Ethereum’s validator exit queue has dropped to zero, a shift that on-chain watchers say might change how the market views promote stress. In line with on-chain metrics and up to date stories, validators who as soon as waited weeks to withdraw are now not lining up. That alone removes a big, seen supply of potential ETH flowing again into markets.

Ethereum Exit Queue Clears

The queue as soon as held hundreds of thousands of ETH. Now it’s empty, knowledge from Ethereum Validator Queue reveals. This implies validators who select to exit may be processed nearly instantly, quite than being compelled to attend. The backlog that fearful merchants in late 2025 has gone.

A change this clear removes an apparent provide overhang and it shifts the steadiness between how a lot ETH stays locked versus how a lot may be spent.

Provide Tightening And Market Noise

Primarily based on stories, staking inflows have been robust sufficient to drag a giant share of circulating ETH out of energetic markets. With fewer validators lined as much as depart, sudden massive dumps tied to emergency exits turn out to be much less seemingly.

Ethereum staking registry and exit queue numbers. Supply: Ethereum Validator Queue

That doesn’t make costs sure, nevertheless it lowers one type of draw back threat. Merchants monitoring on-chain flows now weigh staking habits alongside spot and derivatives exercise when forming short-term views.

Staking Demand Grows

Entry requests to stake ETH are rising quick. Studies notice that the entry queue — ETH ready to turn out to be energetic validators — has climbed to excessive ranges as soon as seen solely in huge onboarding durations.

Wait occasions for brand new activations have stretched into many weeks in locations. Establishments and staking companies are a part of this push, in response to market observers, and their strikes are inclined to lock up bigger sums for longer.

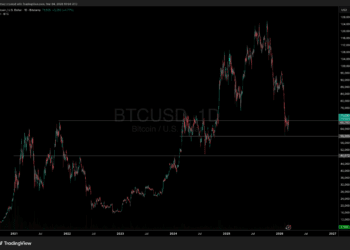

BTCUSD buying and selling at $3,317 on the 24-hour chart: TradingView

Safety, Yield, And Actual Results

Extra ETH locked for staking helps the community’s safety as a result of extra validators are actively taking part. It additionally creates yield alternatives for holders preferring regular returns over buying and selling.

That stated, the presence of enormous staking swimming pools and companies means some dangers are concentrated. If one huge supplier faces bother, the results will likely be felt extensively. Studies say regulators and product issuers are watching intently as staking turns into simpler to entry via mainstream channels.

What Merchants Are Watching

Worth motion will depend upon many issues past exit queues. Derivatives positions, ETF flows, and macro headlines nonetheless matter. Nonetheless, analysts level out that when a visual outlet for mass withdrawals disappears, the narrative round “compelled promoting” weakens.

Liquidity circumstances can shift quietly — after which quickly — if any of these different levers transfer. Market individuals are due to this fact watching withdrawal metrics alongside change balances and futures open curiosity.

Featured picture from Gemini, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Ethereum’s validator exit queue has dropped to zero, a shift that on-chain watchers say might change how the market views promote stress. In line with on-chain metrics and up to date stories, validators who as soon as waited weeks to withdraw are now not lining up. That alone removes a big, seen supply of potential ETH flowing again into markets.

Ethereum Exit Queue Clears

The queue as soon as held hundreds of thousands of ETH. Now it’s empty, knowledge from Ethereum Validator Queue reveals. This implies validators who select to exit may be processed nearly instantly, quite than being compelled to attend. The backlog that fearful merchants in late 2025 has gone.

A change this clear removes an apparent provide overhang and it shifts the steadiness between how a lot ETH stays locked versus how a lot may be spent.

Provide Tightening And Market Noise

Primarily based on stories, staking inflows have been robust sufficient to drag a giant share of circulating ETH out of energetic markets. With fewer validators lined as much as depart, sudden massive dumps tied to emergency exits turn out to be much less seemingly.

Ethereum staking registry and exit queue numbers. Supply: Ethereum Validator Queue

That doesn’t make costs sure, nevertheless it lowers one type of draw back threat. Merchants monitoring on-chain flows now weigh staking habits alongside spot and derivatives exercise when forming short-term views.

Staking Demand Grows

Entry requests to stake ETH are rising quick. Studies notice that the entry queue — ETH ready to turn out to be energetic validators — has climbed to excessive ranges as soon as seen solely in huge onboarding durations.

Wait occasions for brand new activations have stretched into many weeks in locations. Establishments and staking companies are a part of this push, in response to market observers, and their strikes are inclined to lock up bigger sums for longer.

BTCUSD buying and selling at $3,317 on the 24-hour chart: TradingView

Safety, Yield, And Actual Results

Extra ETH locked for staking helps the community’s safety as a result of extra validators are actively taking part. It additionally creates yield alternatives for holders preferring regular returns over buying and selling.

That stated, the presence of enormous staking swimming pools and companies means some dangers are concentrated. If one huge supplier faces bother, the results will likely be felt extensively. Studies say regulators and product issuers are watching intently as staking turns into simpler to entry via mainstream channels.

What Merchants Are Watching

Worth motion will depend upon many issues past exit queues. Derivatives positions, ETF flows, and macro headlines nonetheless matter. Nonetheless, analysts level out that when a visual outlet for mass withdrawals disappears, the narrative round “compelled promoting” weakens.

Liquidity circumstances can shift quietly — after which quickly — if any of these different levers transfer. Market individuals are due to this fact watching withdrawal metrics alongside change balances and futures open curiosity.

Featured picture from Gemini, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.