Utilized Supplies, Inc. (NASDAQ: AMAT) has reported combined outcomes for the second quarter, with earnings beating estimates and revenues barely lacking expectations. The Santa Clara-headquartered firm, a market chief in semiconductor wafer fabrication gear, issued third-quarter steerage beneath analysts’ estimates, driving its inventory decrease quickly after the announcement on Thursday afternoon.

Extending the post-earnings downturn, the inventory opened down 6% on Friday and traded decrease within the early hours of the session. Investor sentiment has been subdued resulting from issues over the potential impression of recent import tariffs on the semiconductor trade. In March, AMAT had slipped to the bottom degree in almost one-and-a-half years. Nevertheless, the inventory’s long-term prospects seem like encouraging. As a number one world semiconductor gear provider, Utilized Supplies is strategically positioned to capitalize on the surging demand for AI purposes, making it a compelling funding choice.

Blended End result

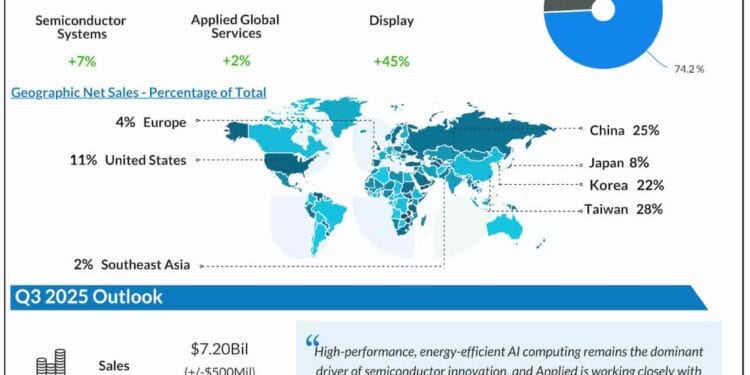

Within the second quarter, a 7% development within the core Semiconductor Techniques enterprise drove up complete revenues to $7.10 billion. Contributing to the top-line development, Utilized World Providers income rose 2% and Show revenues jumped 45%. The corporate’s adjusted earnings rose 14% YoY to $2.39 per share in Q2. Quarterly earnings have persistently crushed estimates for almost three years. On a reported foundation, earnings moved as much as $2.14 billion or $2.63 per share from $1.72 billion or $2.06 per share a 12 months earlier.

Commenting on the outcomes, the corporate’s CEO Gary Dickerson mentioned, “The key expertise traits reshaping the worldwide economic system, together with IoT, automation and robotics, electrical and autonomous autos and clear power are all constructed on high of superior semiconductors. Central to our future market outlook is AI, which is essentially the most transformative expertise of our lifetimes and has nearly limitless potential use circumstances. Whereas we’re seeing outstanding progress in AI capabilities, we’re nonetheless within the early phases of a multi-decade build-out of purposes and infrastructure. Giant-scale deployment of AI would require main advances in computing efficiency and power effectivity that may solely be achieved by means of disruptive innovation throughout the expertise stack.”

Steering

For the third quarter of FY25, the corporate expects revenues of round $7.20 billion and adjusted earnings of roughly $2.35 per share. The steerage is beneath analysts’ estimates for $7.22 billion of income and earnings of $2.36 per share, as of Could 16, 2025. The administration cautioned a few slowdown in ICAPS investments, but it surely sees continued robust investments in modern logic and high-bandwidth reminiscence.

Utilized Supplies attributed its latest underperformance in China to market entry restrictions imposed on US corporations. Outdoors China, its largest abroad market, the corporate grew sooner than others resulting from its energy in modern foundry and DRAM. The agency appears well-positioned to capitalize on the rising AI demand as it’s a main provider of supplies engineering options wanted for AI chip manufacturing.

On Friday morning, Utilized Supplies’ inventory was buying and selling near its early-year ranges, sustaining a downtrend. The inventory opened about 6% beneath its 52-week common worth, reflecting buyers’ issues over the weak Q2 outcomes.