry… pic.twitter.com/Nvlvr0Kkom

— The Tradesman (@The_Tradesman1) August 27, 2025

Ethereum Value: On-chain Metrics Sign Rising Power

The newest on-chain knowledge provides extra constructive indicators for the Ethereum worth. One clear pattern: giant quantities of ETH are being withdrawn from exchanges as buyers transfer cash into non-public wallets or staking.

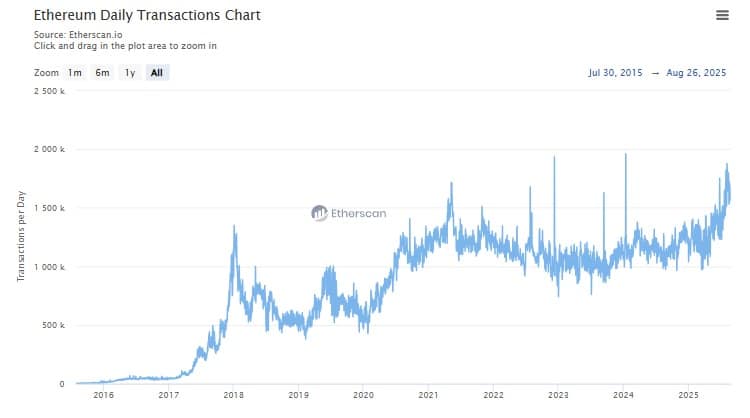

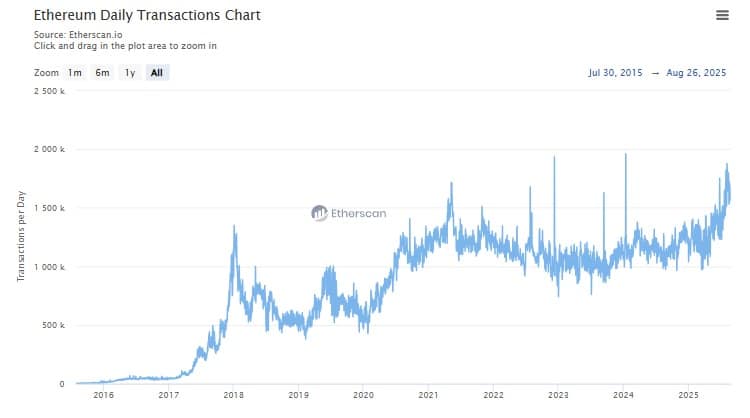

ETH Every day Transactions Evaluation Supply: Etherscan

This “outflow” is a bullish sign, suggesting holders need to lock up property long-term, lowering the provision accessible for buying and selling and supporting future upside potential. Ethereum’s community exercise stays wholesome, with regular progress in every day lively addresses, plus rising transactions because of DeFi and NFT buying and selling.

New whales are additionally accumulating ETH. Metrics from analytics companies present an uptick in pockets balances for each prime funds and key DeFi protocols. ETH held on exchanges is at its lowest stage in months, displaying persons are taking cash off platforms to carry or use in protocols.

This motion, mixed with excessive spot buying and selling volumes, suggests the current worth surge is backed by actual demand, not simply hypothesis

Ethereum Value: New All-Time Highs In Sight?

The ETHUSD weekly chart exhibits the worth is at $4,604, simply beneath the $4,937 resistance, which acted because the final all-time excessive. The coin worth just lately broke out above the essential 50-week SMA ($2,868) and 200-week SMA ($2,448), displaying sturdy momentum after months of sideways motion.

Pattern indicators level to a strong uptrend. The RSI reads 70.61, approaching overbought however not but flashing warning indicators. MACD is deep in bullish territory, with the primary line at 247.87 and the sign line at 275.76. Histograms are constructive, and momentum stays sturdy.

ETHUSD Evaluation. Supply: Tradingview

ADX sits at 28.92, indicating that the uptrend is established and prone to proceed, at the least within the brief time period. In the meantime, the support ranges lie at $4,000 and each the 50- and 200-period shifting averages.

If ETH retreats, these are prone to entice consumers. Main resistance is on the $4,937–$5,000 space. Ought to the ETH worth break this zone, chart projections level to the following targets close to $5,800 and even $6,200, based mostly on the dimensions of the breakout and Fibonacci extensions.

If the coin worth fails to carry $4,600 and momentum stalls, deeper assist is round $4,000. Nonetheless, the present setup stays bullish so long as ETH holds above this band. The upward-sloping shifting averages and robust technicals hold the longer-term pattern constructive.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection