Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

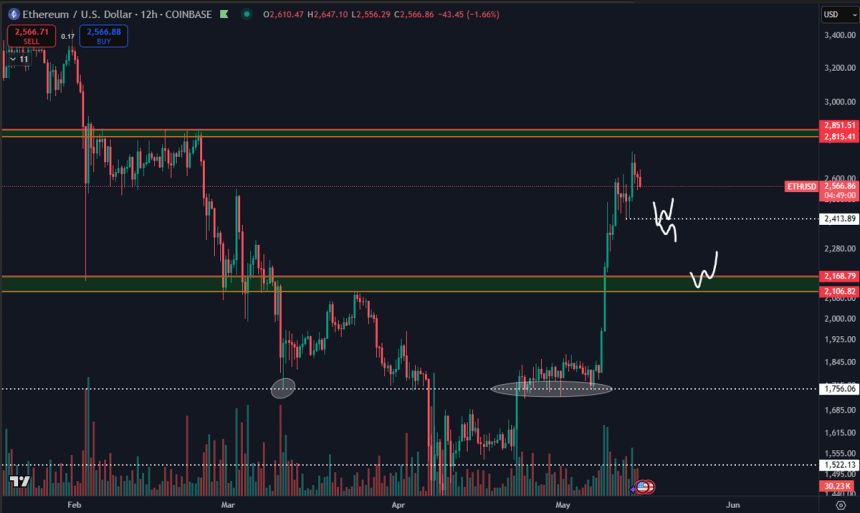

After a number of days of intense shopping for strain and powerful bullish momentum, Ethereum has lastly paused its rally, discovering resistance across the $2,740 mark. The transfer comes after ETH effortlessly cleared key resistance ranges at $2,000 and $2,200, marking considered one of its strongest short-term performances in months. As pleasure builds throughout the broader crypto market, Ethereum’s subsequent transfer may outline the power and sustainability of this breakout.

Associated Studying

With worth now stalling, analysts imagine a interval of consolidation is probably going—and maybe even vital—earlier than the subsequent leg greater. High analyst Daan shared a technical view suggesting that the $2,400 degree might be essential within the coming days. He believes it is smart to retest that native help, which would offer a more healthy construction for additional upside.

Nevertheless, Daan additionally notes a cautionary sign: extraordinarily excessive ranges of Open Curiosity throughout the ETH derivatives market. He’s presently avoiding lengthy positions till a few of that leverage is flushed out, lowering the danger of a sharper pullback. For now, Ethereum bulls should maintain above $2,400 to verify power and hold the uptrend intact, whereas merchants await cleaner situations for potential reentry.

Ethereum’s Surge Faces a Essential Retest Round $2.4K

Ethereum has surged greater than 50% since final week, reclaiming momentum after months of heavy promoting strain. ETH is displaying sustained power for the primary time since late December, fueling optimism that the broader altcoin market might be subsequent. Many analysts are calling for an altseason, and Ethereum’s breakout is seen as a possible catalyst for a bigger transfer throughout altcoins which have severely underperformed in recent times.

Nevertheless, after such a pointy transfer, a interval of consolidation or correction wouldn’t be uncommon—and will even be wholesome. In accordance with Daan, the $2,400 degree might be a key help zone to observe. He believes it is smart for worth to check this space earlier than additional continuation. Daan presently has no real interest in coming into lengthy positions till among the billions in Open Curiosity are flushed from the system. How Ethereum reacts round $2.4K will seemingly set the tone for the subsequent part.

If ETH sweeps $2.4K and shortly bounces, Daan expects a neighborhood vary to type between $2.4K and $2.7K. Nevertheless, if worth loses that degree decisively, the subsequent main help lies at $2.1K. A gradual bleed into that zone may sign weak spot, whereas a fast flush may current a short-lived shopping for alternative.

Regardless of short-term dangers, Daan notes that even a pullback to $2.1K would nonetheless depart ETH up roughly 20% from the prior week. In his view, the bigger buying and selling vary for now could be between $2.1K and $2.8K—a zone that would outline Ethereum’s subsequent main development if bulls can maintain key ranges and regain momentum. For now, the rally is alive, however the subsequent check might be vital.

Associated Studying

Value Consolidation Taking Place Amid Optimism

Ethereum (ETH) is presently buying and selling round $2,565, following a pointy retracement from its current native excessive close to $2,740. After a strong rally that pushed ETH above each the 200-day exponential transferring common (EMA) and easy transferring common (SMA), the value is now consolidating just under the 200-day SMA at $2,702.93. This degree has acted as resistance over the previous few periods, capping Ethereum’s try and proceed its upward momentum.

Quantity has declined barely, reflecting market indecision after final week’s breakout. If bulls can defend the 200-day EMA close to $2,437 and keep greater lows above $2,500, the construction would stay bullish. Nevertheless, a failure to carry these ranges may result in a deeper pullback, with $2,400 and $2,200 as potential helps.

The current worth motion suggests Ethereum is forming a short-term vary between $2,400 and $2,700, which may persist till a transparent breakout above the 200-day SMA. Holding above $2,500 is essential to sustaining bullish momentum, particularly because the altcoin market eyes additional good points.

Associated Studying

If ETH can push above $2,700 with sturdy quantity, it will affirm renewed power and open the trail towards the $3,000–$3,100 resistance zone. Till then, consolidation and warning dominate the short-term outlook.

Featured picture from Dall-E, chart from TradingView

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

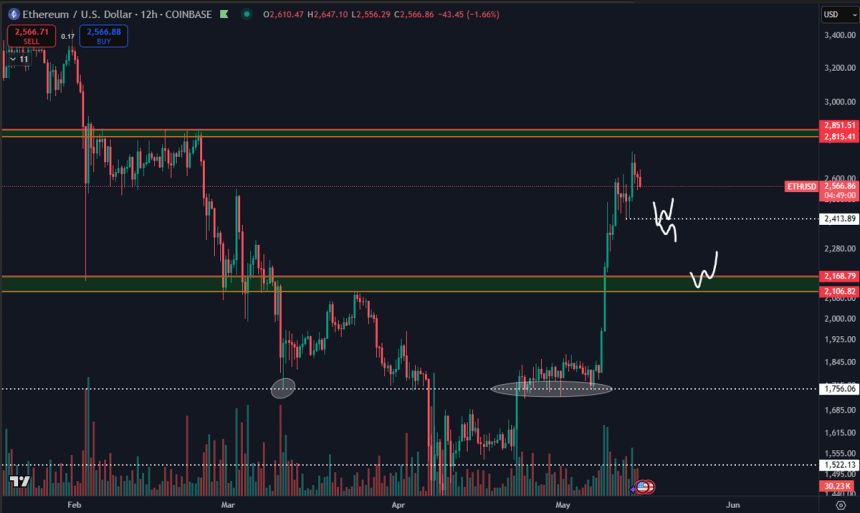

After a number of days of intense shopping for strain and powerful bullish momentum, Ethereum has lastly paused its rally, discovering resistance across the $2,740 mark. The transfer comes after ETH effortlessly cleared key resistance ranges at $2,000 and $2,200, marking considered one of its strongest short-term performances in months. As pleasure builds throughout the broader crypto market, Ethereum’s subsequent transfer may outline the power and sustainability of this breakout.

Associated Studying

With worth now stalling, analysts imagine a interval of consolidation is probably going—and maybe even vital—earlier than the subsequent leg greater. High analyst Daan shared a technical view suggesting that the $2,400 degree might be essential within the coming days. He believes it is smart to retest that native help, which would offer a more healthy construction for additional upside.

Nevertheless, Daan additionally notes a cautionary sign: extraordinarily excessive ranges of Open Curiosity throughout the ETH derivatives market. He’s presently avoiding lengthy positions till a few of that leverage is flushed out, lowering the danger of a sharper pullback. For now, Ethereum bulls should maintain above $2,400 to verify power and hold the uptrend intact, whereas merchants await cleaner situations for potential reentry.

Ethereum’s Surge Faces a Essential Retest Round $2.4K

Ethereum has surged greater than 50% since final week, reclaiming momentum after months of heavy promoting strain. ETH is displaying sustained power for the primary time since late December, fueling optimism that the broader altcoin market might be subsequent. Many analysts are calling for an altseason, and Ethereum’s breakout is seen as a possible catalyst for a bigger transfer throughout altcoins which have severely underperformed in recent times.

Nevertheless, after such a pointy transfer, a interval of consolidation or correction wouldn’t be uncommon—and will even be wholesome. In accordance with Daan, the $2,400 degree might be a key help zone to observe. He believes it is smart for worth to check this space earlier than additional continuation. Daan presently has no real interest in coming into lengthy positions till among the billions in Open Curiosity are flushed from the system. How Ethereum reacts round $2.4K will seemingly set the tone for the subsequent part.

If ETH sweeps $2.4K and shortly bounces, Daan expects a neighborhood vary to type between $2.4K and $2.7K. Nevertheless, if worth loses that degree decisively, the subsequent main help lies at $2.1K. A gradual bleed into that zone may sign weak spot, whereas a fast flush may current a short-lived shopping for alternative.

Regardless of short-term dangers, Daan notes that even a pullback to $2.1K would nonetheless depart ETH up roughly 20% from the prior week. In his view, the bigger buying and selling vary for now could be between $2.1K and $2.8K—a zone that would outline Ethereum’s subsequent main development if bulls can maintain key ranges and regain momentum. For now, the rally is alive, however the subsequent check might be vital.

Associated Studying

Value Consolidation Taking Place Amid Optimism

Ethereum (ETH) is presently buying and selling round $2,565, following a pointy retracement from its current native excessive close to $2,740. After a strong rally that pushed ETH above each the 200-day exponential transferring common (EMA) and easy transferring common (SMA), the value is now consolidating just under the 200-day SMA at $2,702.93. This degree has acted as resistance over the previous few periods, capping Ethereum’s try and proceed its upward momentum.

Quantity has declined barely, reflecting market indecision after final week’s breakout. If bulls can defend the 200-day EMA close to $2,437 and keep greater lows above $2,500, the construction would stay bullish. Nevertheless, a failure to carry these ranges may result in a deeper pullback, with $2,400 and $2,200 as potential helps.

The current worth motion suggests Ethereum is forming a short-term vary between $2,400 and $2,700, which may persist till a transparent breakout above the 200-day SMA. Holding above $2,500 is essential to sustaining bullish momentum, particularly because the altcoin market eyes additional good points.

Associated Studying

If ETH can push above $2,700 with sturdy quantity, it will affirm renewed power and open the trail towards the $3,000–$3,100 resistance zone. Till then, consolidation and warning dominate the short-term outlook.

Featured picture from Dall-E, chart from TradingView